Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9 https://drive google.com/drive/folders/1nT1STX ODDHCugONjGYgsobDvq6Yn8G FIN220-Madule4 2c FIN220- Capital Budgeting Practice 1) Biarcliff Stove Company is considering a new product line to supplement its range line.

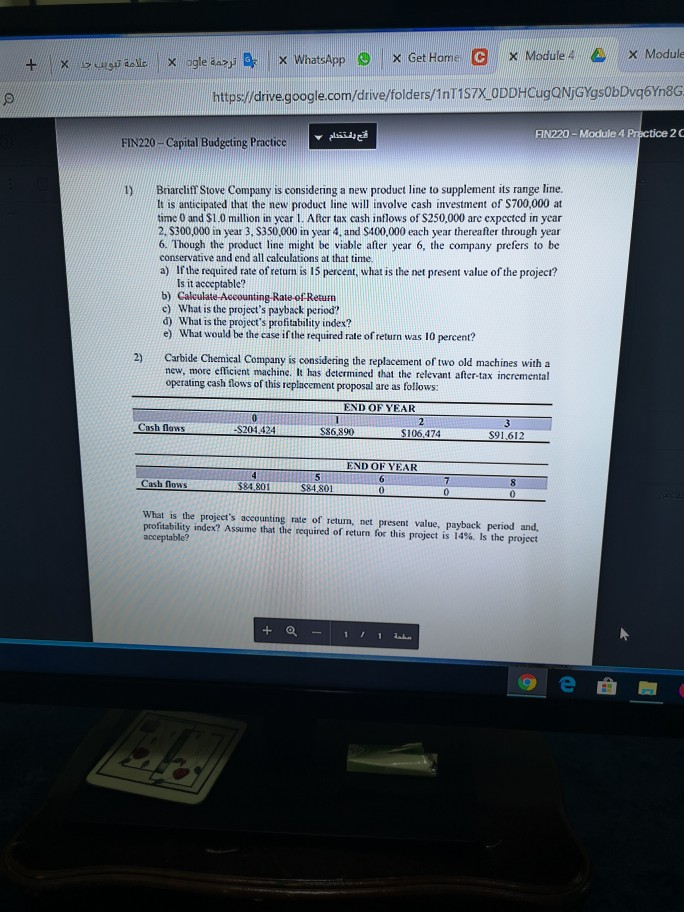

9 https://drive google.com/drive/folders/1nT1STX ODDHCugONjGYgsobDvq6Yn8G FIN220-Madule4 2c FIN220- Capital Budgeting Practice 1) Biarcliff Stove Company is considering a new product line to supplement its range line. It is anticipated that the new product line will involve cash investment of $700,000 at time 0 and S1.0 million in year 1. After tax cash inflows of $250,000 are expected in year 2. $300,000 in year 3, $350,000 in year 4, and $400,000 each year thereafter through year 6. Though the product line might be viable after year 6, the company prefers to be conservative and end all calculations at that time. a) If the required rate of return is 15 percent, what is the net present value of the project? Is it acceptable? b) Calculate Accounting Rate of Reaum c) What is the project's payback period? d) What is the project's profitability index? e) What would be the case if the required rate of return was 10 percent? Carbide Chemical Company is considering the replacement of two old machines with a new, more efficient machine. It has determined that the relevant after-tax incremental operating cash flows of this replacement proposal are as follows: 2) END OF YEAR 106,474 S91.612 END OF YEAR Cash flows $84.801 What is the project's accounting rate of return, net present value, payback period and, profitability index? Assume that the required of return for this project is 14% Is the proyect acceptable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started