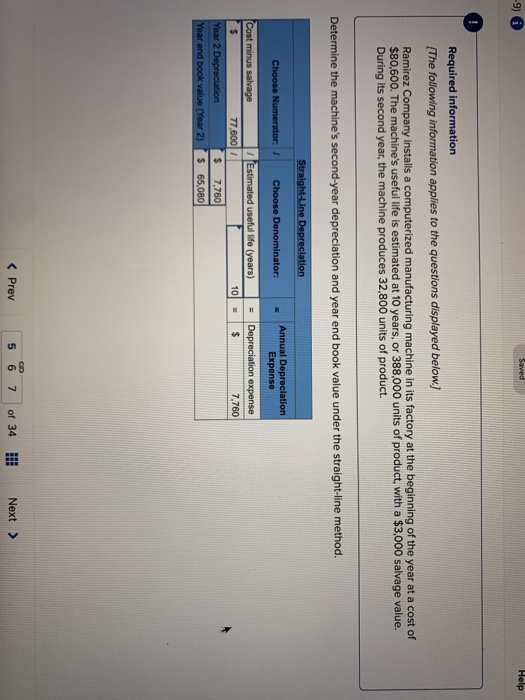

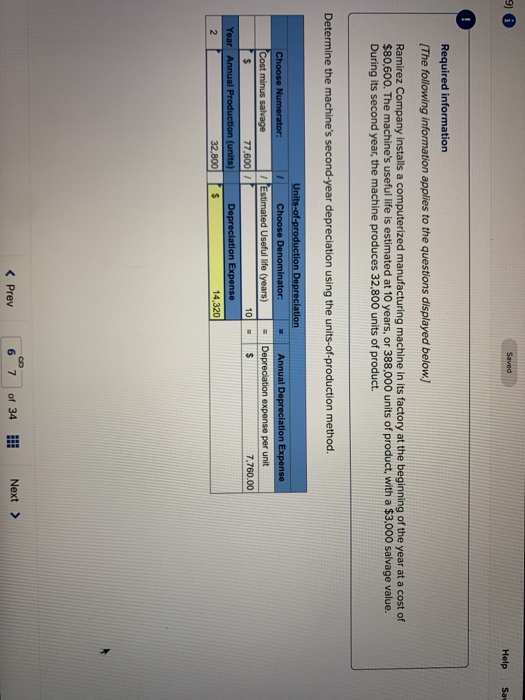

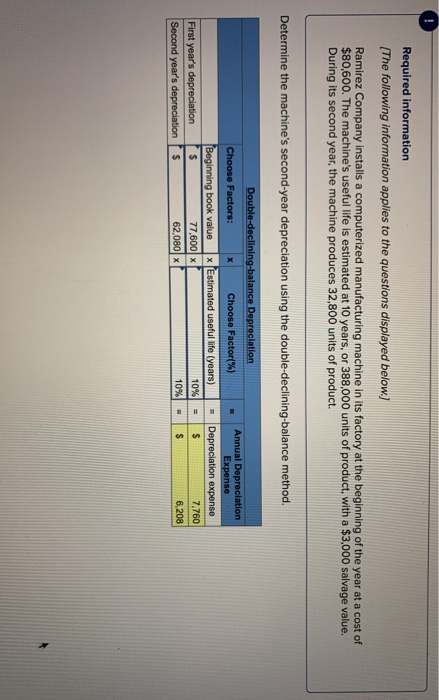

-9) Help Required information [The following information applies to the questions displayed below.) Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $80,600. The machine's useful life is estimated at 10 years, or 388,000 units of product, with a $3,000 salvage value. During its second year, the machine produces 32,800 units of product. Determine the machine's second-year depreciation and year end book value under the straight-line method. Straight-Line Depreciation Choose Numerator: Choose Denominator: - Annual Depreciation Expense Estimated useful life (years) - - Depreciation expense $ 7,760 10 Cost minus salvage 77,600 Year 2 Depreciation Year end book value (Year 2) $ 7,760 $ 65,080 Saved Help Sas Required information [The following information applies to the questions displayed below.) Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $80,600. The machine's useful life is estimated at 10 years, or 388,000 units of product, with a $3,000 salvage value. During its second year, the machine produces 32,800 units of product. Determine the machine's second-year depreciation using the units-of-production method. Units-of-production Depreciation Choose Denominator: - Estimated Useful life (years) Choose Numerator: Cost minus salvage 77,600 Year Annual Production (units) 2 32,800 Annual Depreciation Expense Depreciation expense per unit 7.760.00 10 Depreciation Expense 14,320 $ Required information The following information applies to the questions displayed below.) Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $80,600. The machine's useful life is estimated at 10 years, or 388,000 units of product, with a $3,000 salvage value. During its second year, the machine produces 32,800 units of product. Determine the machine's second-year depreciation using the double-declining-balance method. Double-declining-balance Depreciation Choose Factors: x Choose Factor%) Beginning book value x Estimated useful life (years) $ 77,600 X $ 62,080 X Annual Depreciation Expense Depreciation expense - 10% 7.760 First year's depreciation Second year's depreciation 6,208