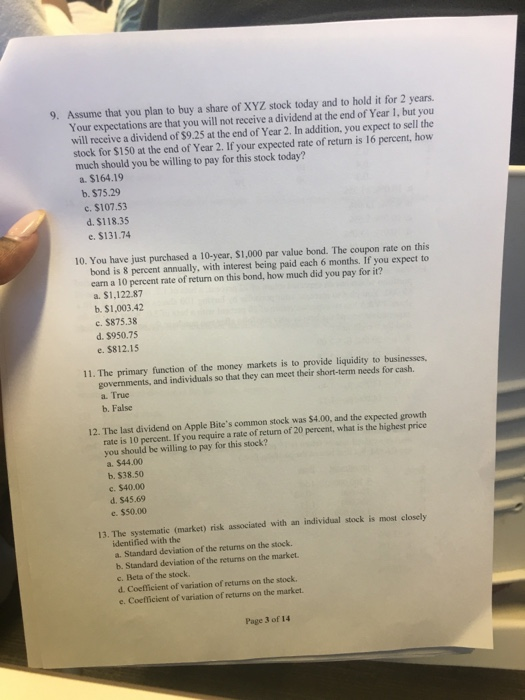

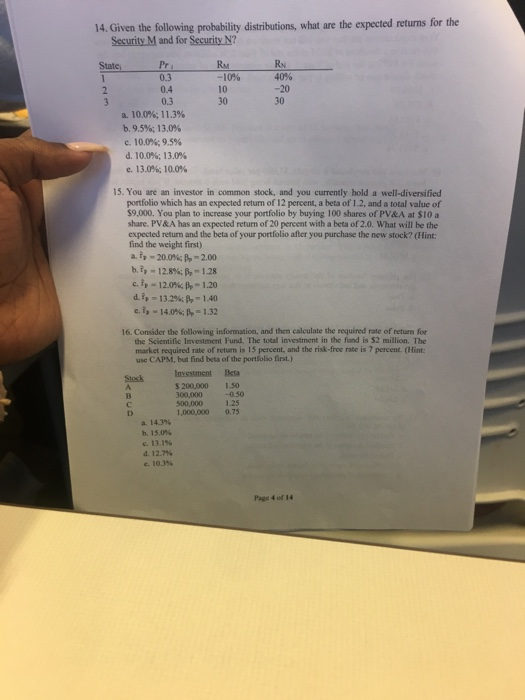

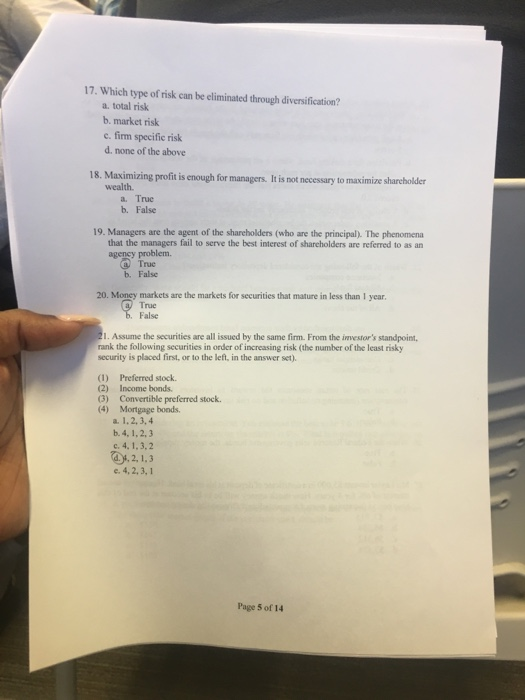

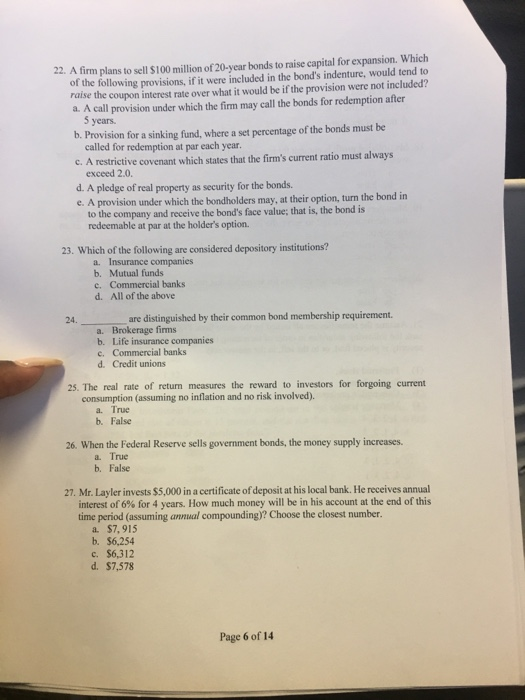

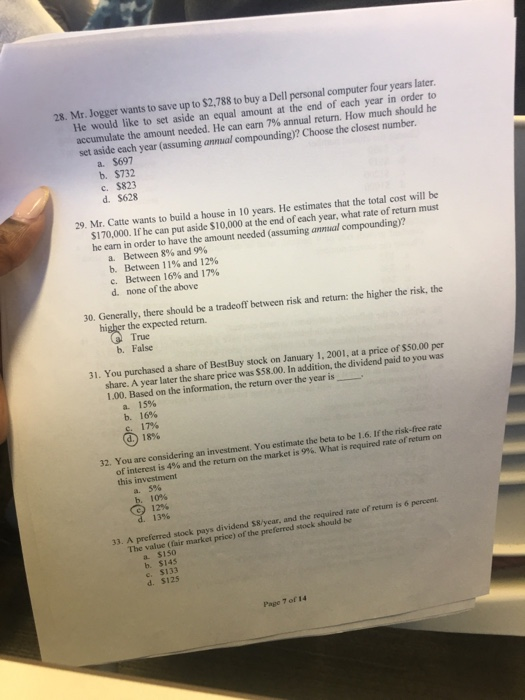

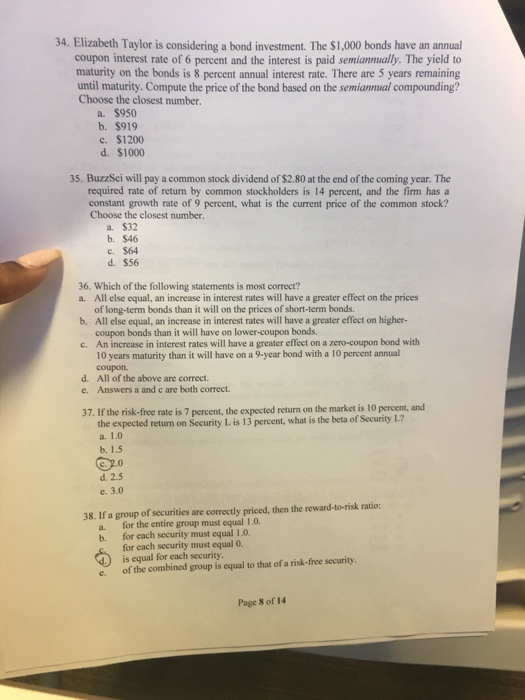

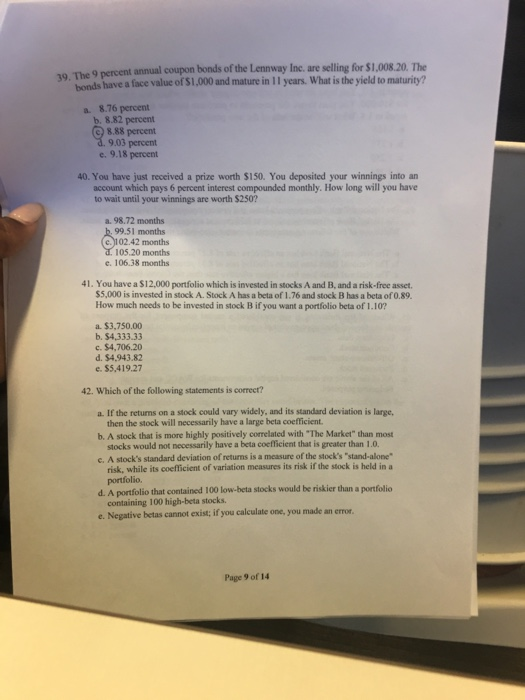

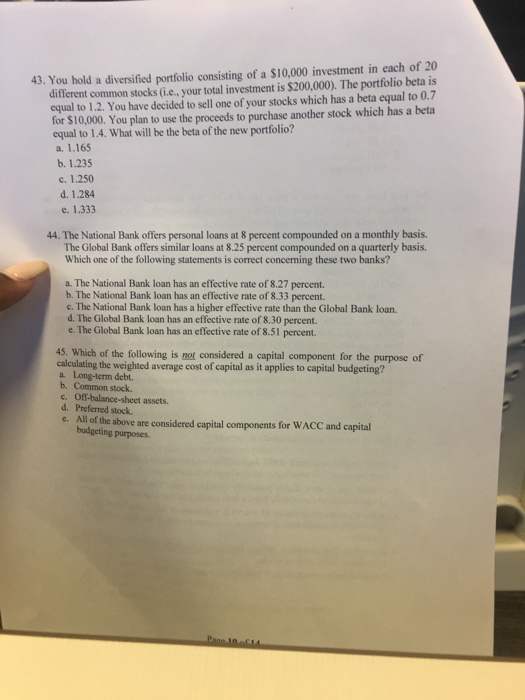

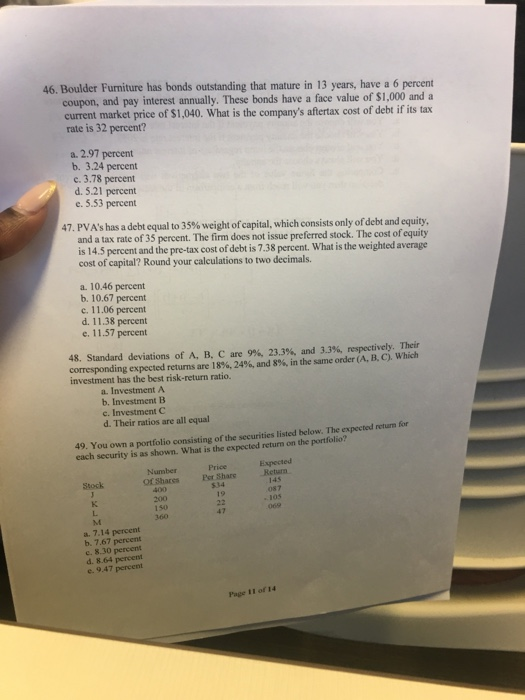

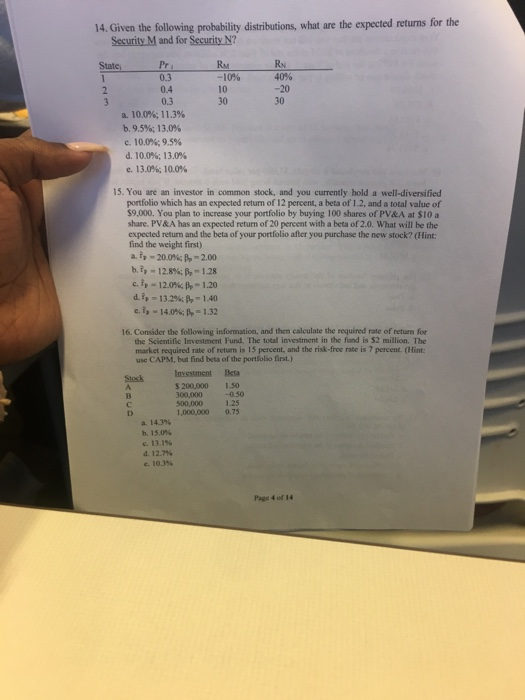

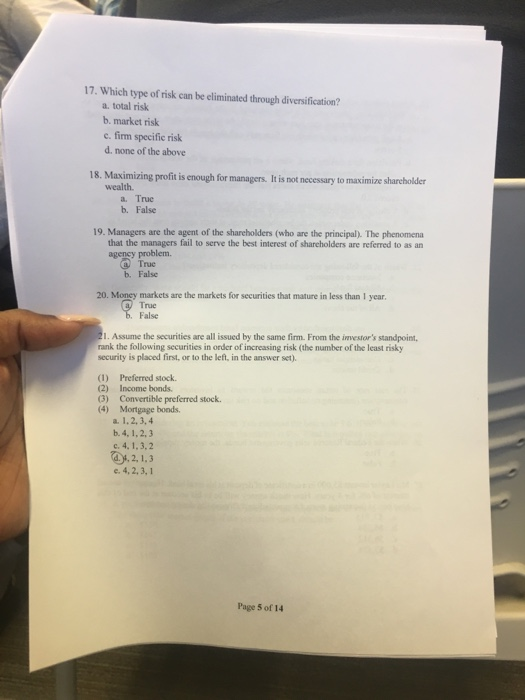

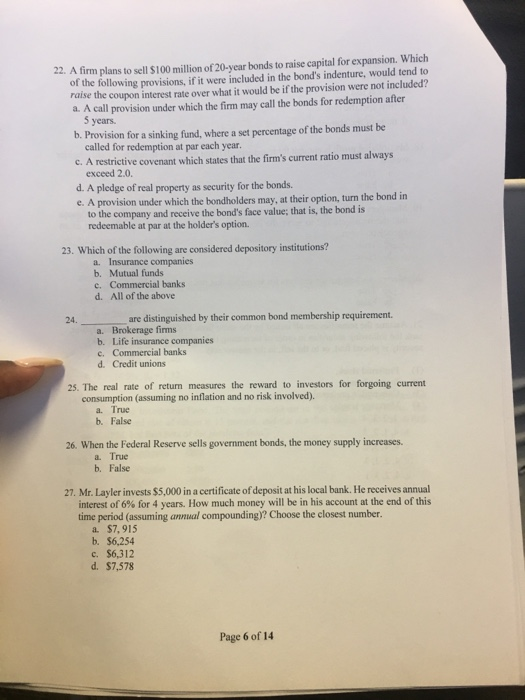

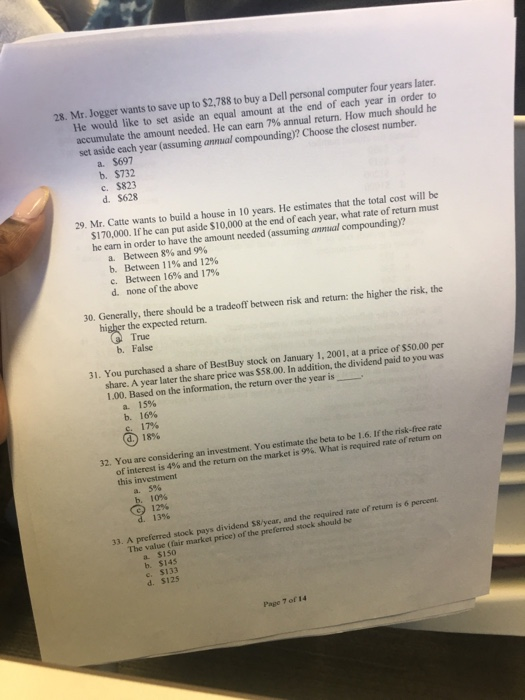

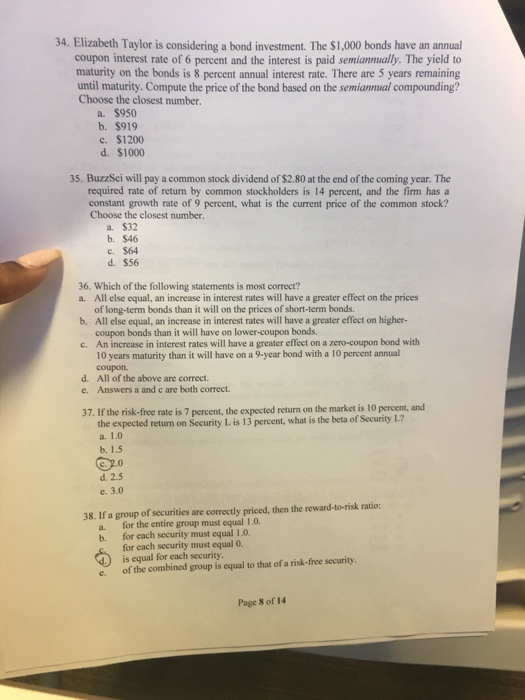

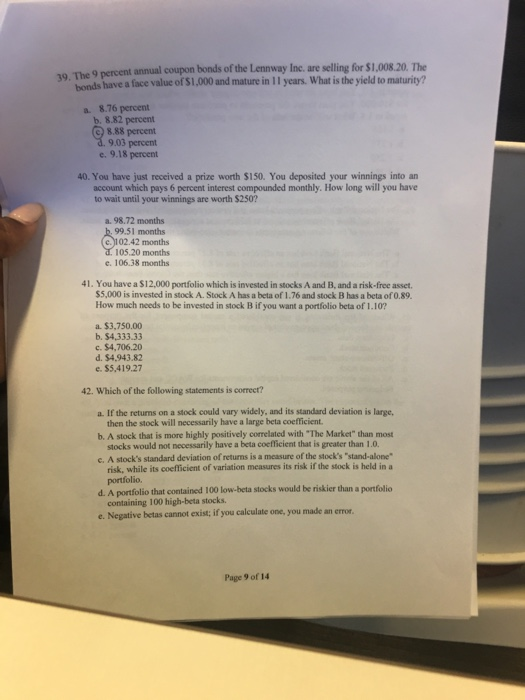

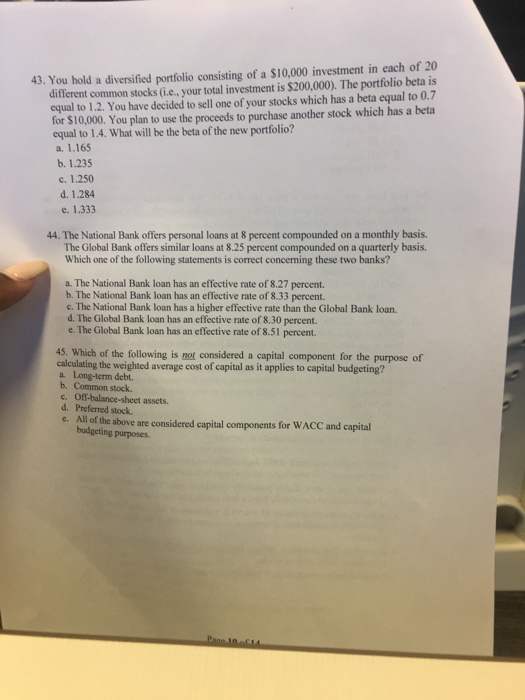

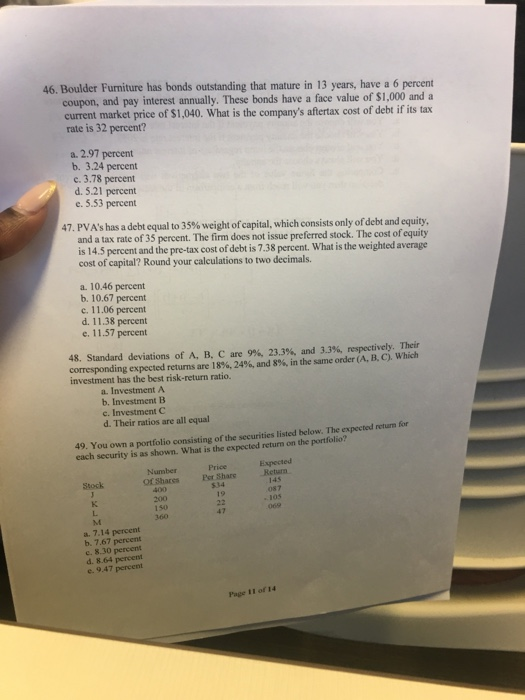

9. Assume that you plan to buy a share of XYZ stock today and to hold it for 2 years. Your expectations are that you will not receive a dividend at the end of Year 1, but you will receive a dividend of $9.25 at the end of Year 2. In addition, you expect to sell the stock for $150 at the end of Year 2. If your expected rate of return is 16 percent, how much should you be willing to pay for this stock today? a. $164.19 b. 575.29 c. $107.53 d. $118.35 e. $131.74 10. You have just purchased a 10-year, S1,000 par value bond. The coupon rate on this bond is 8 percent annually, with interest being paid each 6 months. If you expect to carn a 10 percent rate of return on this bond, how much did you pay for it? a. $1,122.87 b. $1.003.42 c. $875.38 d. $950.75 e. $812.15 11. The primary function of the