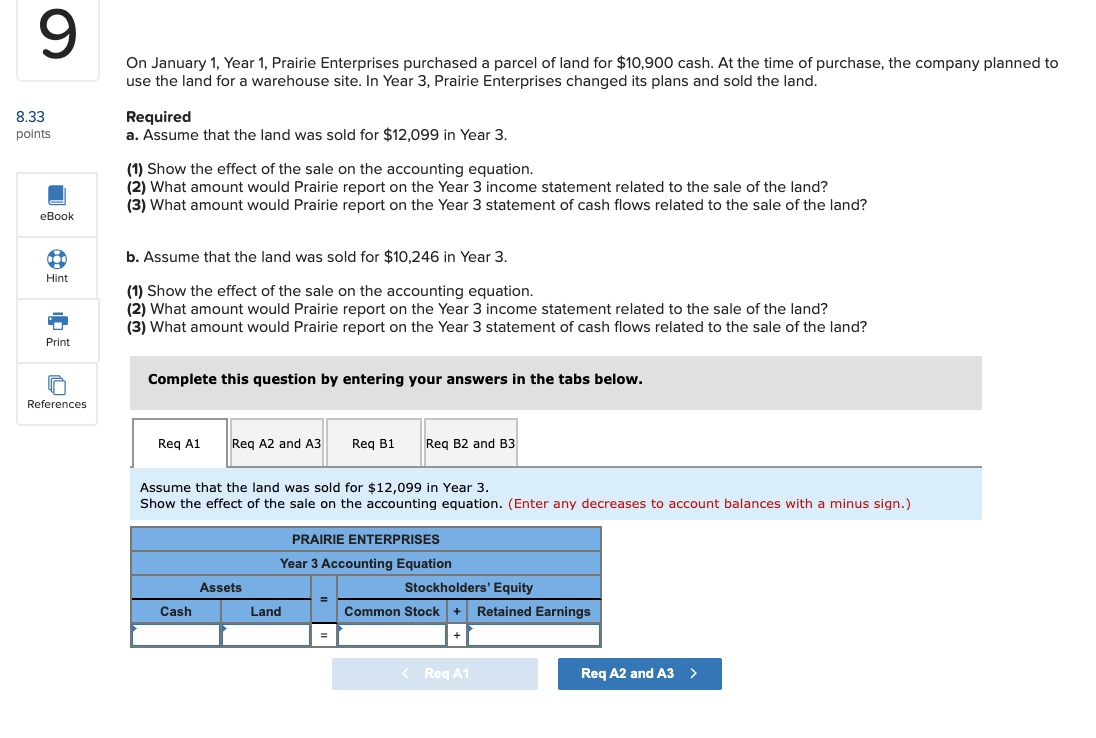

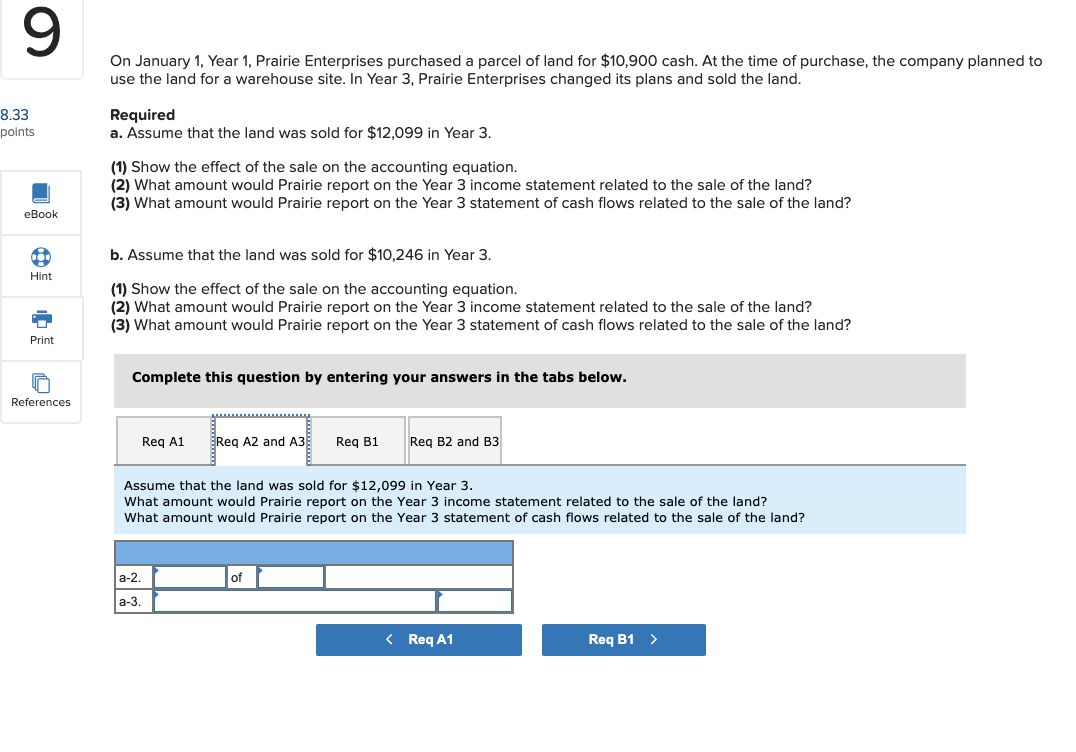

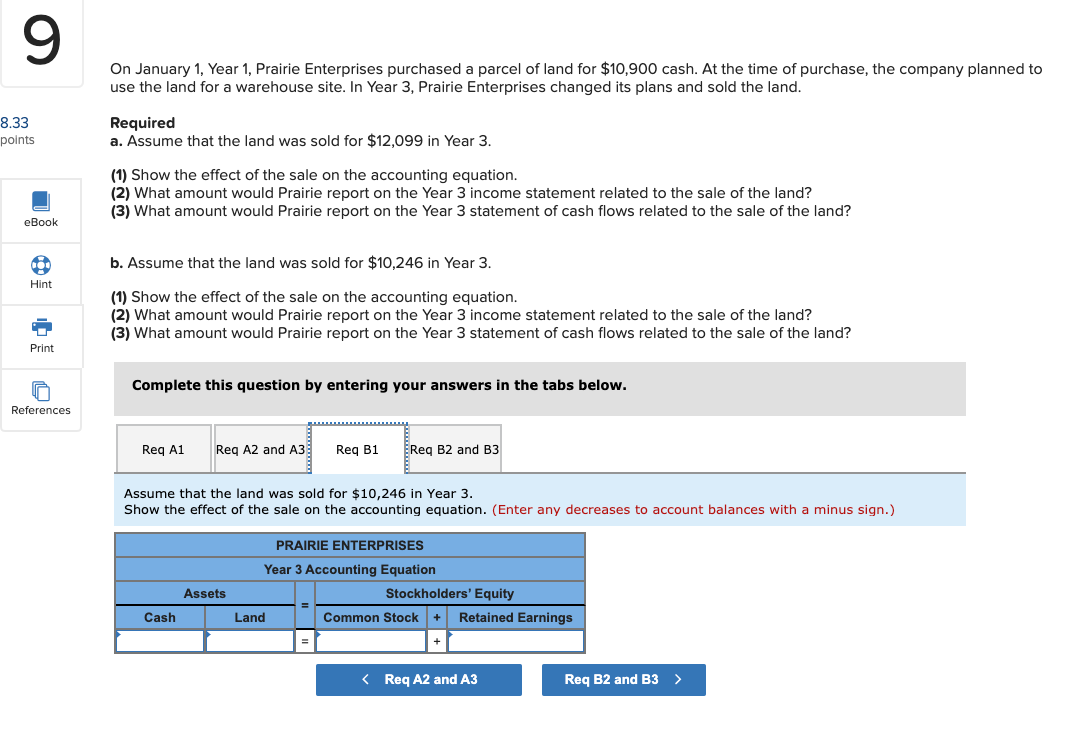

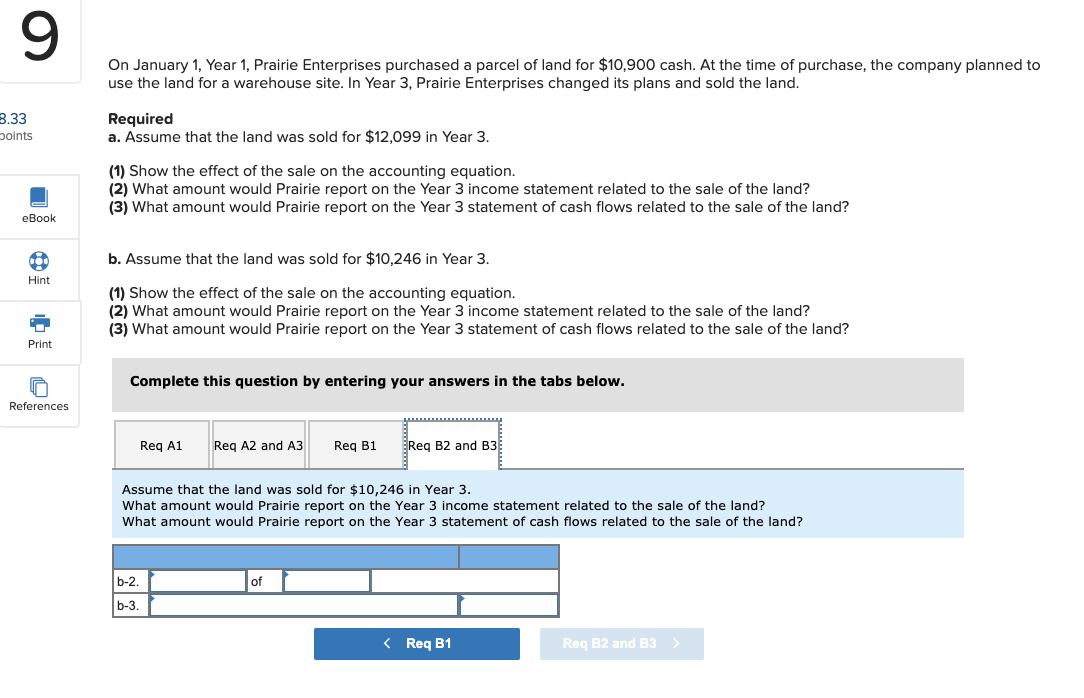

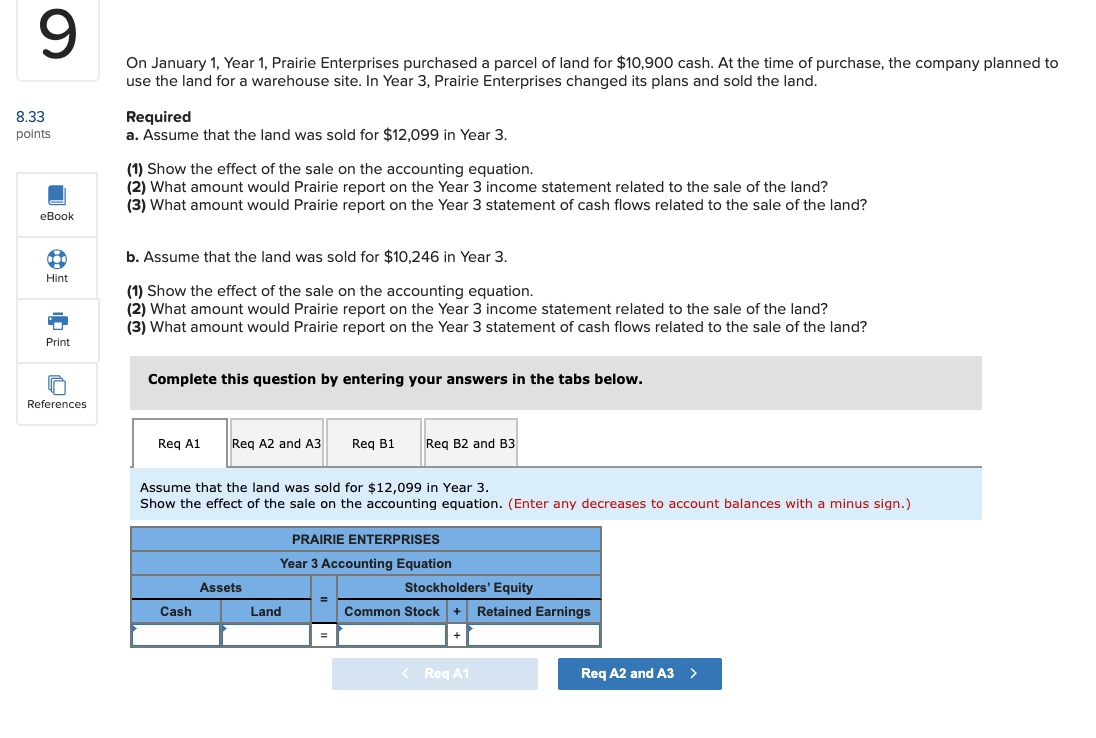

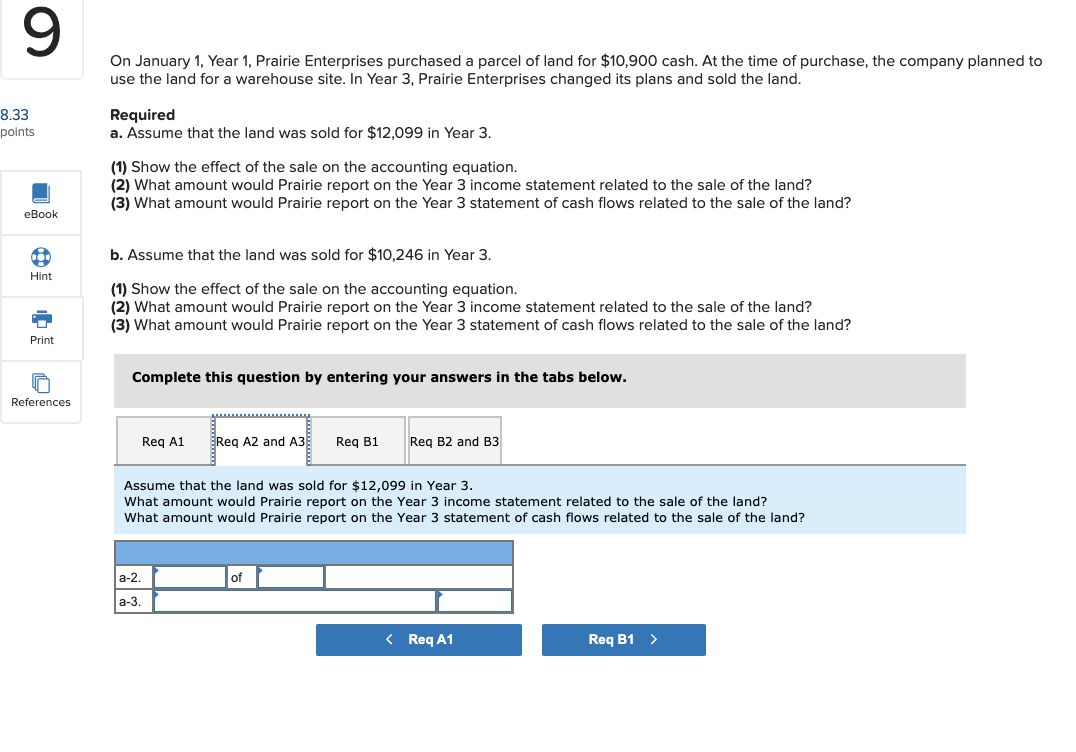

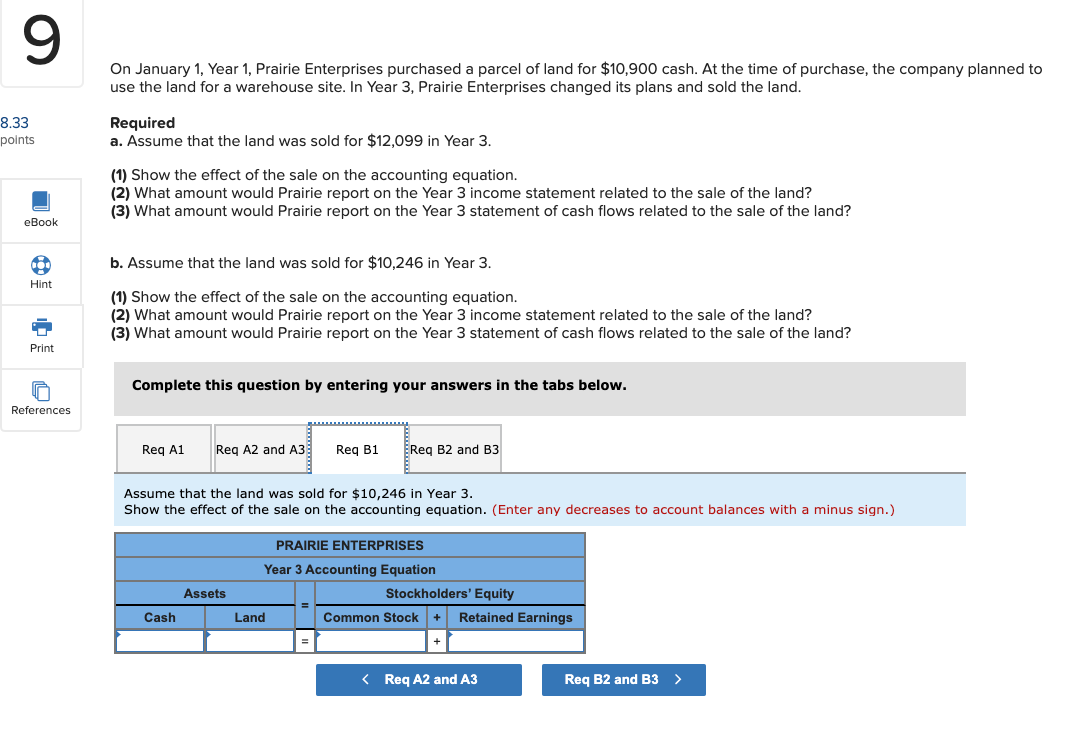

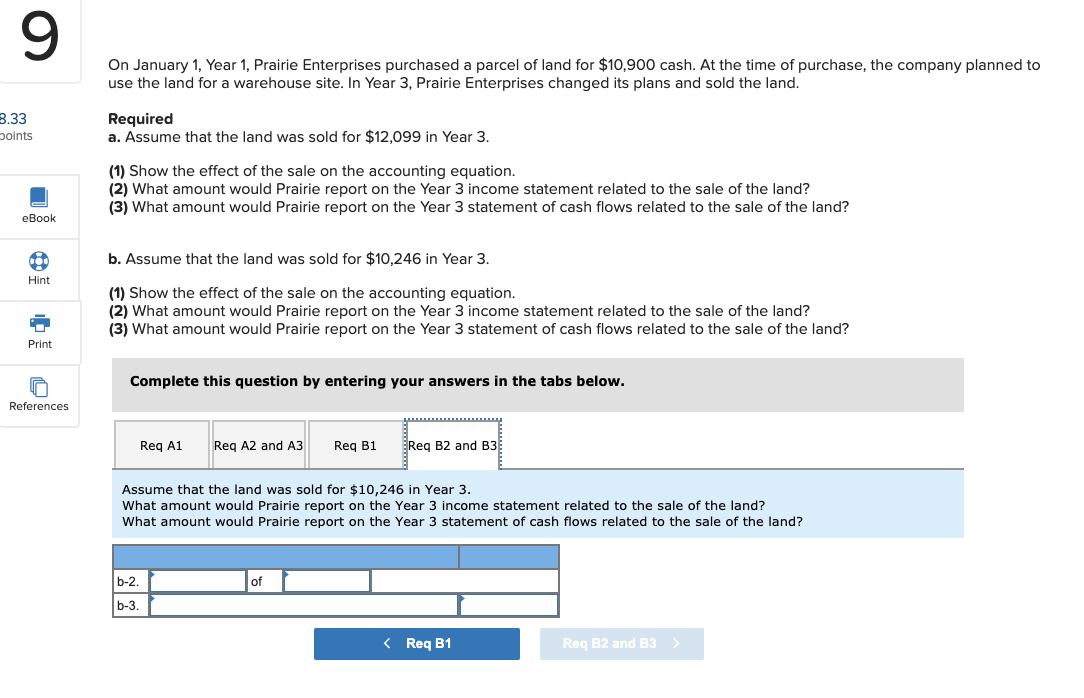

9 On January 1, Year 1, Prairie Enterprises purchased a parcel of land for $10,900 cash. At the time of purchase, the company planned to use the land for a warehouse site. In Year 3, Prairie Enterprises changed its plans and sold the land. 8.33 points Required a. Assume that the land was sold for $12,099 in Year 3. (1) Show the effect of the sale on the accounting equation. (2) What amount would Prairie report on the Year 3 income statement related to the sale of the land? (3) What amount would Prairie report on the Year 3 statement of cash flows related to the sale of the land? eBook 100 b. Assume