Answered step by step

Verified Expert Solution

Question

1 Approved Answer

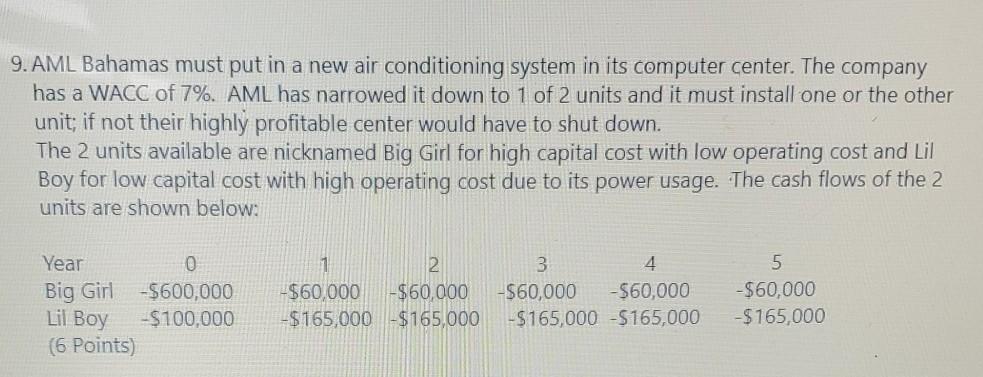

9. AML Bahamas must put in a new air conditioning system in its computer center. The company has a WACC of 7%. AML has narrowed

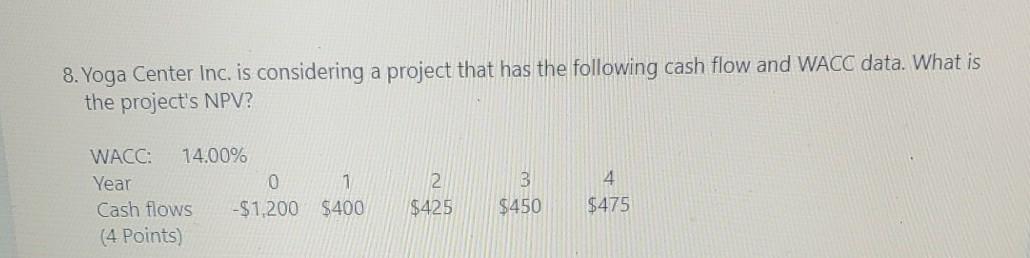

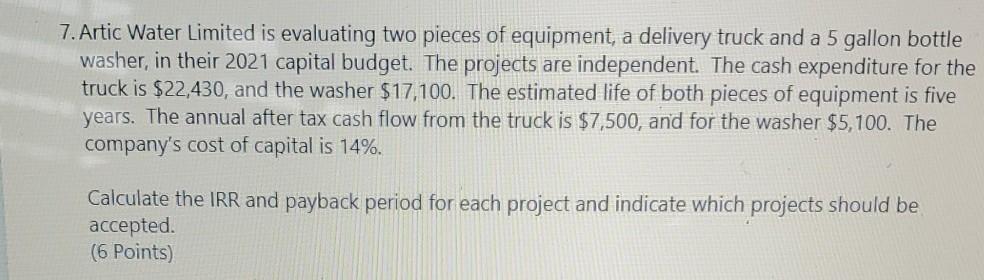

9. AML Bahamas must put in a new air conditioning system in its computer center. The company has a WACC of 7%. AML has narrowed it down to 1 of 2 units and it must install one or the other unit; if not their highly profitable center would have to shut down. The 2 units available are nicknamed Big Girl for high capital cost with low operating cost and Lil Boy for low capital cost with high operating cost due to its power usage. The cash flows of the 2 units are shown below: Year 0 Big Girl -$600,000 Lil Boy $100,000 (6 Points) 1 2 -$60,000 -$60,000 -$165,000 - $ 165,000 3 4 -$60,000 -$60,000 -$165,000-$165,000 5 -$60,000 -$ 165,000 8. Yoga Center Inc. is considering a project that has the following cash flow and WACC data. What is the project's NPV? WACC: 14.00% Year 0 1 Cash flows -$1,200 $400 (4 Points) 2 $425 3 $450 4 $475 7. Artic Water Limited is evaluating two pieces of equipment, a delivery truck and a 5 gallon bottle washer, in their 2021 capital budget. The projects are independent. The cash expenditure for the truck is $22,430, and the washer $17,100. The estimated life of both pieces of equipment is five years. The annual after tax cash flow from the truck is $7,500, and for the washer $5,100. The company's cost of capital is 14%. Calculate the IRR and payback period for each project and indicate which projects should be accepted. (6 Points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started