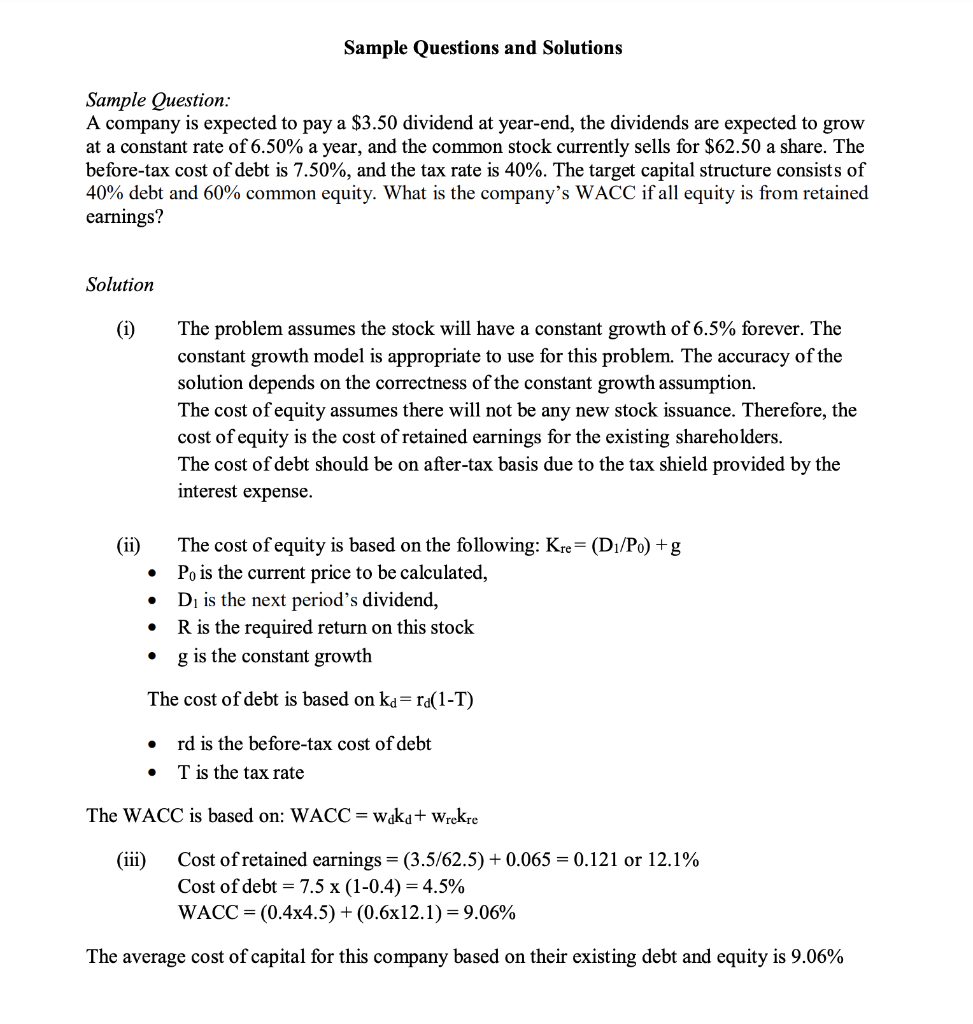

9. Lee Airlines plans to issue 15-year bonds with a par value of $1,000 that will pay $50 every six months. The bonds have a market price of $920. Flotation costs on new debt will be 6%. If the firm is in the 35% marginal tax bracket, what is the posttax cost of new debt? 10. Fisheye Inc. is investing in a new project costing $24 million. It will raise $8 million in bonds, $6 million in preferred stock, and $10 million in retained earnings. If the after-tax cost of debt is 6%, cost of preferred stock is 12%, the cost of retained earnings is 16%, and the cost of new common stock is 20%, what is the WACC? Sample Questions and Solutions Sample Question: A company is expected to pay a $3.50 dividend at year-end, the dividends are expected to grow at a constant rate of 6.50% a year, and the common stock currently sells for $62.50 a share. The before-tax cost of debt is 7.50%, and the tax rate is 40%. The target capital structure consists of 40% debt and 60% common equity. What is the company's WACC if all equity is from retained earnings? Solution (i) The problem assumes the stock will have a constant growth of 6.5% forever. The constant growth model is appropriate to use for this problem. The accuracy of the solution depends on the correctness of the constant growth assumption. The cost of equity assumes there will not be any new stock issuance. Therefore, the cost of equity is the cost of retained earnings for the existing shareholders. The cost of debt should be on after-tax basis due to the tax shield provided by the interest expense. (ii) The cost of equity is based on the following: Kre= (D2/Po) +g Po is the current price to be calculated, D is the next period's dividend, R is the required return on this stock g is the constant growth The cost of debt is based on ka=ra(1-T) rd is the before-tax cost of debt T is the tax rate The WACC is based on: WACC = waka+ Wrekre (iii) Cost of retained earnings = (3.5/62.5) + 0.065 = 0.121 or 12.1% Cost of debt = 7.5 x (1-0.4) = 4.5% WACC = (0.4x4.5) + (0.6x12.1) = 9.06% The average cost of capital for this company based on their existing debt and equity is 9.06%