money markets is to provide liquidity to businesses. governments, and individuals so that they can meet their short-term needs for cash. a. True b. False 12. The last dividend on Apple Bite's common stock was $4.00, and the expected growth rate is 10 percent. If you require a rate of return of 20 percent, what is the highest price you should be willing to pay for this stock? a. $44.00 b. $38.50 c. $40.00 d. $45.69 e $50.00 13. The systematic market) risk associated with an individual stock is most closely identified with the Standard deviation of the returns on the stock. b. Standard deviation of the returns on the market. c. Beta of the stock d. Coefficient of variation of returns on the stock. e. Coefficient of variation of returns on the market. Page 3 of 14 14. Given the following probability distributions, what are the expected returns for the Security M and for Security N? State; Pr RN Ru -10% 0.3 0.4 40% -20 30 10 30 0.3 a. 10.0%; 11.3% b. 9.5%; 13.0% e. 10.0% 9.5% d. 10.0%: 13.0% e. 13.0%; 10.0% 15. You are an investor in common stock, and you currently hold a well-diversified portfolio which has an expected return of 12 percent, a beta of 1.2, and a total value of $9.000. You plan to increase your portfolio by buying 100 shares of PV&A at $10 a share. PV&A has an expected return of 20 percent with a beta of 2.0. What will be the expected return and the beta of your portfolio after you purchase the new stock? (Hint: find the weight first) a.ty - 20.0% B - 2.00 b.1, -12.8%; B. -1.28 