Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. Eastland's currency is called the eastmark, and Westland's currency is called the westmark. In the market in which eastmarks and westmarks are traded

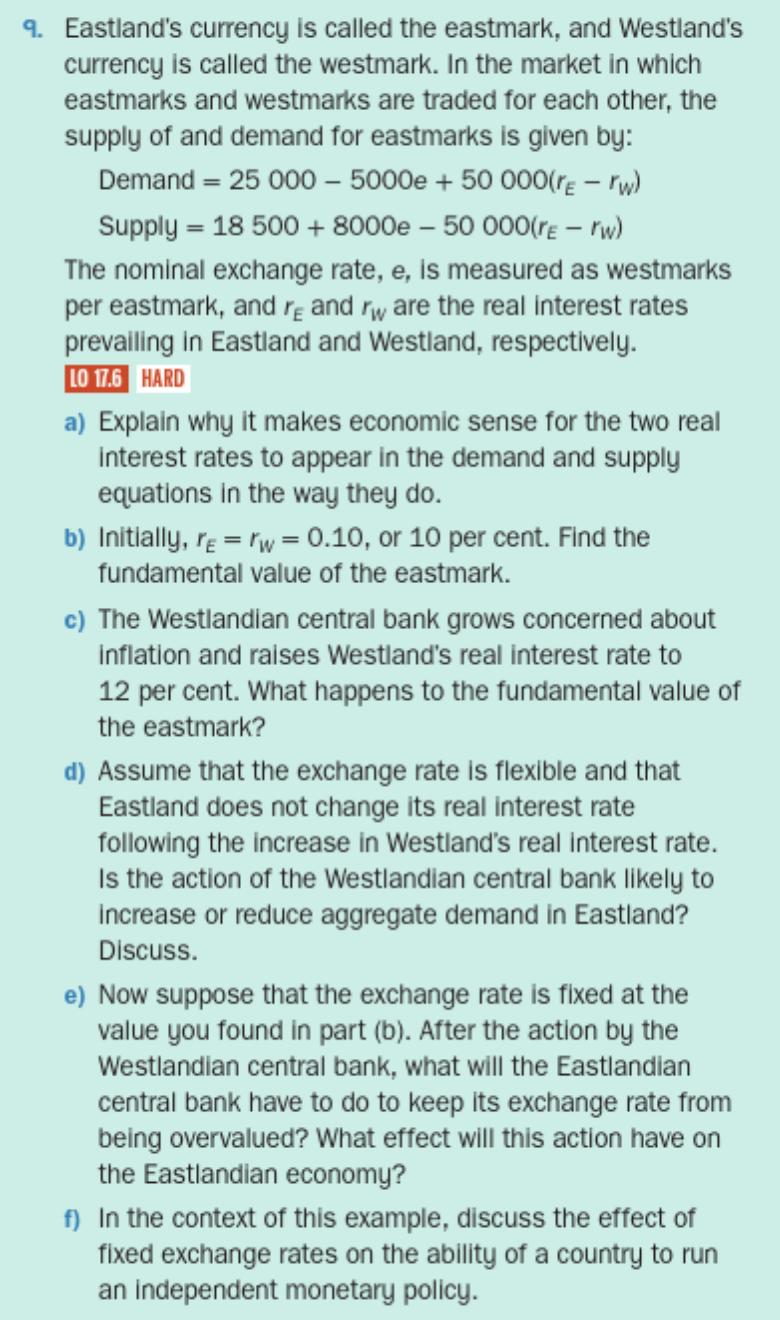

9. Eastland's currency is called the eastmark, and Westland's currency is called the westmark. In the market in which eastmarks and westmarks are traded for each other, the supply of and demand for eastmarks is given by: Demand 25 000 - 5000e + 50 000(re- rw) Supply 18 500 + 8000e - 50 000(re- rw) The nominal exchange rate, e, is measured as westmarks per eastmark, and r and rw are the real interest rates prevailing in Eastland and Westland, respectively. LO 17.6 HARD a) Explain why it makes economic sense for the two real interest rates to appear in the demand and supply equations in the way they do. b) Initially, r =w= 0.10, or 10 per cent. Find the fundamental value of the eastmark. c) The Westlandian central bank grows concerned about inflation and raises Westland's real interest rate to 12 per cent. What happens to the fundamental value of the eastmark? d) Assume that the exchange rate is flexible and that Eastland does not change its real interest rate following the increase in Westland's real interest rate. Is the action of the Westlandian central bank likely to increase or reduce aggregate demand in Eastland? Discuss. e) Now suppose that the exchange rate is fixed at the value you found in part (b). After the action by the Westlandian central bank, what will the Eastlandian central bank have to do to keep its exchange rate from being overvalued? What effect will this action have on the Eastlandian economy? f) In the context of this example, discuss the effect of fixed exchange rates on the ability of a country to run an independent monetary policy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The appearance of real interest rates in the demand and supply equations makes economic sense because interest rates play a crucial role in determin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started