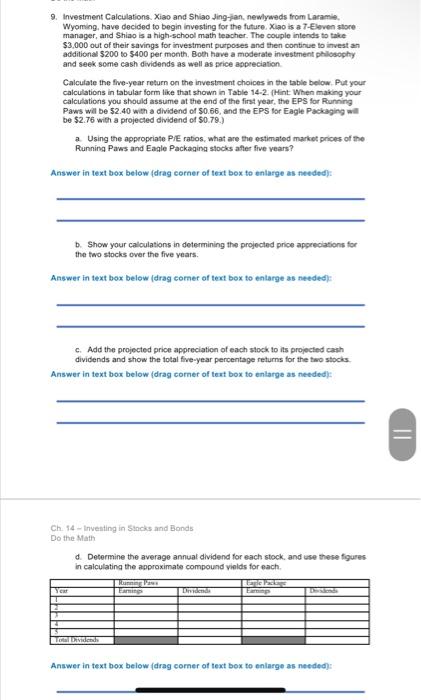

9. Investment Calculations. Xiao and ShiaoJing-jan, newlyweds from Laramie Wyoming, have decided to begin investing for the future. Xiao is a 7-Eleven store manager and Shiao is a high school math teacher. The couple intends to take $3,000 out of their savings for investment purposes and then continue to invest an additional $200 to $400 per month. Both have a moderate investment philosophy and seek some cash dividends as well as price appreciation Calculate the five-year return on the investment choices in the table below Put your calculations in tabular form like that shown in Table 14-2. (Hint: When making your calculations you should assume at the end of the first year, the EPS for Running Paws will be $2.40 with a dividend of $0.66, and the EPS for Eagle Packaging we be 52.76 with a projected dividend of 0.79.) a Using the appropriate P/E ratios, what are the estimated market prices of the Running Paws and Eagle Packaging stocks after five years? Answer in text box below (drag corner of text box to enlarge as needed): Show your calculations in determining the projected price appreciations for the two stocks over the five years. Answer in text box below (drag comer of text box to enlarge as needed): c. Add the projected price appreciation of each stock to its projected cash dividends and show the total five-year percentage returns for the two stocks Answer in text box below (drag comer of text box to enlarge as needed: II Ch 14 - Investing in Sinks and Bonds Do the Math d Determine the average annual dividend for each stock and use these figures in calculating the approximate compound vields for each T. Epic Unded RE Vid Answer in text box below (drag corner of text box to enlarge as needed): 9. Investment Calculations. Xiao and ShiaoJing-jan, newlyweds from Laramie Wyoming, have decided to begin investing for the future. Xiao is a 7-Eleven store manager and Shiao is a high school math teacher. The couple intends to take $3,000 out of their savings for investment purposes and then continue to invest an additional $200 to $400 per month. Both have a moderate investment philosophy and seek some cash dividends as well as price appreciation Calculate the five-year return on the investment choices in the table below Put your calculations in tabular form like that shown in Table 14-2. (Hint: When making your calculations you should assume at the end of the first year, the EPS for Running Paws will be $2.40 with a dividend of $0.66, and the EPS for Eagle Packaging we be 52.76 with a projected dividend of 0.79.) a Using the appropriate P/E ratios, what are the estimated market prices of the Running Paws and Eagle Packaging stocks after five years? Answer in text box below (drag corner of text box to enlarge as needed): Show your calculations in determining the projected price appreciations for the two stocks over the five years. Answer in text box below (drag comer of text box to enlarge as needed): c. Add the projected price appreciation of each stock to its projected cash dividends and show the total five-year percentage returns for the two stocks Answer in text box below (drag comer of text box to enlarge as needed: II Ch 14 - Investing in Sinks and Bonds Do the Math d Determine the average annual dividend for each stock and use these figures in calculating the approximate compound vields for each T. Epic Unded RE Vid Answer in text box below (drag corner of text box to enlarge as needed)