Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9) An analyst looking to appraise a private shoe business called FFG co. with consistently negative earnings but currently own very high value patents and

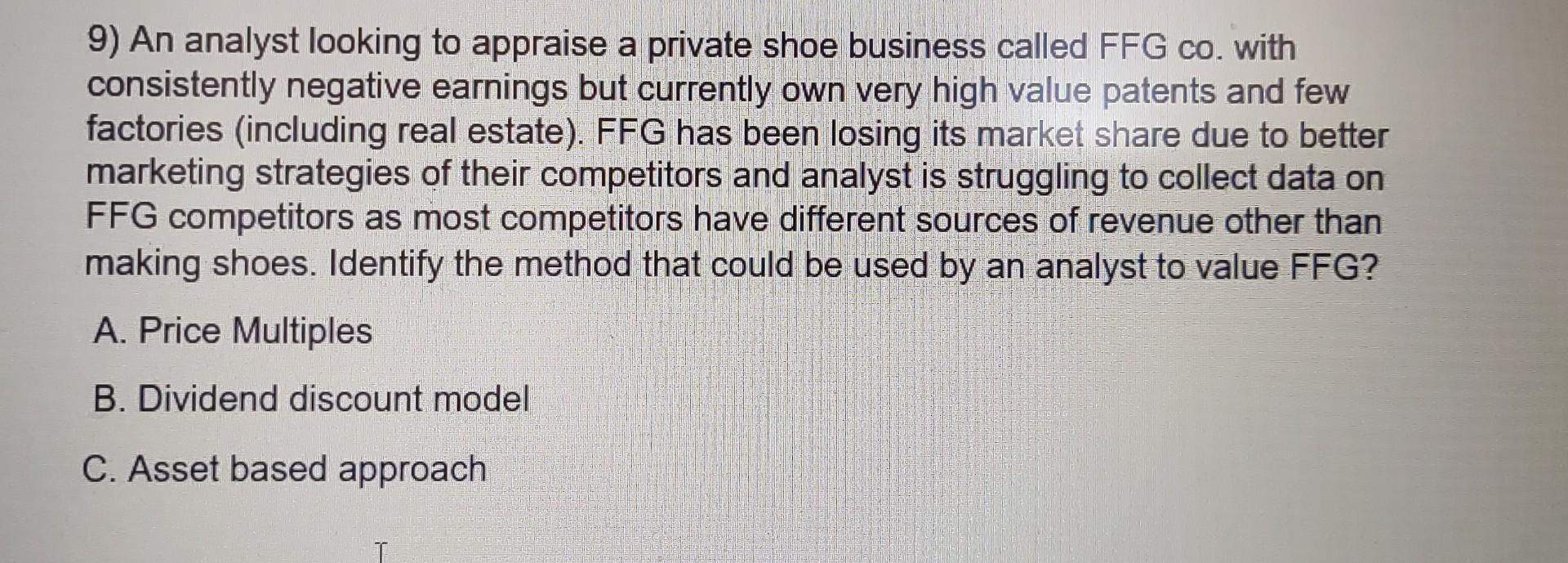

9) An analyst looking to appraise a private shoe business called FFG co. with consistently negative earnings but currently own very high value patents and few factories (including real estate). FFG has been losing its market share due to better marketing strategies of their competitors and analyst is struggling to collect data on FFG competitors as most competitors have different sources of revenue other than making shoes. Identify the method that could be used by an analyst to value FFG? A. Price Multiples B. Dividend discount model C. Asset based approach

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started