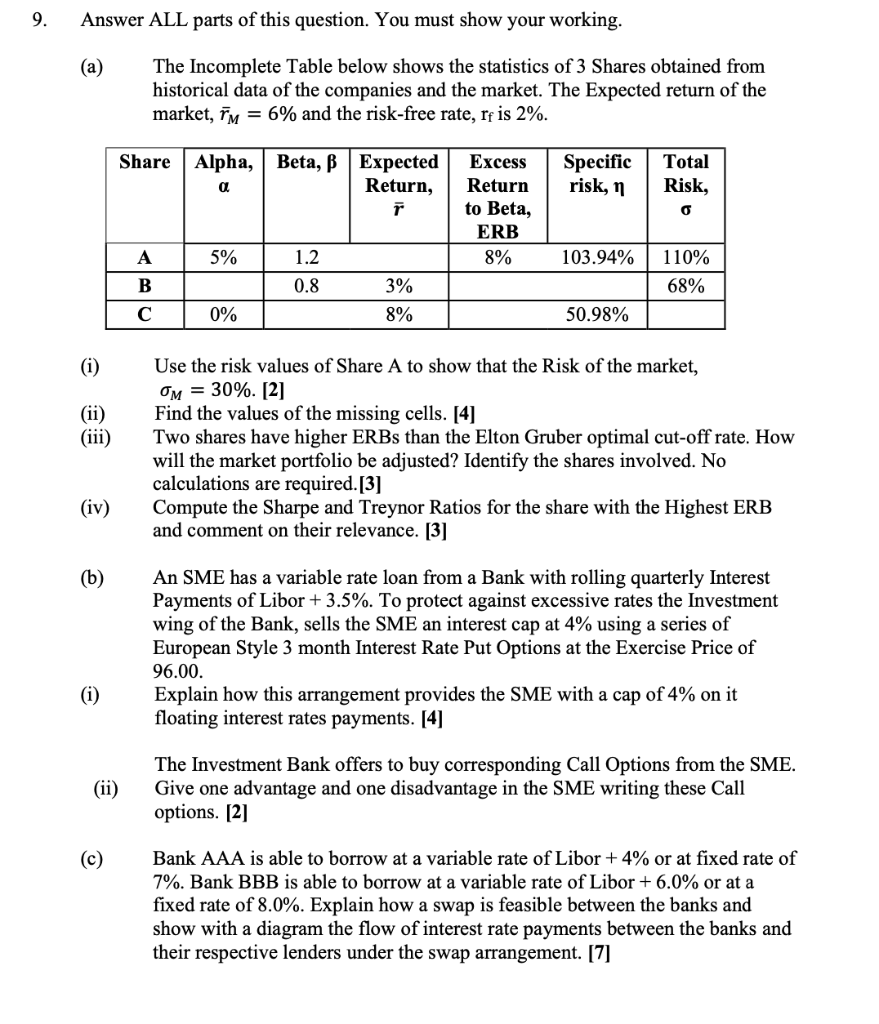

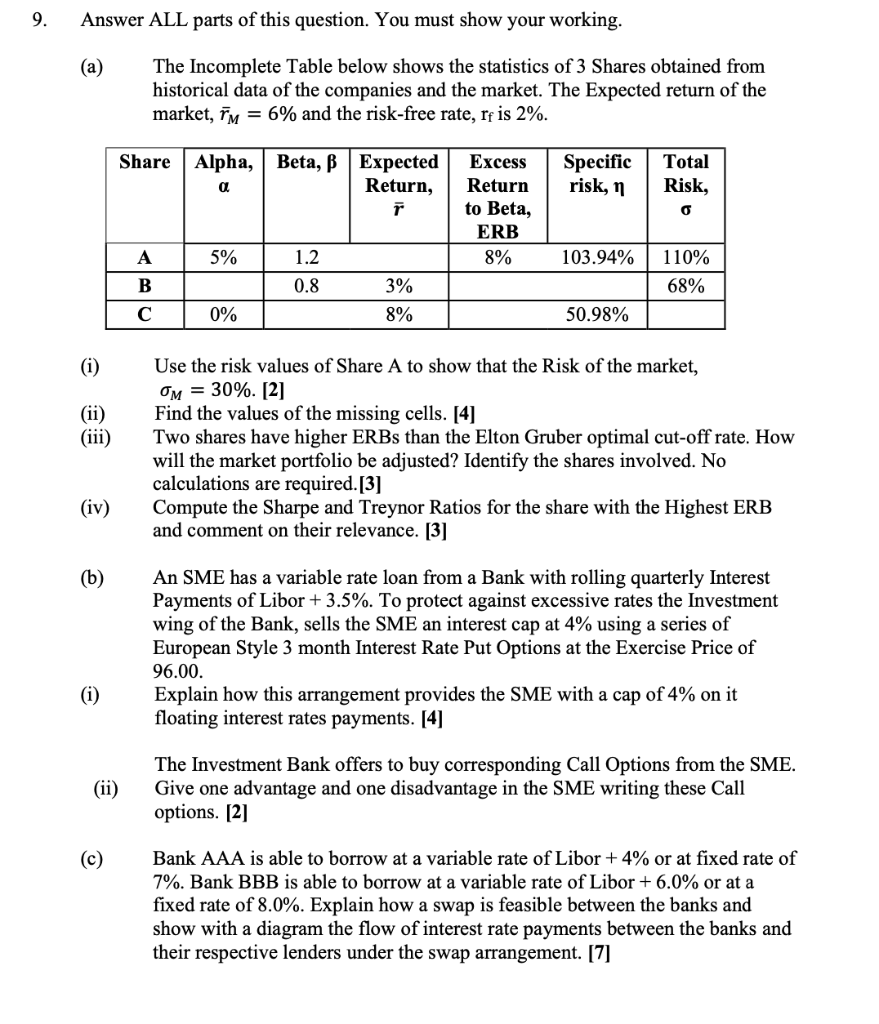

9. Answer ALL parts of this question. You must show your working. (a) The Incomplete Table below shows the statistics of 3 Shares obtained from historical data of the companies and the market. The Expected return of the market, m = 6% and the risk-free rate, rf is 2%. Share Specific Alpha, Beta, Expected Return, r Total Risk, a risk, 1 Excess Return to Beta, ERB 8% 0 5% 103.94% A B 1.2 0.8 110% 68% 3% 0% 8% 50.98% (i) (ii) (iii) Use the risk values of Share A to show that the Risk of the market, OM = 30%. [2] Find the values of the missing cells. [4] Two shares have higher ERBs than the Elton Gruber optimal cut-off rate. How will the market portfolio be adjusted? Identify the shares involved. No calculations are required.[3] Compute the Sharpe and Treynor Ratios for the share with the Highest ERB and comment on their relevance. [3] (iv) (b) An SME has a variable rate loan from a Bank with rolling quarterly Interest Payments of Libor +3.5%. To protect against excessive rates the Investment wing of the Bank, sells the SME an interest cap at 4% using a series of European Style 3 month Interest Rate Put Options at the Exercise Price of 96.00. Explain how this arrangement provides the SME with a cap of 4% on it floating interest rates payments. [4] (i) (ii) The Investment Bank offers to buy corresponding Call Options from the SME. Give one advantage and one disadvantage in the SME writing these Call options. [2] (c) Bank AAA is able to borrow at a variable rate of Libor +4% or at fixed rate of 7%. Bank BBB is able to borrow at a variable rate of Libor + 6.0% or at a fixed rate of 8.0%. Explain how a swap is feasible between the banks and show with a diagram the flow of interest rate payments between the banks and their respective