that the land was sold for $10,246 in Year 3. Hint (1) Show the effect of the sale on the accounting equation. (2) What amount would Prairie report on the Year 3 income statement related to the sale of the land? (3) What amount would Prairie report on the Year 3 statement of cash flows related to the sale of the land? Print Complete this question by entering your answers in the tabs below. References Reg A1 Reg A2 and A3 Req B1 Reg B2 and B3 Assume that the land was sold for $12,099 in Year 3. Show the effect of the sale on the accounting equation. (Enter any decreases to account balances with a minus sign.) PRAIRIE ENTERPRISES Year 3 Accounting Equation Assets Stockholders' Equity Land Common Stock + Retained Earnings Cash = 9 On January 1, Year 1, Prairie Enterprises purchased a parcel of land for $10,900 cash. At the time of purchase, the company planned to use the land for a warehouse site. In Year 3, Prairie Enterprises changed its plans and sold the land. 8.33 points Required a. Assume that the land was sold for $12,099 in Year 3. (1) Show the effect of the sale on the accounting equation. (2) What amount would Prairie report on the Year 3 income statement related to the sale of the land? (3) What amount would Prairie report on the Year 3 statement of cash flows related to the sale of the land? eBook b. Assume that the land was sold for $10,246 in Year 3. Hint (1) Show the effect of the sale on the accounting equation. (2) What amount would Prairie report on the Year 3 income statement related to the sale of the land? (3) What amount would Prairie report on the Year 3 statement of cash flows related to the sale of the land? Print Complete this question by entering your answers in the tabs below. References Req A1 Reg A2 and A3 Req B1 Req B2 and B3 Assume that the land was sold for $12,099 in Year 3. What amount would Prairie report on the Year 