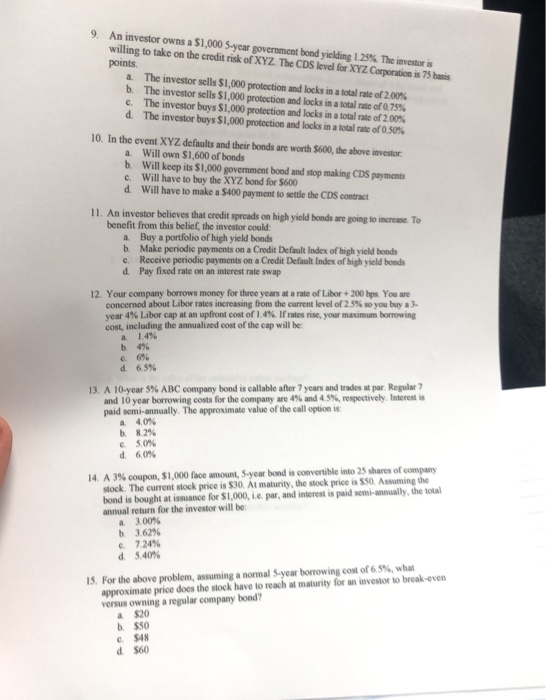

9. An investor owns a $1,000 5-year government bond yielding 1.25% The investor is willing to take on the credit risk of XYZ. The CDS level for XYZ Corporation is 75 basis points. a b. c. d The investor sells $1,000 protection and locks in a total rate of 2.00% The investor sells $1,000 protection and locks in a total rate of 0.75% The investor buys $1,000 protection and locks in a total rate of 2.00% The investor buys $1,000 protection and locks in a total rate of 0.50% total rate of buys $1,000 action and locks 10. In the event XYZ defaults and their bonds are worth $600, the above investor a Will own $1,600 of bonds b. Will keep its $1,000 government bond and stop making CDS payments c. Will have to buy the XYZ bond for $600 d Will have to make a $400 payment to settle the CDS contract 11. An investor believes that credit spreads on high yield bonds are going to increase. To benefit from this belief, the investor could: a. Buy a portfolio of high yield bonds b. Make periodic payments on a Credit Default Index of high yield bonds c. Receive periodic payments on a Credit Default Index of high yield bonds d Pay fixed rate on an interest rate swap 12. Your company borrows money for three years at a rate of Libor + 200 bps. You are concerned about Libor rates increasing from the current level of 2.5% so you buy a 3- year 4% Libor cap at an upfront cost of 1.4% Ifrates rise your maximum borrowing cost, including the annualized cost of the cap will be: b 496 d 6.5% 13. A 10-year 5% ABC company bond is callable after 7 years and trades at par. Regular and 10 year borrowing costs for the company are 4% and 4.5%, respectively. Interestis paid semi-annually. The approximate value of the call option is a 4.0% b8296 5.0% d 6.0% 14. A 3% coupon, $1,000 face amount, S-year bond is convertible into 25 shares of company stock. The current stock price is $30. Al maturity, the stock price is $50. Assuming the bond is bought at issuance for $1,000, le par, and interest is paid semi-annually, the total annual return for the investor will be 3006 3.62% 7.24% d 5.40% 15. For the above problem, assuming a normal 5-year borrowing cost of 6.5%, what approximate price does the stock have to reach at maturity for an investor to break even versus owning a regular company bond? a $20 b $50 S48 d $60