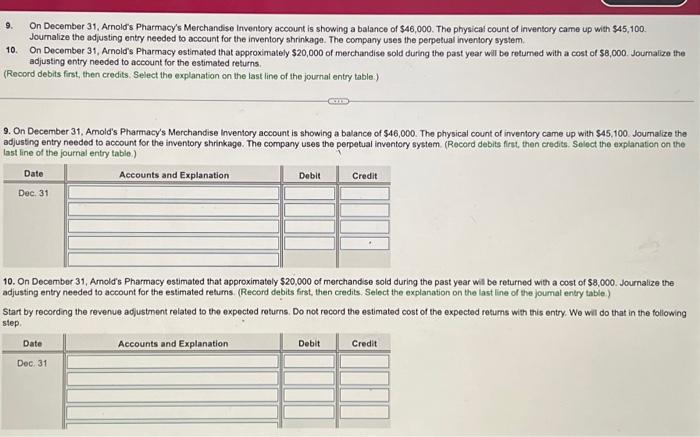

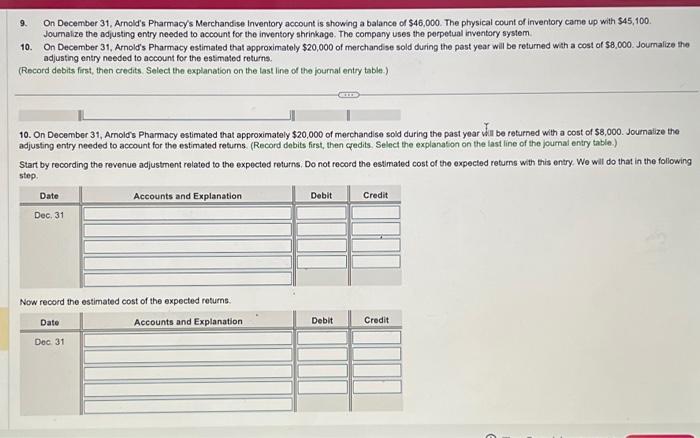

9. On December 31, Arnold's Pharmacy's Merchandise Inventory account is showing a balance of $46,000. The physical count of inventory came up with $45,100. Journalize the adjusting entry needed to account for the irventory shrinkage. The company uses the perpetual inventory system. 10. On Docember 31 , Amold's Pharmacy estimated that approximately $20,000 of merchandise sold during the past year wil be returned with a cost of $8,000. Joumalize the adjusting entry needed to account for the estimated returns. (Record debits first, then credits. Select the explanation on the last line of the journat entry table.) 9. On December 31, Amold's Pharmacy's Merchandise Inventory account is showing a balance of $46,000. The physical count of inventory came up with $45,100. Journalize the adjusting entry needod to acoount for the inventory shrinkage. The company uses the perpetual inventory system. (Record debits first, then credits. Select the explanation on the last line of the journal entry tabie.) 10. On December 31, Anold's Pharmacy estimated that approximately $20,000 of merchandse sold during the past year wit be returned wth a cost of $8,000. Journalize the adjusting entry needed to account for the estimated retums. (Record debits first, then credits. Select the explanation on the last line of the joumal entry table.) Start by recording the revenue adjustment related to the expected returns. Do not record the estimated cost of the expected returns with this entry. We wil do that in the following step. 9. On December 31, Arnold's Pharmacy's Merchandise Inventory account is showing a balance of $46,000. The physical count of inventory came up with $45,100. Journalize the adjusting entry needed to account for the inventory shrinkage. The company uses the perpetual inventory system. 10. On December 31 . Arnold's Pharmacy estimated that approximately $20,000 of merchandise sold during the past year will be returned with a cost of $8,000. Joumalize the adjusting entry needed to account for the estimated returns. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) 10. On December 31, Arnold's Pharmacy estimated that approximately $20,000 of merchandise sold during the past year will be returned with a cost of $8,000. Journalize the adjusting entry needed to account for the estimated returns. (Record dobits first, then edits, Select the explanasion on the last line of the journal entry table.) Start by recording the revenue adjustment related to the expocted returns. Do not record the estimated cost of the expected returns with this entry. We wil do that in the following step. Now record the estimated cost of the expected retums