3 income statement related to the sale of the land? What amount would Prairie report on the Year 3 statement of cash flows related to the sale of the land? a-2. of | a-3. 9 On January 1, Year 1, Prairie Enterprises purchased a parcel of land for $10,900 cash. At the time of purchase, the company planned to use the land for a warehouse site. In Year 3, Prairie Enterprises changed its plans and sold the land. 8.33 points Required a. Assume that the land was sold for $12,099 in Year 3. (1) Show the effect of the sale on the accounting equation. (2) What amount would Prairie report on the Year 3 income statement related to the sale of the land? (3) What amount would Prairie report on the Year 3 statement of cash flows related to the sale of the land? eBook b. Assume that the land was sold for $10,246 in Year 3. Hint (1) Show the effect of the sale on the accounting equation. (2) What amount would Prairie report on the Year 3 income statement related to the sale of the land? (3) What amount would Prairie report on the Year 3 statement of cash flows related to the sale of the land? Print C Complete this question by entering your answers in the tabs below. References Reg A1 Reg A2 and A3 Req B1 Req B2 and B3 Assume that the land was sold for $10,246 in Year 3. Show the effect of the sale on the accounting equation. (Enter any decreases to account balances with a minus sign.) PRAIRIE ENTERPRISES Year 3 Accounting Equation Assets Stockholders' Equity Land Common Stock + Retained Earnings Cash 9 On January 1, Year 1, Prairie Enterprises purchased a parcel of land for $10,900 cash. At the time of purchase, the company planned to use the land for a warehouse site. In Year 3, Prairie Enterprises changed its plans and sold the land. 3.33 Joints Required a. Assume that the land was sold for $12,099 in Year 3. (1) Show the effect of the sale on the accounting equation. (2) What amount would Prairie report on the Year 3 income statement related to the sale of the land? (3) What amount would Prairie report on the Year 3 statement of cash flows related to the sale of the land? eBook b. Assume that the land was sold for $10,246 in Year 3. Hint (1) Show the effect of the sale on the accounting equation. (2) What amount would Prairie report on the Year 3 income statement related to the sale of the land? (3) What amount would Prairie report on the Year 3 statement of cash flows related to the sale of the land? Print Complete this question by entering your answers in the tabs below. References Reg A1 Reg A2 and A3 Req B1 Req B2 and B3 Assume that the land was sold for $10,246 in Year 3. What amount would Prairie report on the Year 3 income statement related to the sale of the land? What amount would Prairie report on the Year 3 statement of cash flows related to the sale of the land? b-2 of b-3.