Question

9 months ago, you went long 3 Lithium future contracts at a price of $481705 per 1000 kg. You put down a margin of

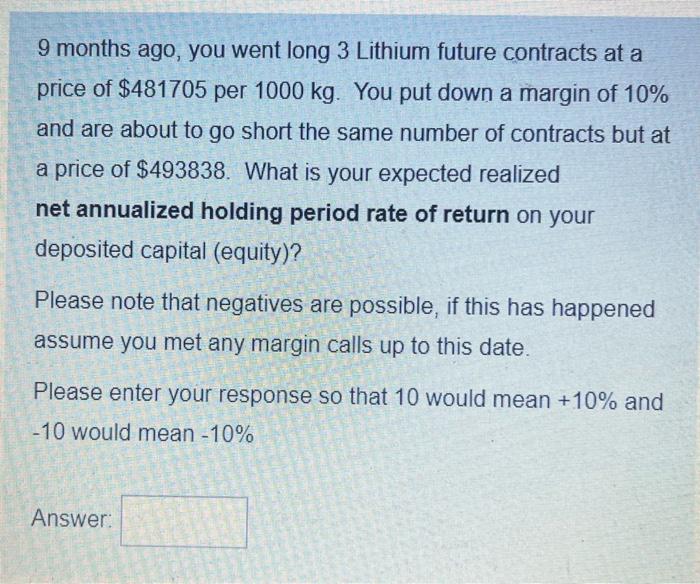

9 months ago, you went long 3 Lithium future contracts at a price of $481705 per 1000 kg. You put down a margin of 10% and are about to go short the same number of contracts but at a price of $493838. What is your expected realized net annualized holding period rate of return on your deposited capital (equity)? Please note that negatives are possible, if this has happened assume you met any margin calls up to this date. Please enter your response so that 10 would mean +10% and -10 would mean -10% Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Investing

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

12th edition

978-0133075403, 133075354, 9780133423938, 133075400, 013342393X, 978-0133075359

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App