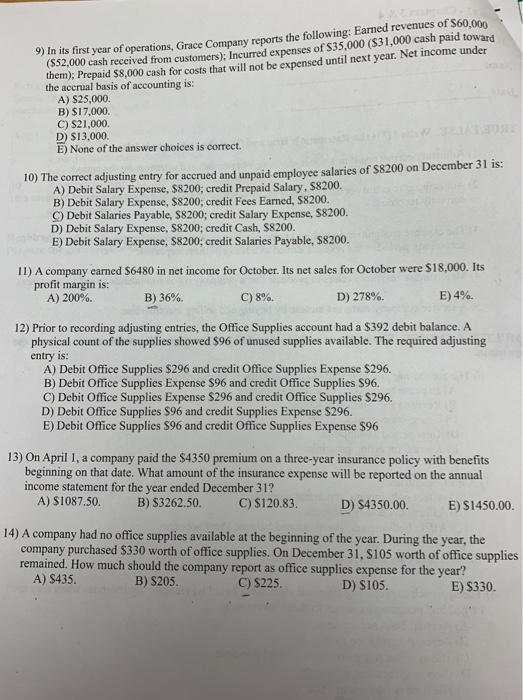

9) In its first year of operations, Grace Company reports the following: Earned revenues of $60,000 (S52,000 cash received from customers): Incurred expenses of $35,000 ($31,000 cash paid toward them); Prepaid $8,000 cash for costs that will not be expensed until next year. Net income under the accrual basis of accounting is: A) $25,000. B) $17,000 C) $21,000. D) $13,000 E) None of the answer choices is correct. 10) The correct adjusting entry for accrued and unpaid emplovee salaries of $8200 on December 31 15: A) Debit Salary Expense, $8200; credit Prepaid Salary, 58200. B) Debit Salary Expense, S8200; credit Fees Earned, 58200. C) Debit Salaries Payable, S8200; credit Salary Expense, S8200. D) Debit Salary Expense, S8200; credit Cash, 58200. E) Debit Salary Expense, S8200; credit Salaries Payable, $8200. 11) A company earned $6480 in net income for October. Its net sales for October were $18,000. Its profit margin is: A) 200%. B) 36% C) 8%. D) 278% E) 4%. 12) Prior to recording adjusting entries, the Office Supplies account had a $392 debit balance. A physical count of the supplies showed $96 of unused supplies available. The required adjusting entry is: A) Debit Office Supplies $296 and credit Office Supplies Expense S296. B) Debit Office Supplies Expense 396 and credit Office Supplies $96. C) Debit Office Supplies Expense $296 and credit Office Supplies $296. D) Debit Office Supplies 596 and credit Supplies Expense S296. E) Debit Office Supplies $96 and credit Office Supplies Expense $96 13) On April 1, a company paid the $4350 premium on a three-year insurance policy with benefits beginning on that date. What amount of the insurance expense will be reported on the annual income statement for the year ended December 312 A) $1087.50. B) $3262.50. C) $120.83. D) $4350.00. E) $1450.00 14) A company had no office supplies available at the beginning of the year. During the year, the company purchased $330 worth of office supplies. On December 31, S105 worth of office supplies remained. How much should the company report as office supplies expense for the year? A) 5435. B) S205. C) $225. D) $105. E) $330