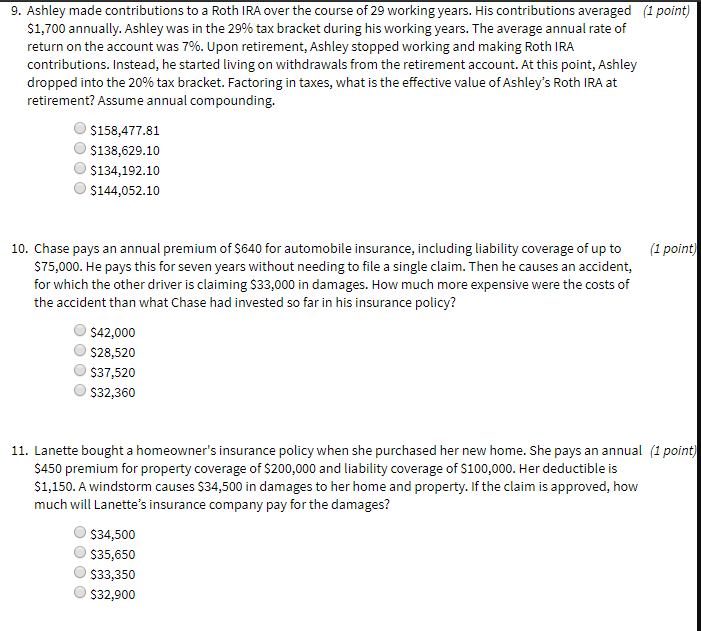

9. Ashley made contributions to a Roth IRA over the course of 29 working years. His contributions averaged (1 point) $1,700 annually. Ashley was in the 29% tax bracket during his working years. The average annual rate of return on the account was 7%. Upon retirement, Ashley stopped working and making Roth IRA contributions. Instead, he started living on withdrawals from the retirement account. At this point, Ashley dropped into the 20% tax bracket. Factoring in taxes, what is the effective value of Ashley's Roth IRA at retirement? Assume annual compounding. o $158,477.81 $138,629.10 $134,192.10 $144,052.10 10. Chase pays an annual premium of $640 for automobile insurance, including liability coverage of up to (1 point) $75,000. He pays this for seven years without needing to file a single claim. Then he causes an accident, for which the other driver is claiming $33,000 in damages. How much more expensive were the costs of the accident than what Chase had invested so far in his insurance policy? $42,000 $28,520 $37,520 $32,360 11. Lanette bought a homeowner's insurance policy when she purchased her new home. She pays an annual (1 point) $450 premium for property coverage of $200,000 and liability coverage of $100,000. Her deductible is $1,150. A windstorm causes $34,500 in damages to her home and property. If the claim is approved, how much will Lanette's insurance company pay for the damages? O $34,500 $35,650 $33,350 $32,900 9. Ashley made contributions to a Roth IRA over the course of 29 working years. His contributions averaged (1 point) $1,700 annually. Ashley was in the 29% tax bracket during his working years. The average annual rate of return on the account was 7%. Upon retirement, Ashley stopped working and making Roth IRA contributions. Instead, he started living on withdrawals from the retirement account. At this point, Ashley dropped into the 20% tax bracket. Factoring in taxes, what is the effective value of Ashley's Roth IRA at retirement? Assume annual compounding. o $158,477.81 $138,629.10 $134,192.10 $144,052.10 10. Chase pays an annual premium of $640 for automobile insurance, including liability coverage of up to (1 point) $75,000. He pays this for seven years without needing to file a single claim. Then he causes an accident, for which the other driver is claiming $33,000 in damages. How much more expensive were the costs of the accident than what Chase had invested so far in his insurance policy? $42,000 $28,520 $37,520 $32,360 11. Lanette bought a homeowner's insurance policy when she purchased her new home. She pays an annual (1 point) $450 premium for property coverage of $200,000 and liability coverage of $100,000. Her deductible is $1,150. A windstorm causes $34,500 in damages to her home and property. If the claim is approved, how much will Lanette's insurance company pay for the damages? O $34,500 $35,650 $33,350 $32,900