c. l-12.0% - 1.20 d.l- 13.296 - 1.40 c.1, -14.0%: Be=1.32 16. Consider the following information, and then calculate the required rate of return for the Scientific Investment Fund. The total investment in the fund is 52 million. The market required rate of return is 15 percent, and the risk-free rate is 7 percent. (Hint: use CAPM, but find beta of the portfolio first.) Investment Beta Stock $ 200.000 50 30. -0.50 500,000 1.000.000 0.75 a. 14.394 h. 15.0% c.13.196 d. 12.7% c. 10.396 1.25 17. Which type of risk can be eliminated through diversification? a. total risk b. market risk c. firm specific risk d. none of the above 18. Maximizing profit is enough for managers. It is not necessary to maximize shareholder wealth a True b. False 19. Managers are the agent of the shareholders (who are the principal). The phenomena that the managers fail to serve the best interest of shareholders are referred to as an agency problem. True b. False 20. Money markets are the markets for securities that mature in less than 1 year. @ True b. False 21. Assume the securities are all issued by the same firm. From the investor's standpoint, rank the following securities in order of increasing risk (the number of the least risky security is placed first, or to the left in the answer set). (1) Preferred stock. (2) Income bonds. (3) Convertible preferred stock. (4) Mortgage bonds. a. 1. 2. 