Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9) From the standpoint of payments received a defined benefit plan in contrast to a defined contribution plan a) Receives an annual debt obligation by

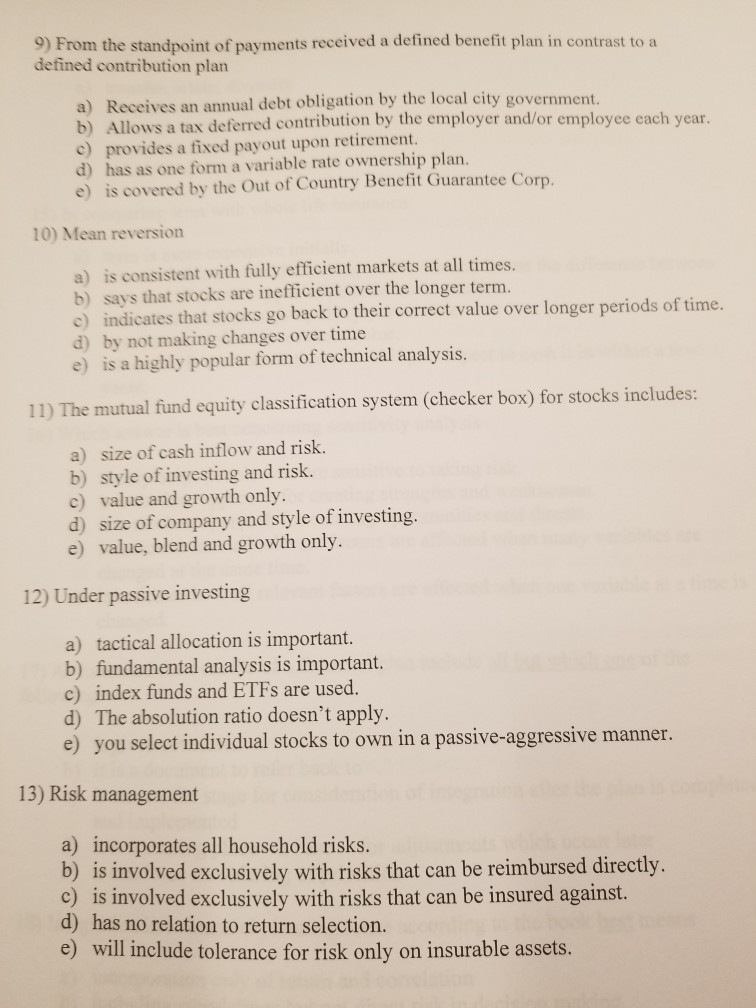

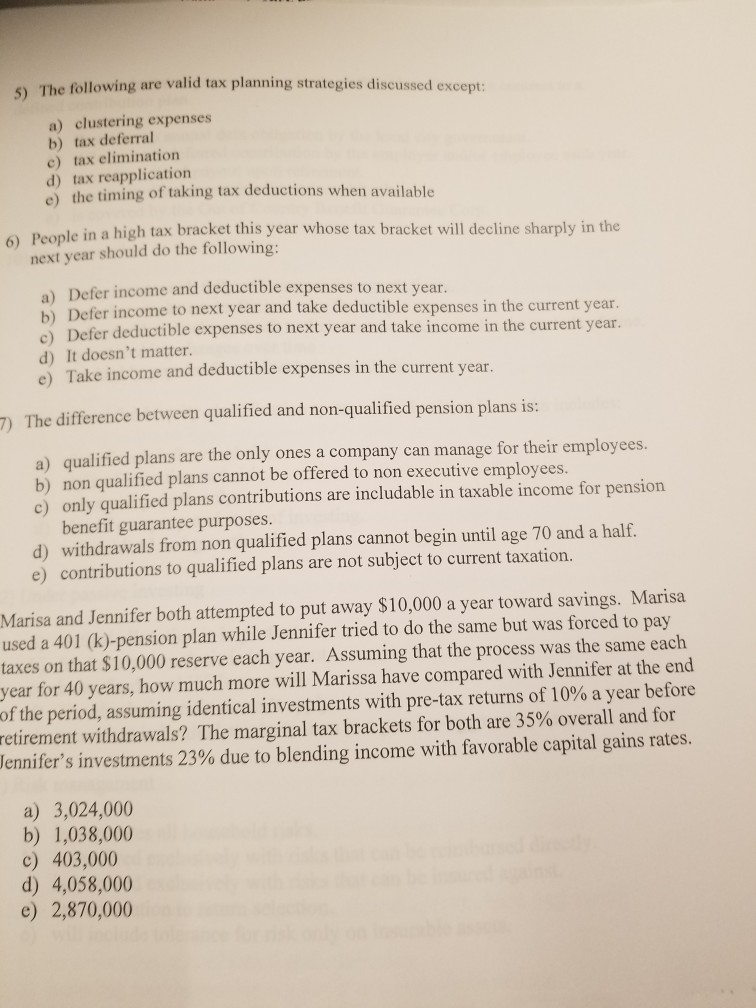

9) From the standpoint of payments received a defined benefit plan in contrast to a defined contribution plan a) Receives an annual debt obligation by the local city government. b) Allows a tax deferred contribution by the employer and/or employee each year. c) provides a fixed payout upon retirement. d) has as one form a variable rate ownership plan. e) is covered by the Out of Country Benefit Guarantee Corp. 10) Mean reversion a) is consistent with fully efficient markets at all times. b) says that stocks are inefficient over the longer term. c) indicates that stocks go back to their correct value over longer periods of time. d) by not making changes over time e) is a highly popular form of technical analysis. 11) The mutual fund equity classification system (checker box) for stocks includes: a) size of cash inflow and risk. b) style of investing and risk. c) value and growth only. d) size of company and style of investing. e) value, blend and growth only. 12) Under passive investing a) tactical allocation is important. b) fundamental analysis is important. c) index funds and ETFs are used. d) The absolution ratio doesn't apply. e) you select individual stocks to own in a passive-aggressive manner. 13) Risk management a) incorporates all household risks. b) is involved exclusively with risks that can be reimbursed directly. c) is involved exclusively with risks that can be insured against. d) has no relation to return selection. e) will include tolerance for risk only on insurable assets. 5) The following are valid tax planning strategies discussed except: a) clustering expenses b) tax deferral c) tax elimination d) tax reapplication e) the timing of taking tax deductions when available ple in a high tax bracket this year whose tax bracket will decline sharply in the next year should do the following: a) Defer income and deductible expenses to next year. b) Defer income to next year and take deductible expenses in the current year. c) Defer deductible expenses to next year and take income in the current year. d) It doesn't matter. e) Take income and deductible expenses in the current year. - The difference between qualified and non-qualified pension plans is: a qualified plans are the only ones a company can manage for their employees. b) non qualified plans cannot be offered to non executive employees. c) only qualified plans contributions are includable in taxable income for pension benefit guarantee purposes. d) withdrawals from non qualified plans cannot begin until age 70 and a half. e) contributions to qualified plans are not subject to current taxation. Marisa and Jennifer both attempted to put away $10,000 a year toward savings. Marisa used a 401 (k)-pension plan while Jennifer tried to do the same but was forced to pay taxes on that $10,000 reserve each year. Assuming that the process was the same each year for 40 years, how much more will Marissa have compared with Jennifer at the end of the period, assuming identical investments with pre-tax returns of 10% a year before retirement withdrawals? The marginal tax brackets for both are 35% overall and for Jennifer's investments 23% due to blending income with favorable capital gains rates, a) 3,024,000 b) 1,038,000 c) 403,000 d) 4,058,000 e) 2,870,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started