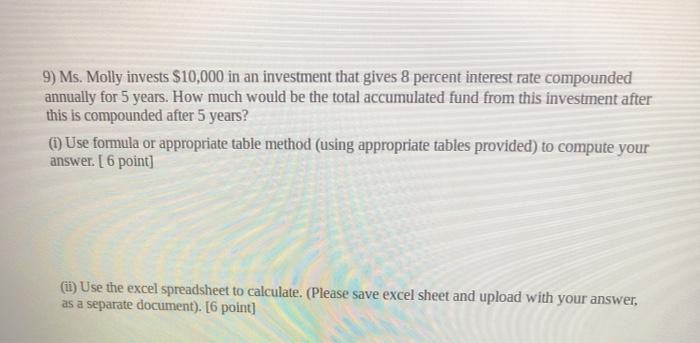

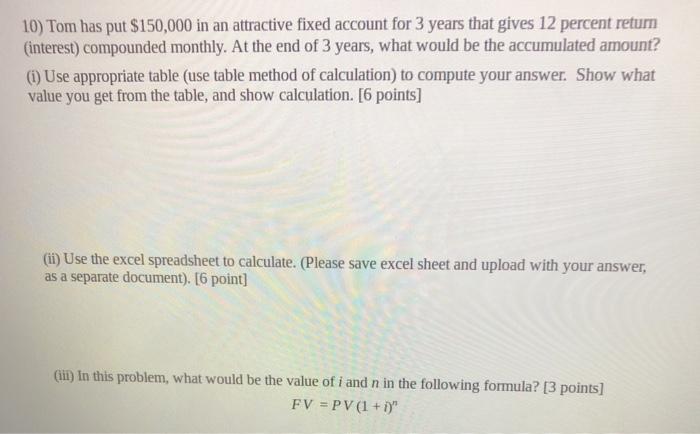

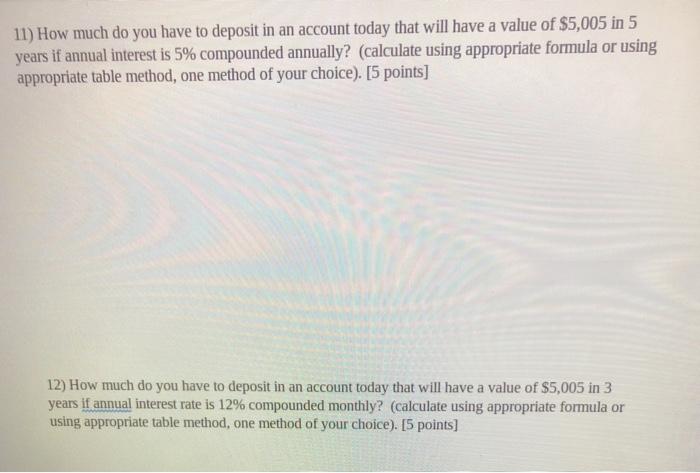

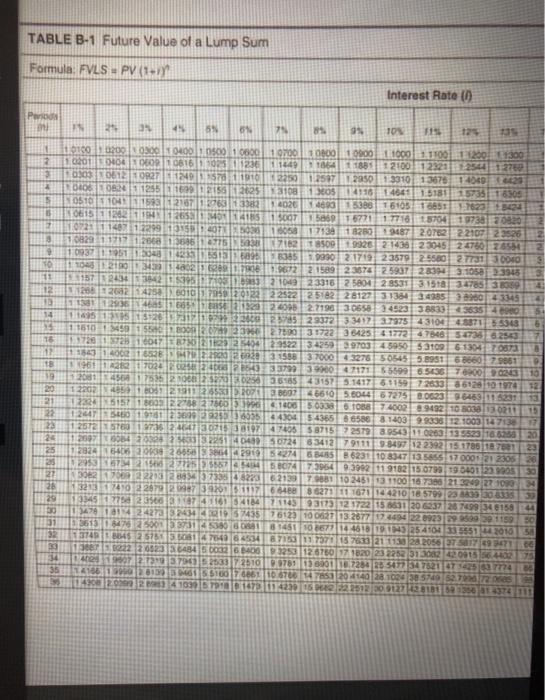

9) Ms. Molly invests $10,000 in an investment that gives 8 percent interest rate compounded annually for 5 years. How much would be the total accumulated fund from this investment after this is compounded after 5 years? 1) Use formula or appropriate table method (using appropriate tables provided) to compute your answer. [ 6 point) (il) Use the excel spreadsheet to calculate. (Please save excel sheet and upload with your answer, as a separate document). [6 point) 10) Tom has put $150,000 in an attractive fixed account for 3 years that gives 12 percent return (interest) compounded monthly. At the end of 3 years, what would be the accumulated amount? () Use appropriate table (use table method of calculation) to compute your answer. Show what value you get from the table, and show calculation. [6 points] (ii) Use the excel spreadsheet to calculate. (Please save excel sheet and upload with your answer, as a separate document). [6 point] (in) in this problem, what would be the value of i and n in the following formula? [3 points] FV = PV (1+1)" 11) How much do you have to deposit in an account today that will have a value of $5,005 in 5 years if annual interest is 5% compounded annually? (calculate using appropriate formula or using appropriate table method, one method of your choice). [5 points] 12) How much do you have to deposit in an account today that will have a value of $5,005 in 3 years if annual interest rate is 12% compounded monthly? (calculate using appropriate formula or using appropriate table method, one method of your choice). [5 points) TABLE B-1 Future Value of a Lump Sum Formula: FVLS - PV (1+ Interest Rate (0) Puro 3 4 59 04 29 84 99 104 F15 129 COS 08 1 10100 200 00 0400 6500 10000 11 9700 10000 10000 1000. ITO 200 1300 0201 DOOR 10816 1123611449 1864 118851 21001 1232122544 1270 6303 061227 1249 157 19 2250 1.257 12950 33101307014060423 BLOG OB 1125 1125 125 130 13505 14110 14641 1.5181157351 1 6305 0510 11041 1593 2167 333214020 14600153881 6105168578233424 15 0615 1 1202 15 418 5007 5 1 6771 17716 5704 19738 0820 072 1402 6050 713 18280947 20762 22107 23526 13 1 0829 1111 2666 3031628500199262 143823045 2 4750 5554 10937 1951 9813385999021719235792.5580 2773130010 100 24 TAI NGHEH0274 293 29 30 31 11 191157 2434 3842 393 21049233162 58044 28531 3.1518347851 38059 12 20120824258 12012 2252225182 28127313843493560 4 3345 112936 46 122 112 40912.71903 065034523 3853303635 14 195 15 23795 29372 3 3412 3.7975431044807155343 1150 5490 3002782031722 3642541772 475461 5473562543 18 720 540012952234259397034.5950537096131477 11 153 40CE 031588370004 327650545 5.89516866075861 TB 1961 1543337993947171 55896513672000 19 2081 45 025011575485431575.14175915972633 8612010 12 20 12202 38691 46610580446 7275 80623 384690715231 21 13324 8605 9961400 50338 6 TOBB 7 4002894492 10 8033021115 22 12447 SEED 9161 453514 4304 $436556588 8.1403 9933512100314 17 23 1 2512 sted 9735 246 474065871572519 8.9543010263 135523 20 24 2093 054 2530 4040 50724 8 3412 791119 8497 12 2392 15 1786 25 1224 5405 2063 429101622746 BS 623110 8347 135 2305 2953 67 4414580747396493982 11 9182/15 0799 1121 3082 482236 21379881 10243913110018 11:28 3213 740 2979 S6 64888 6271 11 1670 144210 1125 3345 M71143793173121722 15 30 3474 422 743576123 10 0627 13.267 11131 3613 5003 81450 10 867 32 13743 45348713 30 8400 325012 34 739 25109781 35 14168 85 18611106762 14300 410306114231 16 5150 10