Answered step by step

Verified Expert Solution

Question

1 Approved Answer

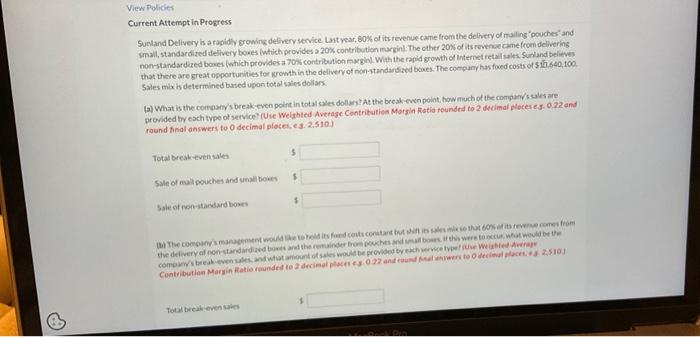

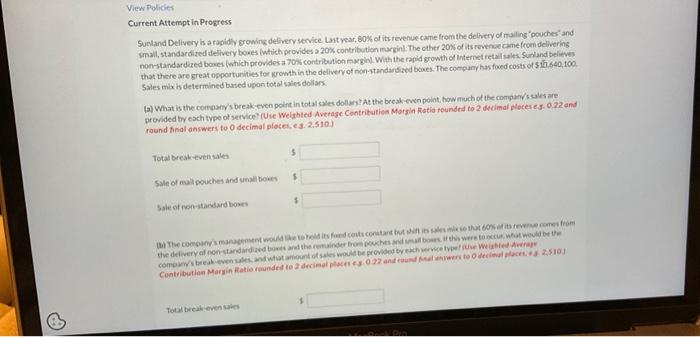

9 Mali, standardized delivery boves (which provides a 20% contribution marginl. The other 20% of its revenvecamefrem delivering nonstandardeed boses (which provides a 70ss contributionmygin.

9

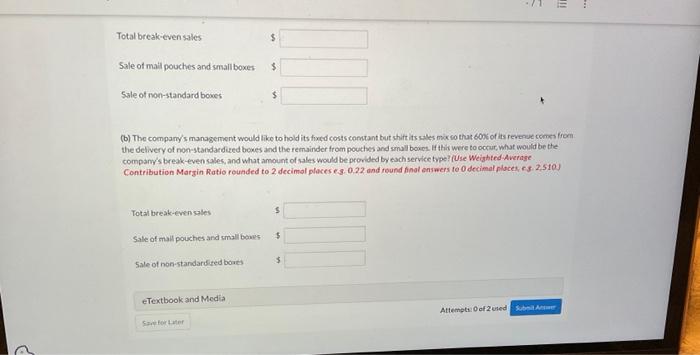

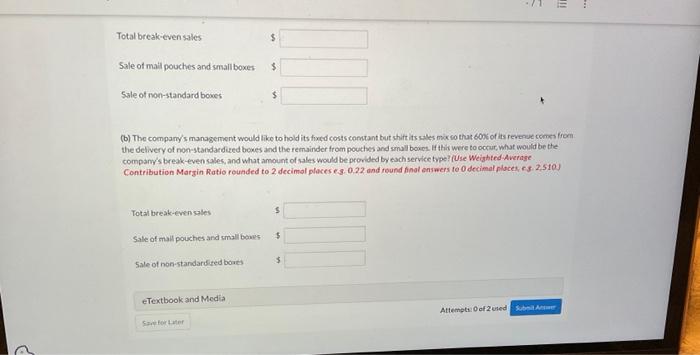

Mali, standardized delivery boves (which provides a 20% contribution marginl. The other 20% of its revenvecamefrem delivering nonstandardeed boses (which provides a 70ss contributionmygin. Wath the rapid growth of loternet retal males. Suriand believes that there are great opporturities for Nowthin the delivery of non-standardized bowes. The company has foed costs of 519640,100 . Sales mix is deterrined based ugon total saies dollars. (a) What is the compary's break-even point in total kiles dollars? At the break-evin point, how much of the compary/s sales are provided ty esch type of servicel (Uie Welahted Average Contritutien Morgin Rotid roundra to 2 decimal feleces es: 0.32 and round final answers to 0 decimal pioces, e. 3.2,510) (b) The company's management would tike to hold its fixcd costs contant but shift its sales mix co that b00c of its reverue comer from the delivery of non-standardieed boxes and the remainder from pouthes and simall bones. H thir were to occur, what would be the company's break-even sales, and what amount of sales would be provided by each service type? (Use Weighted-Average: Contribution Margin Ratio rounded to 2 decimal places es. 0.22 and reund finat snswers fo 0 decimal rilaces, es. 2.510

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started