3.4 b. 4, 1,2,3 c. 4.1.3.2 d.4, 2, 1,3 c. 4,2,3,1 Page 5 of 14 28. Mr. Jogger wants to save up to $2,788 to buy a Dell personal computer four years later, He would like to set aside an equal amount at the end of each year in order to accumulate the amount needed. He can earn 7% annual return. How much should be set aside each year (assuming annual compounding)? Choose the closest number a $697 b. $732 c. $823 d. 5628 29. Mr. Catte wants to build a house in 10 years. He estimates that the total cost will be $170,000. If he can put aside $10,000 at the end of each year, what rate of return must he carn in order to have the amount needed (assuming anal compounding)? a. Between 8% and 9% b. Between 11% and 12% c. Between 16% and 17% d. none of the above 30. Generally, there should be a tradeoff between risk and return the higher the risk, the higher the expected return. @ True b. False 31. You purchased a share of BestBuy stock on January 1, 2001, at a price of $50.00 per share. A year later the share price was 558.00. In addition, the dividend paid to you was 1.00. Based on the information, the return over the year is a 15% b. 16% s. 17% a) 18% 32. You are considering an investment. You estimate the beta to be 1.6. If the risk-free rate of interest is 4% and the return on the market is 96. What is required rate of return on this investment 594 b. 1096 12% d. 1396 33. A preferred stock pays dividend 58 year, and the required rate of return is 6 percent The value (air market price of the preferred stock should be b. S150 $145 5133 $125 Page 7 of 14 34. Elizabeth Taylor is considering a bond investment. The $1.000 bonds have an