9. Pecos Company is considering the purchase of new equipment that will cost $225,000. The equipment will save the company $82,000 per year in before-tax cash operating costs. The equipment has an estimated useful life of ten years and $25,000 salvage value under the tax law. Pecos estimates that the market value of the equipment at the end of year 10 could be as high as $32,000 or as low as $21,000. Pecoss required rate of return is 10% and its tax rate is 30%. Required: (1) What are the annual after-tax cash flows that can be generated from this equipment?

9. Pecos Company is considering the purchase of new equipment that will cost $225,000. The equipment will save the company $82,000 per year in before-tax cash operating costs. The equipment has an estimated useful life of ten years and $25,000 salvage value under the tax law. Pecos estimates that the market value of the equipment at the end of year 10 could be as high as $32,000 or as low as $21,000. Pecoss required rate of return is 10% and its tax rate is 30%. Required: (1) What are the annual after-tax cash flows that can be generated from this equipment?

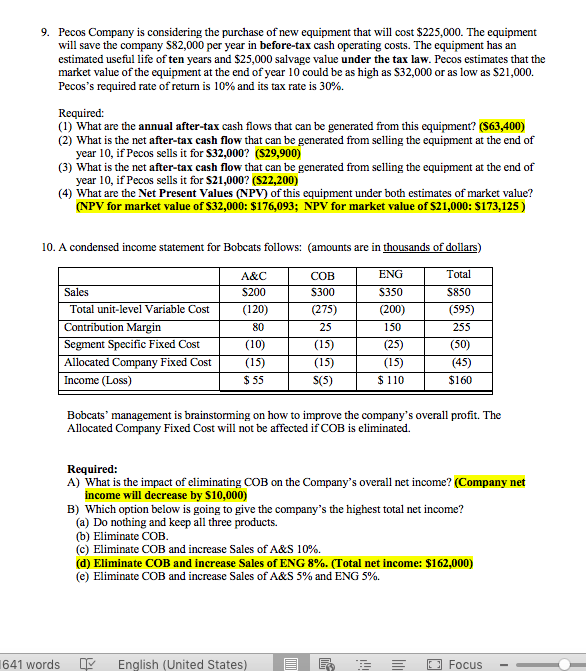

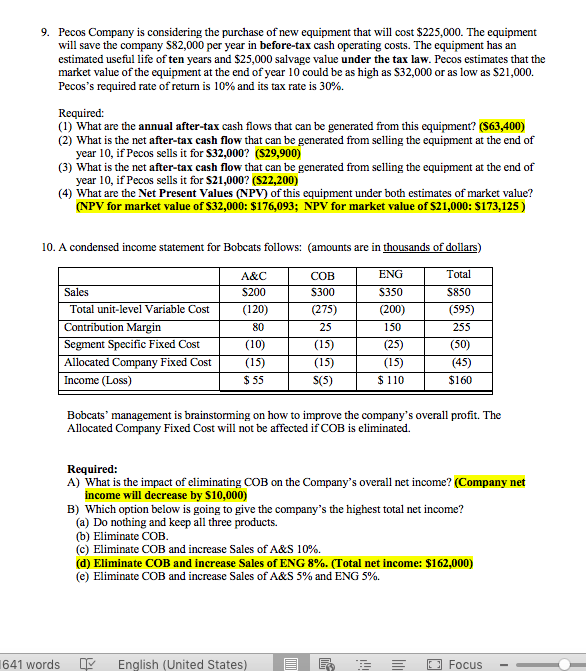

9. Pecos Company is considering the purchase of new equipment that will cost $225,000. The equipment will save the company $82,000 per year in before-tax cash operating costs. The equipment has an estimated useful life of ten years and $25,000 salvage value under the tax law. Pecos estimates that the market value of the equipment at the end of year 10 could be as high as S32,000 or as low as $21,000. Pecos's required rate of return is 10% and its tax rate is 30%. Required: (1) What are the annual after-tax cash flows that can be generated from this equipment? (S63,400) (2) What is the net after-tax cash flow that can be generated from selling the equipment at the end of year 10, if Pecos sells it for S32,000? (S29,900) year 10, if Pecos sells it for $21,000? (S22,200) (NPV for market value of $32,000: $176,093; NPV for market value of $21,000: S173,125) (3) What is the net after-tax cash flow that can be generated from slling the equipment at the end of (4) What are the Net Present Values (NPV) of this equipment under both estimates of market value? 10. A condensed income statement for Bobcats follows: (amounts are in thousands of dollars) ENG S350 (200) 150 (25) (15) $ 110 Total S850 (595) 255 (50) (45) $160 A&C S300 (275) 25 (15) (15) S(5) Sales Total unit-level Variable Cost Contribution Margin Segment Specific Fixed Cost Allocated Company Fixed Cos(15) Income (Loss) (120) 80 (10) S 55 Bobcats' management is brainstorming on how to improve the company's overall profit. The Allocated Company Fixed Cost will not be affected if COB is eliminated. Required: A) What is the impact of eliminating COB on the Company's overall net income? (Company net income will decrease by $10,000) B) Which option below is going to give the company's the highest total net income? (a) Do nothing and keep all three products. (b) Eliminate COB (c) Eliminate COB and increase sales of A&S 10%. (d) Eliminate COB and increase sales of ENG 8%. (Total net income: $162,000) (e) Eliminate COB and increase sales of A&S 5% and ENG 5%. 641 words English (United States Focus

9. Pecos Company is considering the purchase of new equipment that will cost $225,000. The equipment will save the company $82,000 per year in before-tax cash operating costs. The equipment has an estimated useful life of ten years and $25,000 salvage value under the tax law. Pecos estimates that the market value of the equipment at the end of year 10 could be as high as $32,000 or as low as $21,000. Pecoss required rate of return is 10% and its tax rate is 30%. Required: (1) What are the annual after-tax cash flows that can be generated from this equipment?

9. Pecos Company is considering the purchase of new equipment that will cost $225,000. The equipment will save the company $82,000 per year in before-tax cash operating costs. The equipment has an estimated useful life of ten years and $25,000 salvage value under the tax law. Pecos estimates that the market value of the equipment at the end of year 10 could be as high as $32,000 or as low as $21,000. Pecoss required rate of return is 10% and its tax rate is 30%. Required: (1) What are the annual after-tax cash flows that can be generated from this equipment?