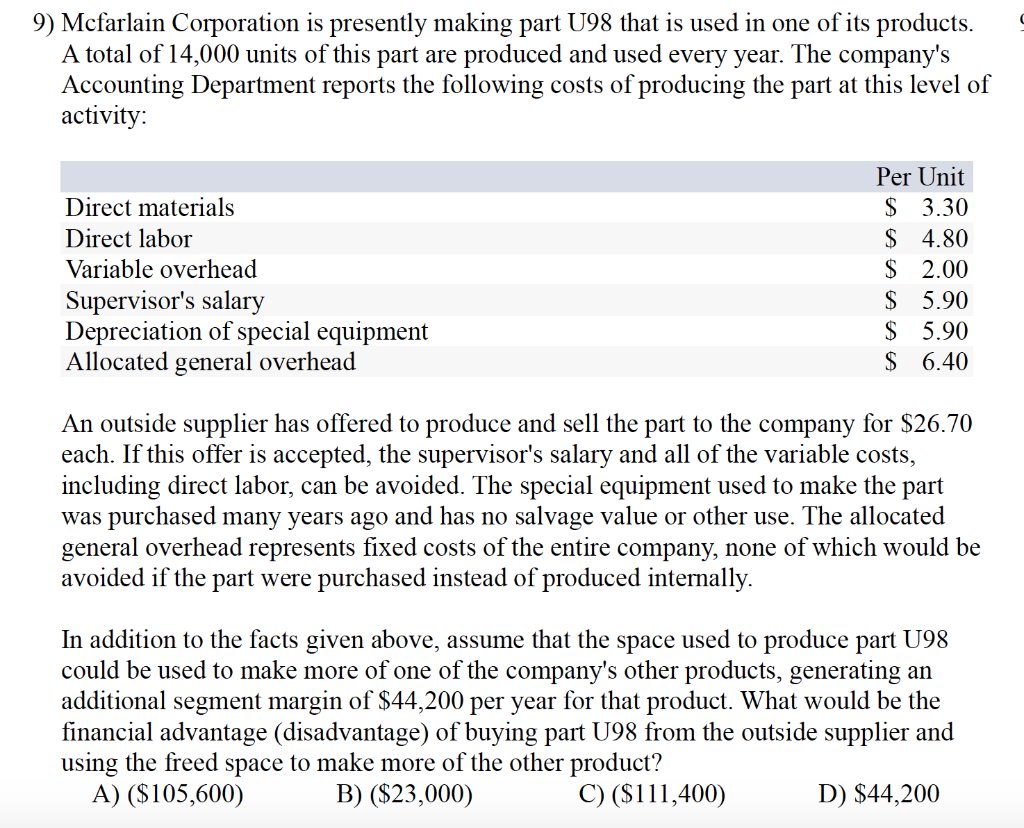

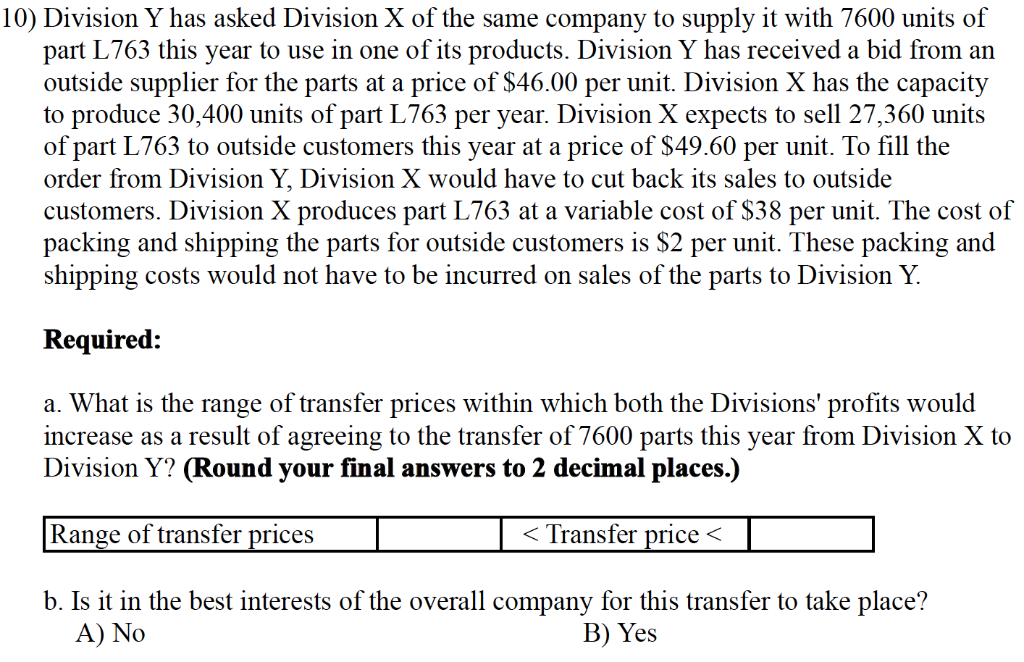

9) Mcfarlain Corporation is presently making part U98 that is used in one of its products A total of 14,000 units of this part are Accounting Department reports the following costs of producing the part at this level of activity produced and used every year. The company's Per Unit Direct materials 3.30 $ 4.80 Direct labor Variable overhead 2.00 S 5.90 S 5.90 S 6.40 Supervisor's salary Depreciation of special equipment Allocated general overhead An outside supplier has offered to produce and sell the part to the company for $26.70 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no general overhead represents fixed costs of the entire company, none of which would be avoided if the part salvage value or other use. The allocated purchased instead of produced internally were In addition to the facts given above, could be used to make more of one of the company's other products, generating an additional segment margin of $44,200 per year for that product. What would be the financial advantage (disadvantage) of buying part U98 from the outside supplier and using the freed space to make more of the other product? A) ($105,600) assume that the space used to produce part U98 B) ($23,000) C) (S111,400) D) $44,200 10) Division Y has asked Division X of the same company to supply it with 7600 units of part L763 this year to use in one of its products. Division Y has received a bid from an outside supplier for the parts at a price of $46.00 per unit. Division X has the capacity to produce 30,400 units of part L763 per year. Division X expects to sell 27,360 units of part L763 to outside customers this year at a price of $49.60 per unit. To fill the order from Division Y, Division X would have to cut back its sales to outside customers. Division X produces part L763 at a variable cost of $38 per unit. The cost of packing and shipping the parts for outside customers is $2 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to Division Y Required: a. What is the range of transfer prices within which both the Divisions' profits would increase as a result of agreeing to the transfer of 7600 parts this year from Division X to Division Y? (Round your final answers to 2 decimal places.) Range of transfer prices