Answered step by step

Verified Expert Solution

Question

1 Approved Answer

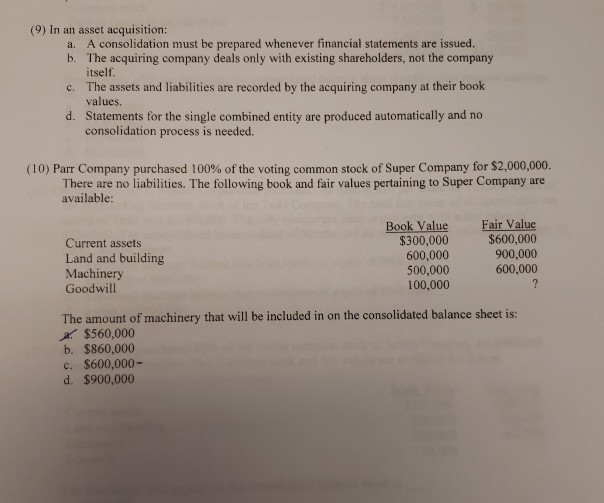

(9) In an asset acquisition: a. A consolidation must be prepared whenever financial statements are issued. b. The acquiring company deals only with existing shareholders,

(9) In an asset acquisition: a. A consolidation must be prepared whenever financial statements are issued. b. The acquiring company deals only with existing shareholders, not the company itself. c. The assets and liabilities are recorded by the acquiring company at their book values. d. Statements for the single combined entity are produced automatically and no consolidation process is needed. (10) Parr Company purchased 100% of the voting common stock of Super Company for $2,000,000 There are no liabilities. The following book and fair values pertaining to Super Company are available: Current assets Land and building Machinery Goodwill Book Value $300,000 600,000 500,000 100,000 Fair Value $600,000 900,000 600,000 The amount of machinery that will be included in on the consolidated balance sheet is: * $560,000 b. $860,000 c. $600,000 - d. $900,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started