Answered step by step

Verified Expert Solution

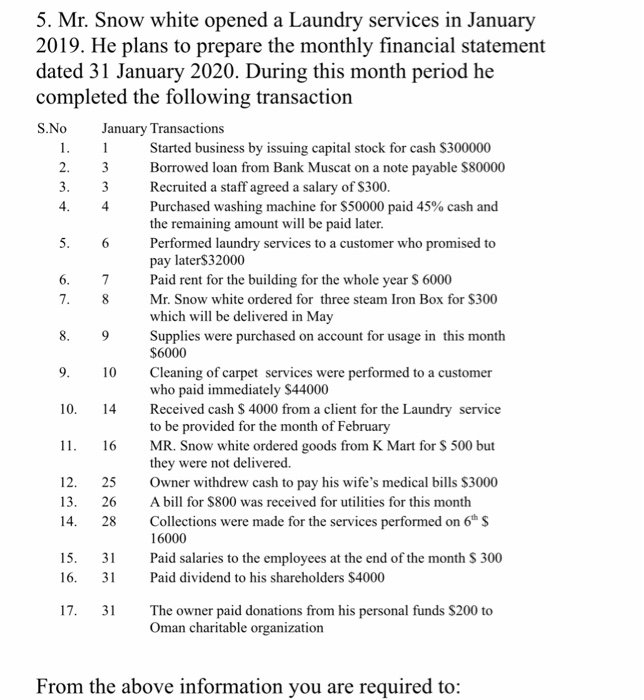

Question

1 Approved Answer

9. Consider the following adjustments to prepare the Adjusted Trial Balance after completing the unadjusted trial balance. (10 Marks) Adjusting entries for A.Supplies at the

9. Consider the following adjustments to prepare the Adjusted Trial Balance after completing the unadjusted trial balance. (10 Marks)

Adjusting entries for

A.Supplies at the end of the month amounted to $ 4000

B.Rent for the month amounted to $ 500

C.The life span of the washing machine was 5 years and residual value 2000

D. Salary of $ 150 will be paid in February

E.Unearned revenue was$ 1000 at the end of the month

10. Use the adjusted Trial Balance to prepare Income statement, statement of owners equity and statement of financial Position. (6.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started