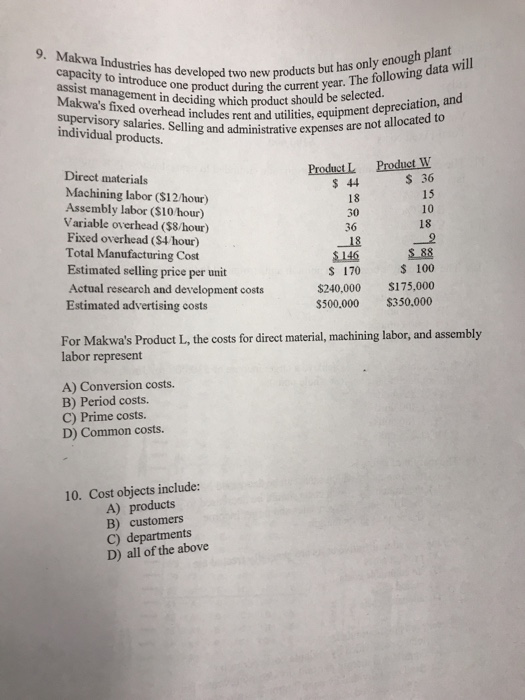

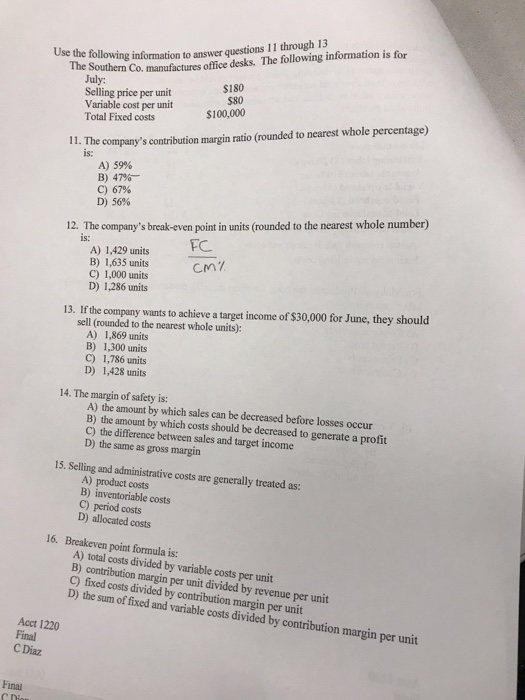

9. Makwa Industries has developed two new proear enough plant d capacity to introduce one product during the ustries has assist manag Makwa's fiv ideciding which product should be selected. supervisory salaries. Selling and administrative expenses a nsor Salaries. Sel inudes rent and utilities, equipment depreciation, and individual products. are not allocated to Produst L $ 44 18 30 36 Product W 36 15 10 18 Direct materials Machining labor ($12/hour) Assembly labor (S10 hour) Variable overhead ($8/hour Fixed overhead ($4 hour) Total Manufacturing Cost Estimated selling price per unit Actual research and development costs Estimated advertising costs $ 146 S 170 100 $240,000 S175,000 $500,000 $350,000 For Makwa's Product L, the costs for direct material, machining labor, and assembly labor represent A) Conversion costs. B) Period costs. C) Prime costs. D) Common costs. 10. Cost objects include: A) products B) customers C) departments D) all of the above the Southern Co. manufactures office desks. The following information is for $180 $80 Use the following information to answer questions 11 through 13 July: Selling price per unit Variable cost per unit$100,000 Total Fixed costs 11. The company's contribution margin ratio (rounded to nearest whole percentage) is: A) 59% B) 47%- C) 67% D) 56% 12. The company's break-even point in units (rounded to the nearest whole number) is: A) 1,429 units B) 1,635 units C) 1,000 units D) 1,286 units (- CM7 13. If the company wants to achieve a target income of $30,000 for June, they should sell (rounded to the nearest whole units): A) 1,869 units B) 1,300 units C) 1,786 units D) 1,428 units 14. The margin of safety is: A) the amount by which sales can be decreased before losses occur B) the amount by which costs should be decreased to generate a profit C) the difference between sales and target income D) the same as gross margin 15. Selling and administrative costs are generally treated as: A) product costs B) inventoriable costs C) period costs D) allocated costs 16. Breakeven point formula is: A) total costs divided by variable costs per unit B) contribution margin C) fixed costs divided by contribution margin per unit D) the sum of fixed and variable costs divided by per unit divided by revenue per unit Acct 1220 Final C Diaz Fina