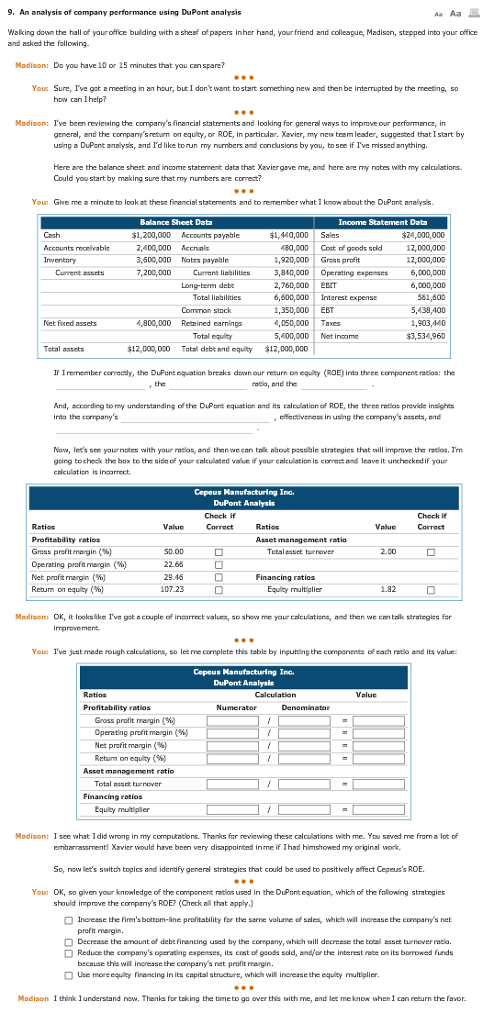

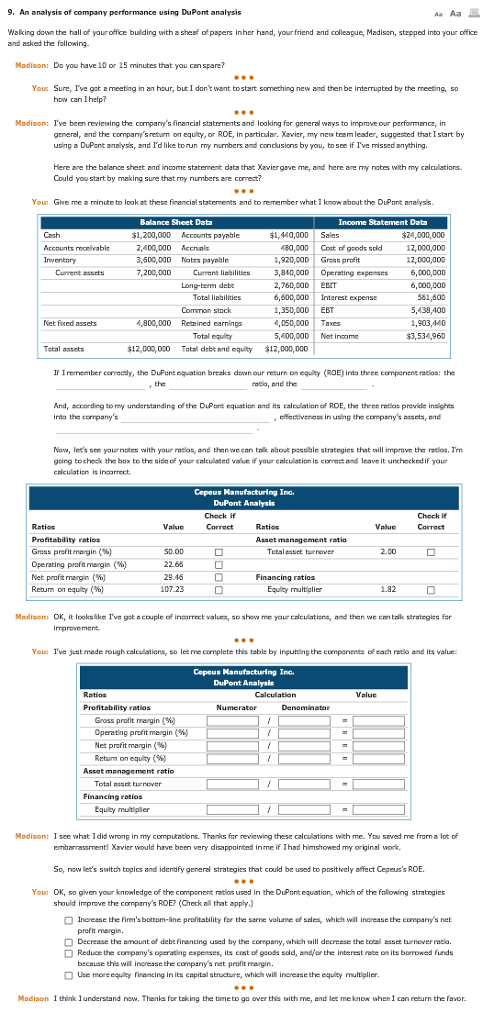

9. An analysis of company performance using DuPont analysis Walking down the hall of your office building with a sheaf of papers inher hand, your friend and colleague, Madisan, stepped into your office and asked the fellowing. Madison: Do you have 10 or 15 minutes that you canspare? You: Sure, I've got meeting in an hour, b1 don't want tostart something new and then be imterrupted by the meeting, so how can Ihelp? Madison: I've been reviesing the compay's financial statements and loaking for general ways to improve our performance, in general, and the company's return on equity, or ROE, in particular. Xavier, my new teem leader,suggested that I start by usnga DuPont analyss, and I'd like torun my numbers and condlusions by you, to see if I've missed anything. Here are the balange sheet and income staterrent dsta that Xavier me, and here are my nates with my calculations. Could you start by making sure that my numbers are correct? You: Give me minute to lokat these financial statements and to remember what I know about the DuPont analysis. Balance Sheet Data Cash $1,200,000 Accunts payable $1,440,00D Sales $24,000,000 ccounts ecvable 2,400,000 Accnal 3,500,000 Nats payable 7,200,000 urent liabilities 3,840,000 Operating expenses 6,coD,co 0,000Cost of gods sdid 1,920,000 Gress profit 12,000,00D Current assets 2,760,000 ET ,600,000 Interest expense ,350,000 EBT ,050,000 Taxes 5,400,000 Net inome 6,coD,CO0 81,600 5,438,400 1,903,440 $3,534,960 Long-term debt Total liabilities Common stnck Net fioxed assets 4,800,000 Retained earnilings Total equity Tetal assets 12,000,0C0 Total debt and equity $12,000,000 If Iremember correcdy, the DuPont equation breaks down our return on equty (ROE) inta three compoent ratlos: the atia, and the And, accordirg to my understanding ofthe DuPont equation and its calculation of ROE, the three ratlas provide insighs inta the cormpany's effactiveness in using the company's assets, and Now, let's see yaurnotes with your ratas, and then we can talk nbout passible strategies that will improve the ratlos, Tm gaing tochack the bax to the sida of your calculated value if your cnlculation is corratt and leave it unchecked if your calculatien is inarrect DuPont Analysis Check if Check if Correct Ratios Profitability ratios Gross profit margin ( Operating profit margin (%) Net profit magn (%) Rearm on equity (%) Value Ratios Value 50.00 Tetalasset turnover 2.00 Financinsultbolier Equity multiplier 1.82 Madison: OK, it loaksike I'va get a couple of inaarrect values, so show rre your caiculatiens, and then we enn taik strategien for You: I've just made rough calculations, so let me cormplete this table by inguting the compenents of each ratlo and its value DuPont Analysis Gross profit margin (%) Operating profit margin (%) Net profit margin (%) Return on equity (%) Asset management ratio Total asset turnover Financing ratios Equity multipler Madison: I see what I did wrong in my computations. Thanks for revewng these calculationsh me. You saved me froma lot of embarrassment Xavier would have been very disappoinbed inme if Ihad himsowed my orinl work So, now let's switch topics and idendfy general strategies that could be used to positvely affect Cepeus's ROE. ou Ok, so given your knowledge of the component ratlos used in the DuPont equatian, which of the following strategies should improve the company's RDE(Check al that apply.) Increase the fim'sbottom-lne profitability for the same volurme of seles, which will increase the company's net preft margin. Decrease the amount of debe financing used by the company,which aill decrease the tl asset turnover ratlo Reduce the cormpany's operating expenses, its cost of goods sold, andor the interest rate on its barrowed funds because this will increase the company's net profit rargin. Use mo equlty firancing in its eapital structure, which will incresse the equlty multiglier. Madison I think Iunderstand now. Thanls for taking the timeto go over this with me, and let meknow when I can return the favor