annual coupon interest rate of 6 percent and the interest is paid semiannually. The yield to maturity on the bonds is 8 percent annual interest rate. There are 5 years remaining until maturity. Compute the price of the bond based on the semiannual compounding? Choose the closest number a. $950 b. $919 c. $1200 d. $1000 35. BuzzSci will pay a common stock dividend of $2.80 at the end of the coming year. The required rate of return by common stockholders is 14 percent, and the firm has a constant growth rate of 9 percent, what is the current price of the common stock? Choose the closest number. a. $32 b. S46 c. $64 d. $56 36. Which of the following statements is most correct? a. All else equal, an increase in interest rates will have a greater effect on the prices of long-term bonds than it will on the prices of short-term bonds. b. All else equal, an increase in interest rates will have a greater effect on higher- coupon bonds than it will have on lower-coupon bonds. c. An increase in interest rates will have a greater effect on a zero-coupon bond with 10 years maturity than it will have on a 9-year bond with a 10 percent annual coupon. d. All of the above are correct. e. Answers a and care both correct. 37. If the risk-free rate is 7 percent, the expected return on the market is 10 percent, and the expected return on Security L is 13 percent, what is the beta of Security L? a. 1.0 b. 1.5 @ 2.0 d. 2.5 e. 3.0 38. If a group of securities are correctly priced, then the reward-to-risk ratio: a. for the entire group must equal 1.0. b. for each security must equal 1.0. for each security must equal 0. 