9

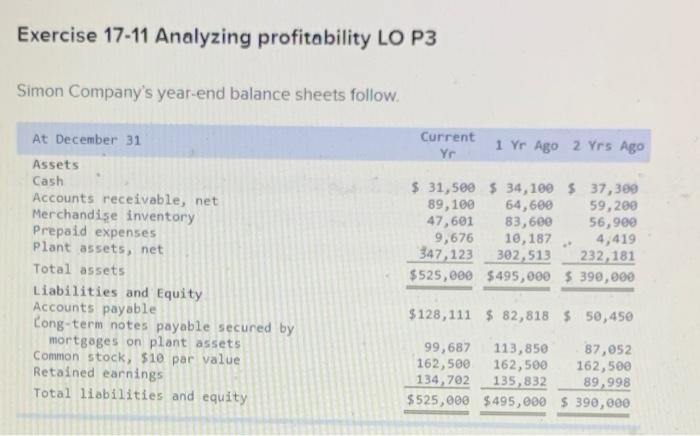

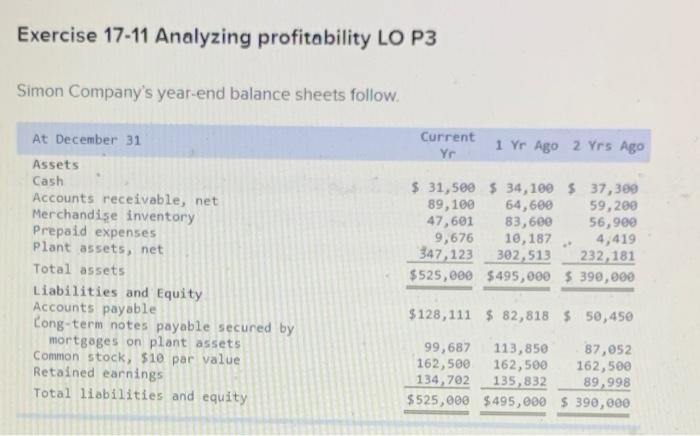

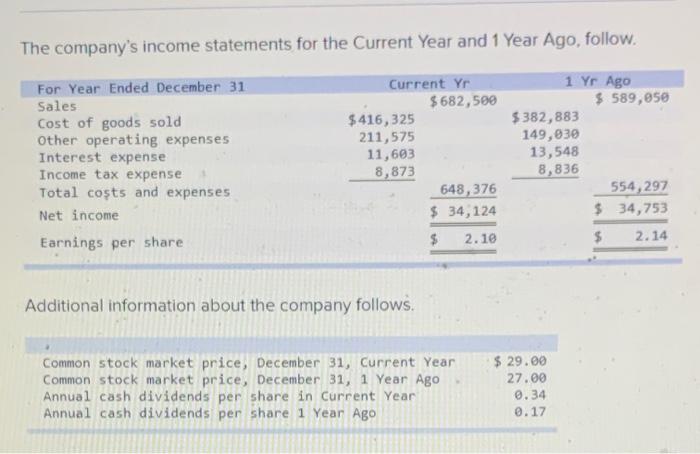

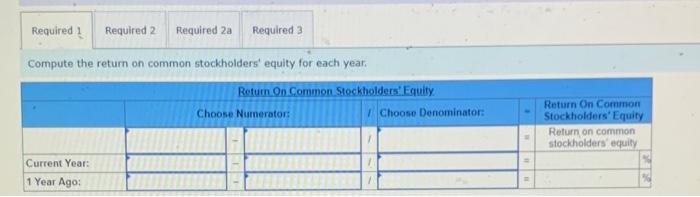

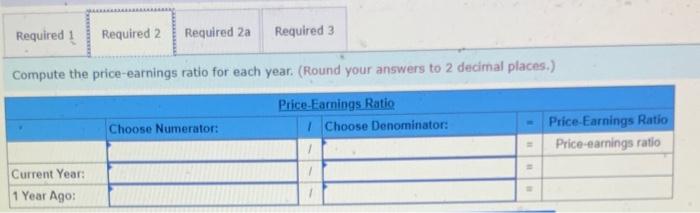

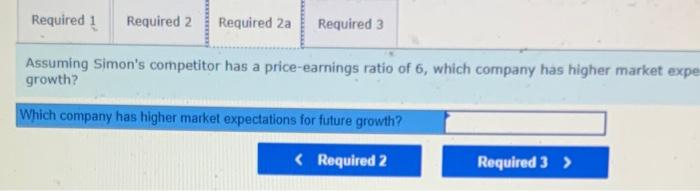

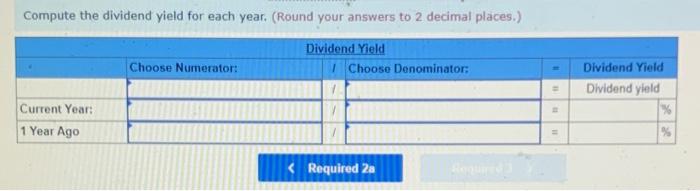

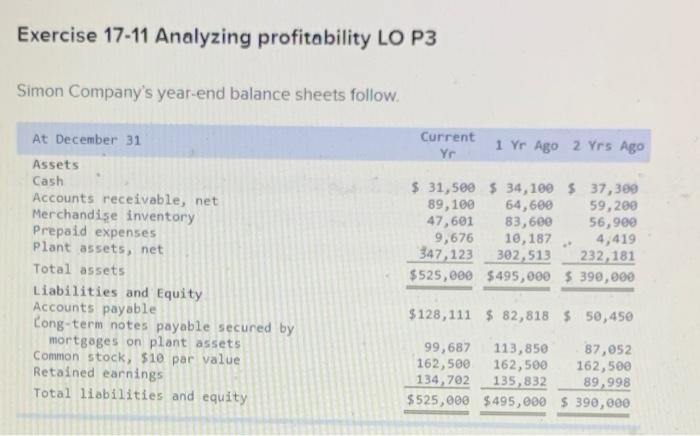

Exercise 17-11 Analyzing profitability LO P3 Simon Company's year-end balance sheets follow, Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses plant assets, net Total assets Liabilities and Equity Accounts payable Cong-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 31,500 $ 34,100 S 37, 309 89,100 64,680 59,288 47,601 83,600 56,900 9,676 10,187 4,419 347,123 302,513 232,181 $525,000 $495,000$ 390,000 $128, 111 $ 82,818 $ 50,450 99,687 113,850 87,052 162,500 162,500 162,500 134,702 135,832 89,998 $525,000 $495,000 $ 390,000 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current Yr $682,500 $416,325 211,575 11,683 8,873 648, 376 $ 34,124 $ 2.10 1 Yr Ago $ 589,050 $382,883 149,039 13,548 8,836 554,297 $ 34,753 $ 2.14 Additional information about the company follows. Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year ago $ 29.00 27.00 0.34 0.17 Required 1 Required 2 Required 2a Required 3 Compute the return on common stockholders' equity for each year. Retum On Common Stockholders' Equity Choose Numerator: Choose Denominator: Return On Common Stockholders' Equity Return on common stockholders equity Current Year: 1 Year Ago: Required 1 Required 2 Required 2a Required 3 Compute the price-earnings ratio for each year. (Round your answers to 2 decimal places.) Price Earnings Ratio Choose Denominator: Choose Numerator: Price Earnings Ratio Price-earnings ratio Current Year: 1 Year Ago: Required 1 Required 2 Required 2a Required 3 Assuming Simon's competitor has a price-earnings ratio of 6, which company has higher market expe growth? Which company has higher market expectations for future growth? Compute the dividend yield for each year. (Round your answers to 2 decimal places.) Choose Numerator: Dividend Yield Choose Denominator: Dividend Yield Dividend yield Current Year: 1 Year Ago