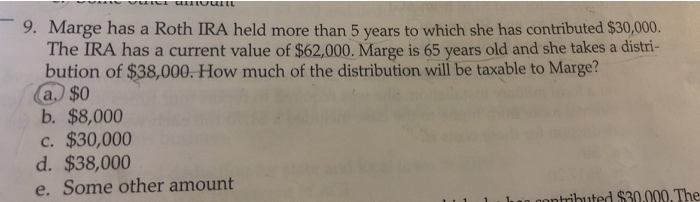

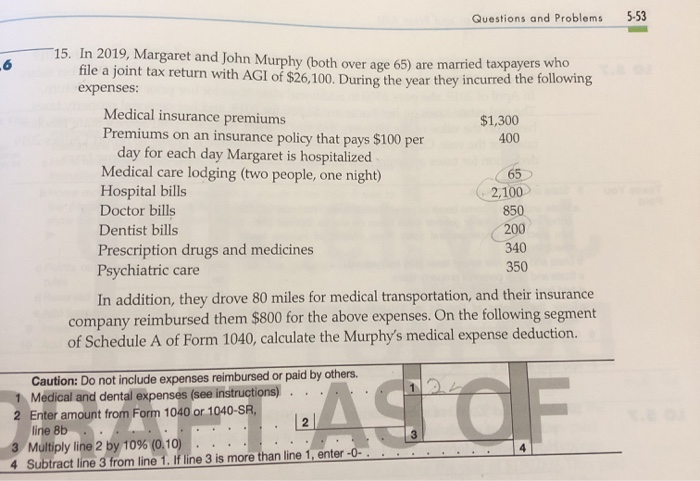

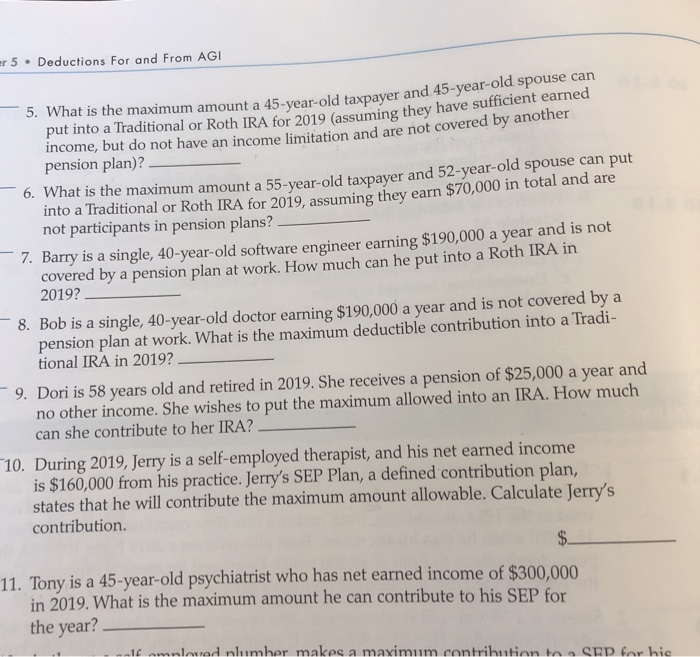

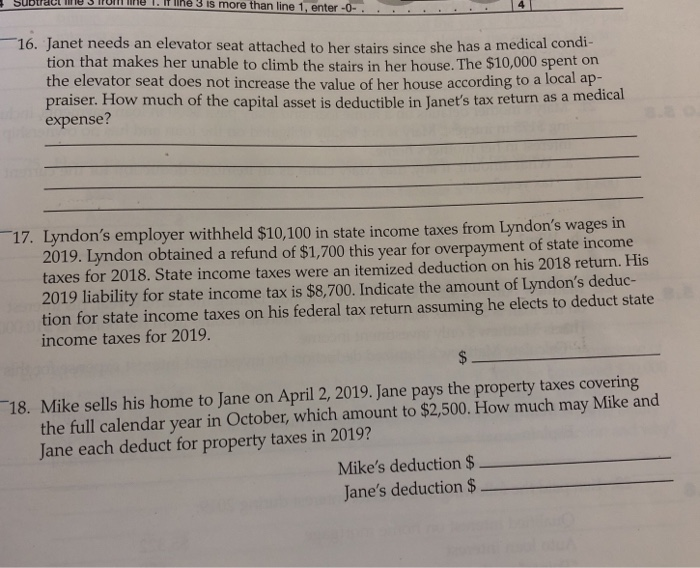

9. Marge has a Roth IRA held more than 5 years to which she has contributed $30,000, The IRA has a current value of $62,000. Marge is 65 years old and she takes a distri- bution of $38,000. How much of the distribution will be taxable to Marge? a. $0 b. $8,000 c. $30,000 d. $38,000 e. Some other amount 1 luontributed $30.000. The Questions and Problems 5.53 15. In 2019, Margaret and John Murphy (both over age 65) are married taxpayers who file a joint tax return with AGI of $26,100. During the year they incurred the following expenses: Medical insurance premiums $1,300 Premiums on an insurance policy that pays $100 per 400 day for each day Margaret is hospitalized Medical care lodging (two people, one night) 65 Hospital bills 2,100 Doctor bills 850 Dentist bills Prescription drugs and medicines 340 Psychiatric care 350 In addition, they drove 80 miles for medical transportation, and their insurance company reimbursed them $800 for the above expenses. On the following segment of Schedule A of Form 1040, calculate the Murphy's medical expense deduction. 200 Caution: Do not include expenses reimbursed or paid by others. 1 Medical and dental expenses (see instructions)... 2 Enter amount from Form 1040 or 1040-SR. line 8b . . . . . . 3 Multiply line 2 by 10% (0.10) ..... 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter-O-... BAFTAS DE er 5. Deductions For and From AGI 5. What is the maximum amount That is the maximum amount a 15-year old taynaver and 45-year-old spouse can put into a Traditional or Roth IRA for 2019 (assuming they have or Roth IRA for 2019 (assuming they have sufficient earned income, but do not have an income limitation and are not covered by another pension plan)? - 6. What is the maximum amount a 55-year-old taxpayer and 5 into a Traditional or Roth IRA for 2019, assuming they earn $70,000 in total and are not participants in pension plans? - 7. Barry is a single, 40-year-old software engineer earning $190,000 a year and is not covered by a pension plan at work. How much can he put into a Roth IRA in 2019? 