2 is equal for each security. e of the combined group is equal to that of a risk-free security, Page 8 of 14 10 The 9 percent annual coupon bonds of the Lennway Inc. are selling for $1.008.20. The bands have a face value of $1,000 and mature in Il years. What is the yield to maturity? 8.76 percent b. 8.82 percent @ 8.88 percent 3. 9.03 percent e. 9.18 percent 40. You have just received a prize worth $150. You deposited your winnings into an account which pays 6 percent interest compounded monthly. How long will you have to wait until your winnings are worth $250? a. 98.72 months b. 99.51 months ( 102.42 months 105 20 months e. 106.38 months 41. You have a $12.000 portfolio which is invested in stocks A and B, and a risk-free asset. $5,000 is invested in stock A. Stock A has a beta of 1.76 and stock Bhas a beta of 0.89. How much needs to be invested in stock B if you want a portfolio beta of 1.10? a. $3,750,00 b. $4,333.33 c. $4,706.20 d. $4,943.82 e. 55,419.27 42. Which of the following statements is correct? a. If the returns on a stock could vary widely, and its standard deviation is large, then the stock will necessarily have a large bela coefficient. b. A stock that is more highly positively correlated with "The Market" than most stocks would not necessarily have a beta coefficient that is greater than 1.0 C. A stock's standard deviation of returns is a measure of the stock's "stand-alone