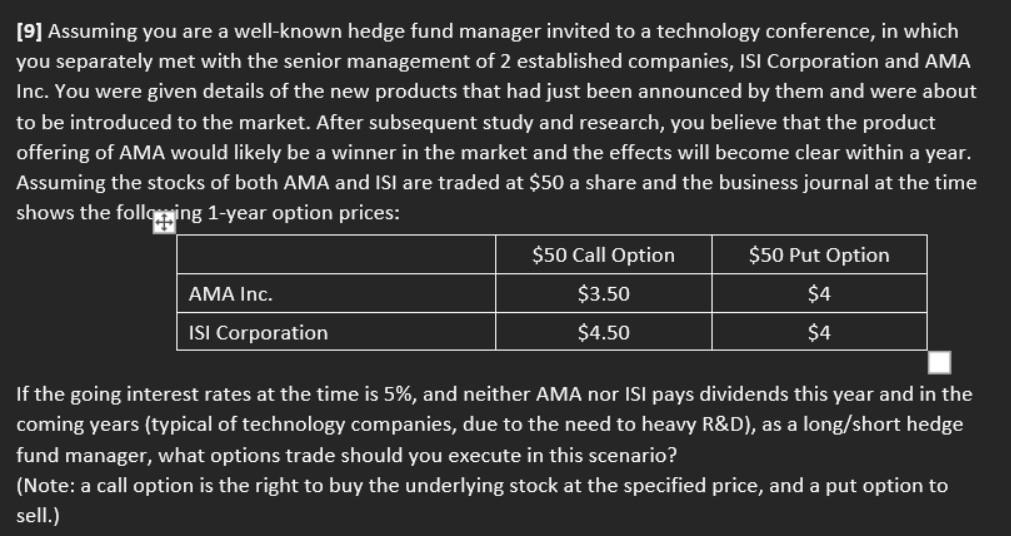

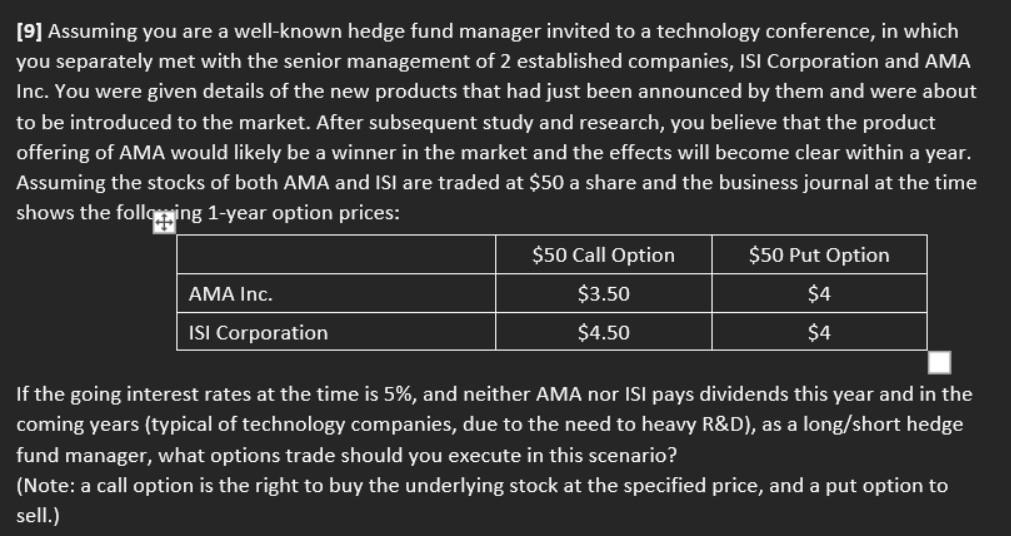

[9] Assuming you are a well-known hedge fund manager invited to a technology conference, in which you separately met with the senior management of 2 established companies, ISI Corporation and AMA Inc. You were given details of the new products that had just been announced by them and were about to be introduced to the market. After subsequent study and research, you believe that the product offering of AMA would likely be a winner in the market and the effects will become clear within a year. Assuming the stocks of both AMA and ISI are traded at $50 a share and the business journal at the time shows the following 1-year option prices: $50 Call Option $50 Put Option AMA Inc. $3.50 $4 ISI Corporation $4.50 $4 If the going interest rates at the time is 5%, and neither AMA nor ISI pays dividends this year and in the coming years (typical of technology companies, due to the need to heavy R&D), as a long/short hedge fund manager, what options trade should you execute in this scenario? (Note: a call option is the right to buy the underlying stock at the specified price, and a put option to sell.) [9] Assuming you are a well-known hedge fund manager invited to a technology conference, in which you separately met with the senior management of 2 established companies, ISI Corporation and AMA Inc. You were given details of the new products that had just been announced by them and were about to be introduced to the market. After subsequent study and research, you believe that the product offering of AMA would likely be a winner in the market and the effects will become clear within a year. Assuming the stocks of both AMA and ISI are traded at $50 a share and the business journal at the time shows the following 1-year option prices: $50 Call Option $50 Put Option AMA Inc. $3.50 $4 ISI Corporation $4.50 $4 If the going interest rates at the time is 5%, and neither AMA nor ISI pays dividends this year and in the coming years (typical of technology companies, due to the need to heavy R&D), as a long/short hedge fund manager, what options trade should you execute in this scenario? (Note: a call option is the right to buy the underlying stock at the specified price, and a put option to sell.)