8. Bob is a single, 40-year-old doctor earning $190,000 a year and is not covered by a pension plan at work. What is the maximum deductible contribution into a Tradi- tional IRA in 2019? -9. Dori is 58 years old and retired in 2019. She receives a pension of $25,000 a year and no other income. She wishes to put the maximum allowed into an IRA. How much can she contribute to her IRA? - 10. During 2019, Jerry is a self-employed therapist, and his net earned income is $160,000 from his practice. Jerry's SEP Plan, a defined contribution plan, states that he will contribute the maximum amount allowable. Calculate Jerry's contribution. 11. Tony is a 45-year-old psychiatrist who has net earned income of $300,000 in 2019. What is the maximum amount he can contribute to his SEP for the year? 10 nmnloved nlumber makes a maximum contribution to SEP for his Subura U J TUMU I. IT line 3 is more than line 1, enter-O-. -16 lanet needs an elevator seat attached to her stairs since she has a medical cond tion that makes her unable to climb the stairs in her house. The $10,000 spent on the elevator seat does not increase the value of her house according to a local praiser. How much of the capital asset is deductible in Janet's tax return as a mea expense? 17. Lyndon's employer withheld $10,100 in state income taxes from Lyndon's wages in 2019. Lyndon obtained a refund of $1,700 this year for overpayment of state income taxes for 2018. State income taxes were an itemized deduction on his 2018 return. His 2019 liability for state income tax is $8,700. Indicate the amount of Lyndon's deduc- tion for state income taxes on his federal tax return assuming he elects to deduct state income taxes for 2019. 18. Mike sells his home to Jane on April 2, 2019. Jane pays the property taxes covering the full calendar year in October, which amount to $2,500. How much may Mike and Jane each deduct for property taxes in 2019? Mike's deduction $ Jane's deduction $