risk, while its coefficient of variation measures its risk if the stock is held in a portfolio d. A portfolio that contained 100 low-beta stocks would be riskier than a portfolio containing 100 high-beta stocks. e. Negative betas cannot exist; if you calculate one, you made an error Page 9 of 14 43. You hold a diversified portfolio consisting of a $10,000 investment in each of 20 different common stocks (ie., your total investment is $200,000). The portfolio beta is equal to 1.2. You have decided to sell one of your stocks which has a beta equal to 0.7 for $10,000. You plan to use the proceeds to purchase another stock which has a beta equal to 1.4. What will be the beta of the new portfolio? a. 1.165 b. 1.235 c. 1.250 d. 1.284 e. 1.333 44. The National Bank offers personal loans at 8 percent compounded on a monthly basis. The Global Bank offers similar loans at 8.25 percent compounded on a quarterly basis. Which one of the following statements is correct concerning these two banks? a. The National Bank loan has an effective rate of 8.27 percent. b. The National Bank loan has an effective rate of 8.33 percent. c. The National Bank loan has a higher effective rate than the Global Bank loan. d. The Global Bank loan has an effective rate of 8.30 percent. e. The Global Bank loan has an effective rate of 8.51 percent. 45. Which of the following is not considered a capital component for the purpose of calculating the weighted average cost of capital as it applies to capital budgeting? a Long-term debt. b. Common stock. c. Off-balance sheet assets. d. Preferred stock e. All of the above are considered capital components for WACC and capital budgeting purposes 46. Boulder Furniture has bonds outstanding that mature in 13 years, have a 6 percent coupon, and pay interest annually. These bonds have a face value of $1,000 and a current market price of $1,040. What is the company's aftertax cost of debt if its tax rate is 32 percent? a. 2.97 percent b. 3.24 percent c. 3.78 percent d. 5.21 percent e. 5.53 percent 47. PVA's has a debt equal to 35% weight of capital, which consists only of debt and equity. and a tax rate of 35 percent. The firm does not issue preferred stock. The cost of equity is 14.5 percent and the pre-tax cost of debt is 7.38 percent. What is the weighted average cost of capital? Round your calculations to two decimals. a. 10.46 percent b. 10.67 percent c. 11.06 percent d. 11.38 percent e. 11.57 percent 48. Standard deviations of A, B, C are 9%, 23.3%, and 3.3%, respectively. Their corresponding expected returns are 18%, 24%, and 8%, in the same order (A, B, C). Which investment has the best risk-return ratio. a. Investment A b. Investment B c. Investment d. Their ratios are all equal 49. You own a portfolio consisting of the securities listed below. The expected return for each security is as shown. What is the expected return on the portfolio? Expected Price se Share Number O Shares Return Stock a. 7.14 percent b. 767 percent c. 8.30 percent d. 8.64 percen 9.47 percent