Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. According to the concept of loss aversion, individual investors are most likely to do which of the following? a. Sell stocks with losses more

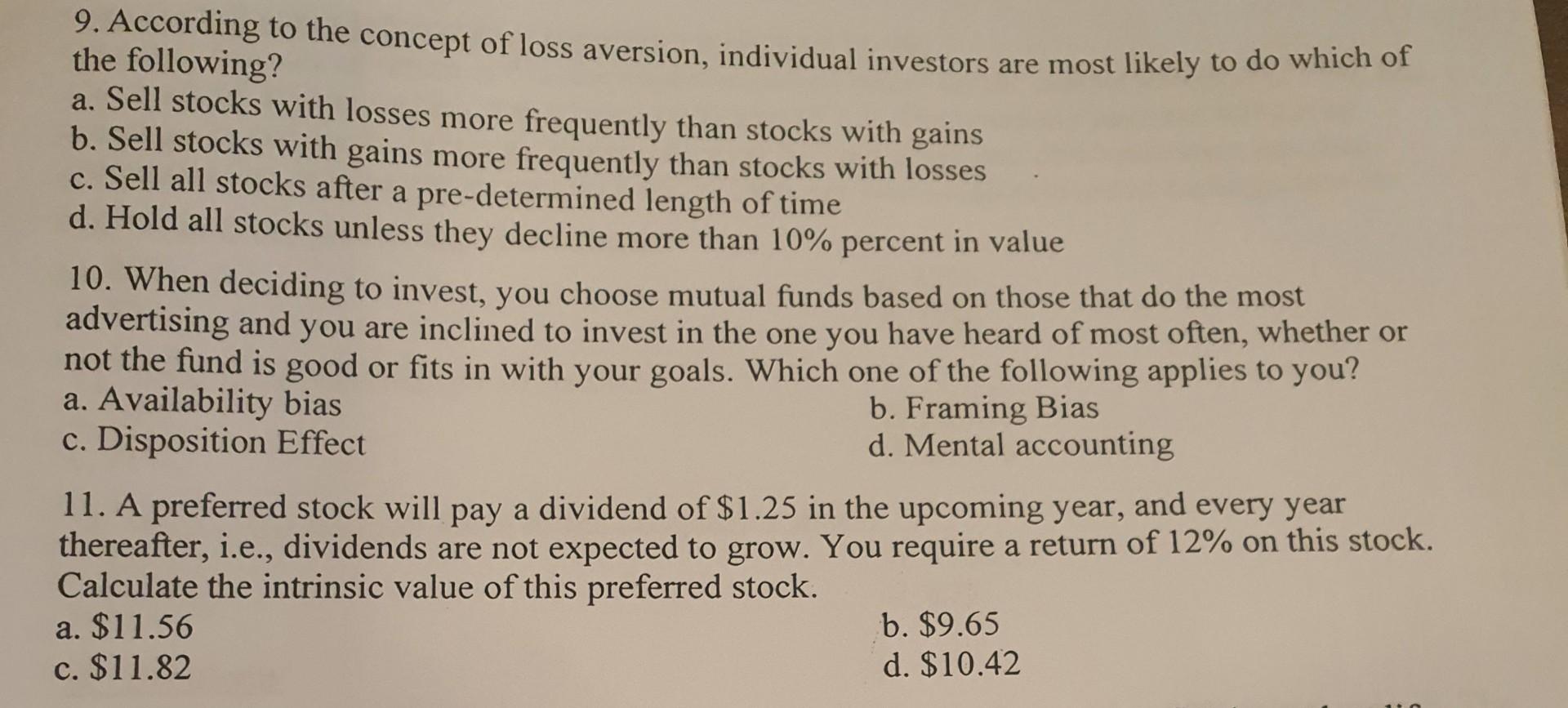

9. According to the concept of loss aversion, individual investors are most likely to do which of the following? a. Sell stocks with losses more frequently than stocks with gains b. Sell stocks with gains more frequently than stocks with losses c. Sell all stocks after a pre-determined length of time d. Hold all stocks unless they decline more than 10% percent in value 10. When deciding to invest, you choose mutual funds based on those that do the most advertising and you are inclined to invest in the one you have heard of most often, whether or not the fund is good or fits in with your goals. Which one of the following applies to you? a. Availability bias b. Framing Bias c. Disposition Effect d. Mental accounting 11. A preferred stock will pay a dividend of $1.25 in the upcoming year, and every year thereafter, i.e., dividends are not expected to grow. You require a return of 12% on this stock. Calculate the intrinsic value of this preferred stock. a. $11.56 b. $9.65 c. $11.82 d. $10.42

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started