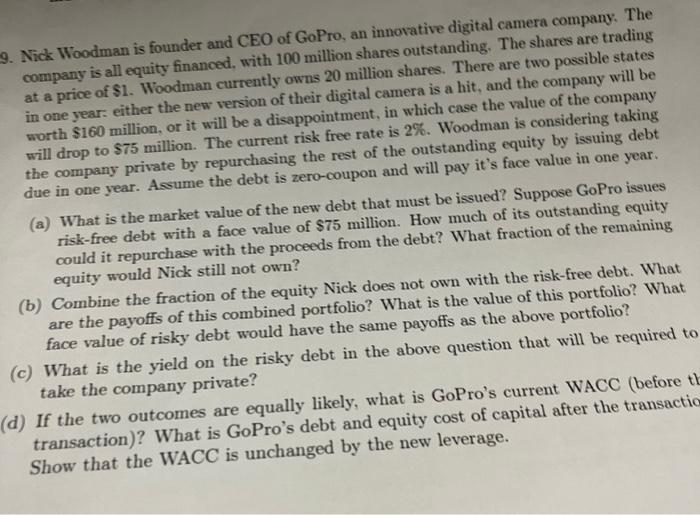

9. Nick Woodman is founder and CEO of GoPro, an innovative digital camera company. The company is all equity financed, with 100 million shares outstanding. The shares are trading at a price of $1. Woodman currently owns 20 million shares. There are two possible states in one year: either the new version of their digital camera is a hit, and the company will be worth $160 million, or it will be a disappointment, in which case the value of the company will drop to $75 million. The current risk free rate is 2%. Woodman is considering taking the company private by repurchasing the rest of the outstanding equity by issuing debt due in one year. Assume the debt is zero-coupon and will pay it's face value in one year. (a) What is the market value of the new debt that must be issued? Suppose GoPro issues risk-free debt with a face value of $75 million. How much of its outstanding equity could it repurchase with the proceeds from the debt? What fraction of the remaining equity would Nick still not own? (b) Combine the fraction of the equity Nick does not own with the risk-free debt. What are the payoffs of this combined portfolio? What is the value of this portfolio? What face value of risky debt would have the same payoffs as the above portfolio? (c) What is the yield on the risky debt in the above question that will be required to take the company private? (d) If the two outcomes are equally likely, what is GoPro's current WACC (before th transaction)? What is GoPro's debt and equity cost of capital after the transactio Show that the WACC is unchanged by the new leverage. 9. Nick Woodman is founder and CEO of GoPro, an innovative digital camera company. The company is all equity financed, with 100 million shares outstanding. The shares are trading at a price of $1. Woodman currently owns 20 million shares. There are two possible states in one year: either the new version of their digital camera is a hit, and the company will be worth $160 million, or it will be a disappointment, in which case the value of the company will drop to $75 million. The current risk free rate is 2%. Woodman is considering taking the company private by repurchasing the rest of the outstanding equity by issuing debt due in one year. Assume the debt is zero-coupon and will pay it's face value in one year. (a) What is the market value of the new debt that must be issued? Suppose GoPro issues risk-free debt with a face value of $75 million. How much of its outstanding equity could it repurchase with the proceeds from the debt? What fraction of the remaining equity would Nick still not own? (b) Combine the fraction of the equity Nick does not own with the risk-free debt. What are the payoffs of this combined portfolio? What is the value of this portfolio? What face value of risky debt would have the same payoffs as the above portfolio? (c) What is the yield on the risky debt in the above question that will be required to take the company private? (d) If the two outcomes are equally likely, what is GoPro's current WACC (before th transaction)? What is GoPro's debt and equity cost of capital after the transactio Show that the WACC is unchanged by the new leverage