Answered step by step

Verified Expert Solution

Question

1 Approved Answer

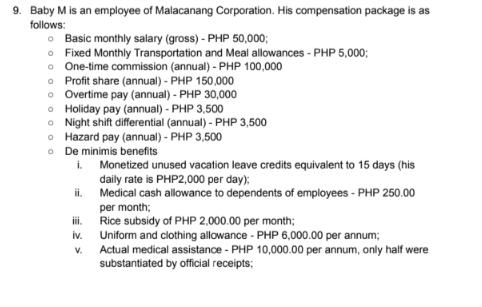

9. Baby M is an employee of Malacanang Corporation. His compensation package is as follows: Basic monthly salary (gross) - PHP 50,000; o Fixed

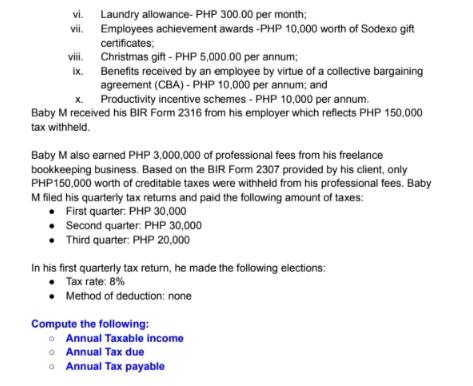

9. Baby M is an employee of Malacanang Corporation. His compensation package is as follows: Basic monthly salary (gross) - PHP 50,000; o Fixed Monthly Transportation and Meal allowances - PHP 5,000; o One-time commission (annual) - PHP 100,000 Profit share (annual) - PHP 150,000 Overtime pay (annual) - PHP 30,000 Holiday pay (annual) - PHP 3,500 o Night shift differential (annual) - PHP 3,500 o Hazard pay (annual) -PHP 3,500 O De minimis benefits i. Monetized unused vacation leave credits equivalent to 15 days (his daily rate is PHP2,000 per day); Medical cash allowance to dependents of employees - PHP 250.00 per month; Rice subsidy of PHP 2,000.00 per month; ii. iv. V. Uniform and clothing allowance - PHP 6,000.00 per annum; Actual medical assistance - PHP 10,000.00 per annum, only half were substantiated by official receipts; vi. Laundry allowance-PHP 300.00 per month; vii. Employees achievement awards -PHP 10,000 worth of Sodexo gift certificates; Christmas gift - PHP 5,000.00 per annum; viii. ix. Benefits received by an employee by virtue of a collective bargaining agreement (CBA) - PHP 10,000 per annum; and X. Productivity incentive schemes - PHP 10,000 per annum. Baby M received his BIR Form 2316 from his employer which reflects PHP 150,000 tax withheld. Baby M also earned PHP 3,000,000 of professional fees from his freelance bookkeeping business. Based on the BIR Form 2307 provided by his client, only PHP150,000 worth of creditable taxes were withheld from his professional fees. Baby M filed his quarterly tax returns and paid the following amount of taxes: First quarter: PHP 30,000 . Second quarter: PHP 30,000 Third quarter: PHP 20,000 In his first quarterly tax return, he made the following elections: Tax rate: 8% Method of deduction: none Compute the following: Annual Taxable income Annual Tax due o Annual Tax payable

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To compute the annual taxable income we need to calculate the total gross income and subtract the allowable deductions Lets break down the information ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started