Answered step by step

Verified Expert Solution

Question

1 Approved Answer

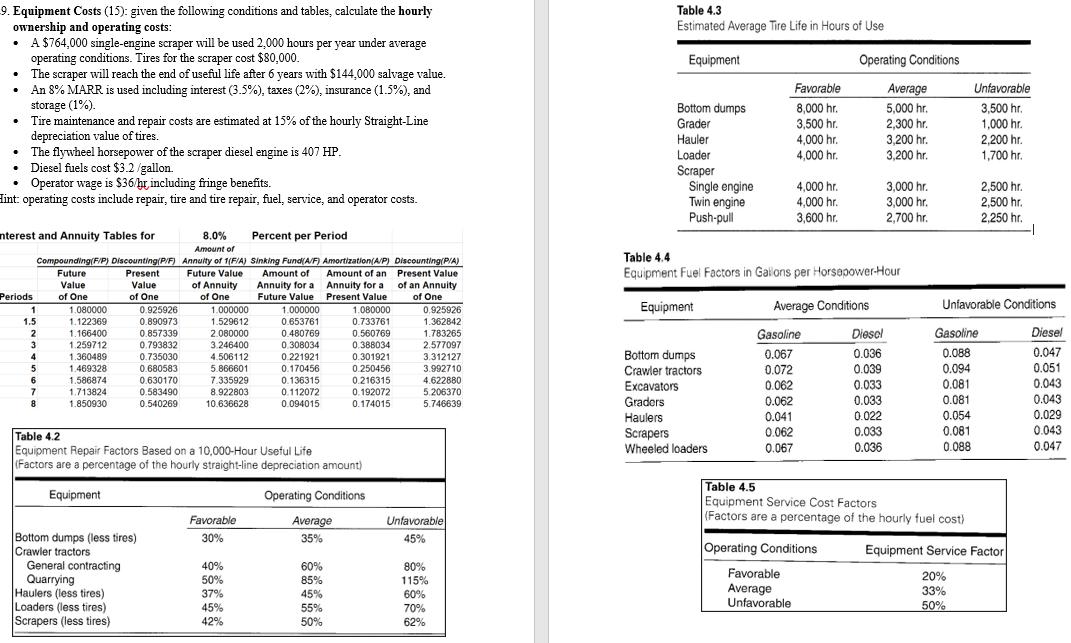

9. Equipment Costs (15): given the following conditions and tables, calculate the hourly ownership and operating costs: A $764,000 single-engine scraper will be used

9. Equipment Costs (15): given the following conditions and tables, calculate the hourly ownership and operating costs: A $764,000 single-engine scraper will be used 2,000 hours per year under average operating conditions. Tires for the scraper cost $80,000. The scraper will reach the end of useful life after 6 years with $144,000 salvage value. An 8% MARR is used including interest (3.5%), taxes (2%), insurance (1.5%), and storage (1%). Table 4.3 Estimated Average Tire Life in Hours of Use Equipment Operating Conditions Favorable Average Unfavorable Bottom dumps 8,000 hr. 5,000 hr. 3,500 hr. Future Value Future Value of Annuity Periods of One of One Tire maintenance and repair costs are estimated at 15% of the hourly Straight-Line depreciation value of tires. The flywheel horsepower of the scraper diesel engine is 407 HP. Diesel fuels cost $3.2/gallon. Operator wage is $36/hr, including fringe benefits. Hint: operating costs include repair, tire and tire repair, fuel, service, and operator costs. nterest and Annuity Tables for Compounding(F/P) Discounting (P/F) Annuity of 1(F/A) Sinking Fund(A/F) Amortization(A/P) Discounting(P/A) Present Value of One Grader 3,500 hr. 2,300 hr. 1,000 hr. Hauler 4,000 hr. 3,200 hr. 2,200 hr. Loader 4,000 hr. 3,200 hr. 1,700 hr. Scraper Single engine 4,000 hr. 3,000 hr. 2,500 hr. Twin engine 4,000 hr. 3,000 hr. 2,500 hr. Push-pull 3,600 hr. 2,700 hr. 2,250 hr. 8.0% Amount of Percent per Period Table 4.4 Amount of Annuity for a Amount of an Annuity for a Present Value of an Annuity Equipment Fuel Factors in Gallons per Horsepower-Hour Future Value Present Value of One 1 1.080000 0.925926 1.000000 1.000000 1.080000 0,925926 Equipment Average Conditions Unfavorable Conditions 1.5 1.122369 0.890973 1.529612 0.653761 0.733761 1.362842 2 1.166400 0.857339 2.080000 0.480769 0.560769 1.783265 Gasoline Diesel Gasoline Diesel 3 1.259712 0.793832 3.246400 0.308034 0.388034 2.577097 4 1.360489 0.735030 4.506112 0.221921 0.301921 3.312127 Bottom dumps 0.067 0.036 0.088 0.047 5 1.469328 0.680583 5.866601 0.170456 0.250456 3.992710 Crawler tractors 0.072 0.039 0.094 0.051 6 1.586874 0.630170 7.335929 0.136315 0.216315 4.622880 7 1.713824 0.583490 8.922803 Excavators 0.062 0.033 0.081 0.043 0.112072 0.192072 5.206370 8 1.850930 0.540269 10.636628 0.094015 0.174015 5.746639 Graders 0.062 0.033 0.081 0.043 Haulers 0.041 0.022 0.054 0.029 Table 4.2 Scrapers 0.062 0.033 0.081 0.043 Equipment Repair Factors Based on a 10,000-Hour Useful Life (Factors are a percentage of the hourly straight-line depreciation amount) Wheeled loaders 0.067 0.036 0.088 0.047 Equipment Operating Conditions Favorable Average Unfavorable Bottom dumps (less tires) 30% 35% 45% Crawler tractors General contracting 40% 60% 80% Quarrying 50% 85% 115% Haulers (less tires) 37% 45% 60% Loaders (less tires) 45% 55% 70% Scrapers (less tires) 42% 50% 62% Table 4.5 Equipment Service Cost Factors (Factors are a percentage of the hourly fuel cost) Operating Conditions Favorable Average Unfavorable Equipment Service Factor 20% 33% 50%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started