lenders under the swap arrangement. [7] 9. Answer ALL parts of this question. You must show your working. (a) The Incomplete Table below shows the statistics of 3 Shares obtained from historical data of the companies and the market. The Expected return of the market, m = 6% and the risk-free rate, rf is 2%. Share Specific Alpha, Beta, Expected Return, r Total Risk, a risk, 1 Excess Return to Beta, ERB 8% 0 5% 103.94% A B 1.2 0.8 110% 68% 3% 0% 8% 50.98% (i) (ii) (iii) Use the risk values of Share A to show that the Risk of the market, OM = 30%. [2] Find the values of the missing cells. [4] Two shares have higher ERBs than the Elton Gruber optimal cut-off rate. How will the market portfolio be adjusted? Identify the shares involved. No calculations are required.[3] Compute the Sharpe and Treynor Ratios for the share with the Highest ERB and comment on their relevance. [3] (iv) (b) An SME has a variable rate loan from a Bank with rolling quarterly Interest Payments of Libor +3.5%. To protect against excessive rates the Investment wing of the Bank, sells the SME an interest cap at 4% using a series of European Style 3 month Interest Rate Put Options at the Exercise Price of 96.00. Explain how this arrangement provides the SME with a cap of 4% on it floating interest rates payments. [4] (i) (ii) The Investment Bank offers to buy corresponding Call Options from the SME. Give one advantage and one disadvantage in the SME writing these Call options. [2] (c) Bank AAA is able to borrow at a variable rate of Libor +4% or at fixed rate of 7%. Bank BBB is able to borrow at a variable rate of Libor + 6.0% or at a fixed rate of 8.0%. Explain how a swap is feasible between the banks and show with a diagram the flow of interest rate payments between the banks and their respective lenders under the swap arrangement. [7]