Answered step by step

Verified Expert Solution

Question

1 Approved Answer

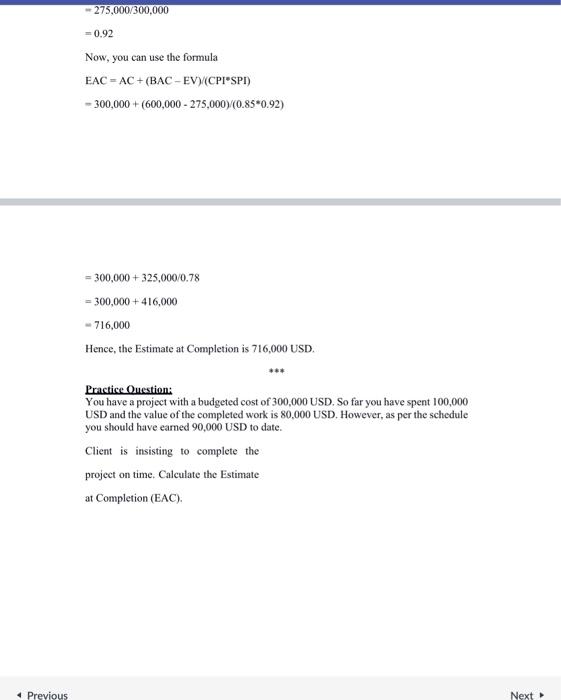

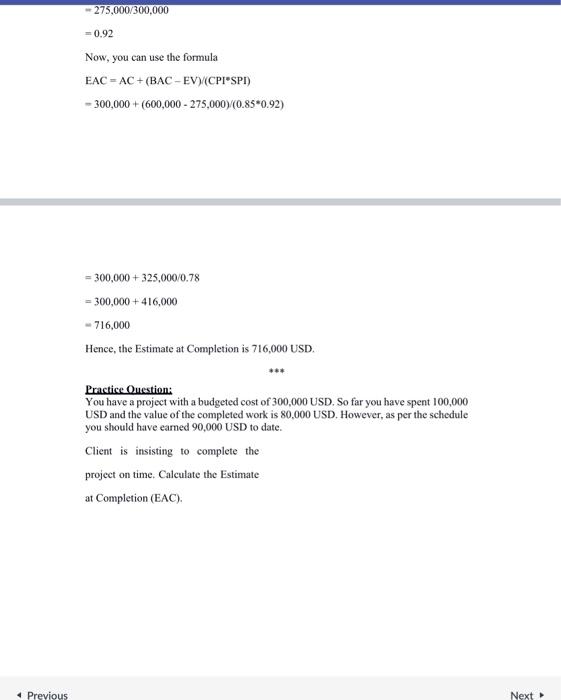

9 pleasw give me right answer write on paper with clear handwritting =275,000/300,000=0.92 Now, you can use the formula EAC=AC+(BACEV)(CPISPI)300,000+(600,000275,000)/(0.850.92) =300,000+325,000/0.78=300,000+416,000=716,000 Hence, the Estimate at

9

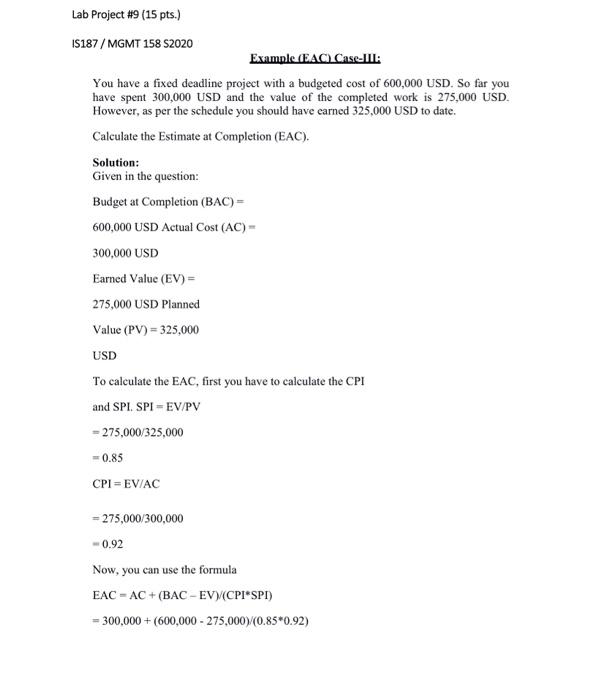

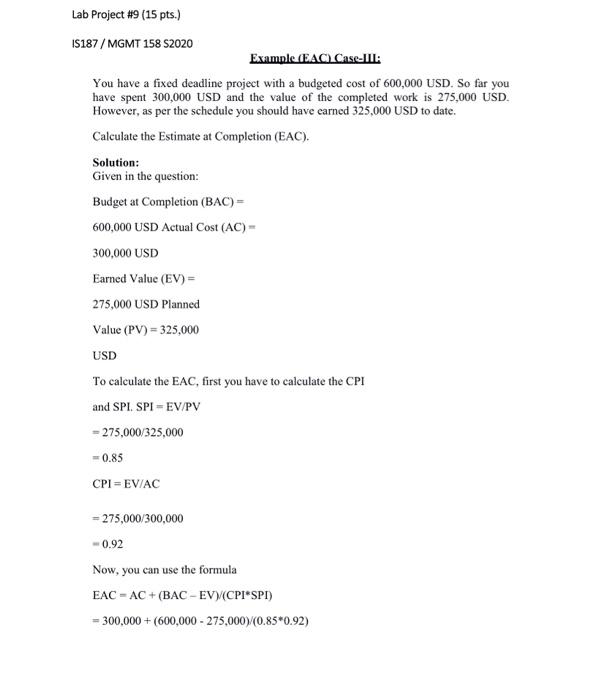

=275,000/300,000=0.92 Now, you can use the formula EAC=AC+(BACEV)(CPISPI)300,000+(600,000275,000)/(0.850.92) =300,000+325,000/0.78=300,000+416,000=716,000 Hence, the Estimate at Completion is 716,000 USD. Practice Ouestion: You have a project with a budgeted cost of 300,000 USD. So far you have spent 100,000 USD and the value of the completed work is 80,000 USD. However, as per the schedule you should have eamed 90,000 USD to date. Client is insisting to complete the project on time. Calculate the Estimate at Completion (EAC). Lab Project \#9 (15 pts.) IS187/MGMT 158 S2020 Examnle(EAC)Case-II: You have a fixed deadline project with a budgeted cost of 600,000 USD. So far you have spent 300,000 USD and the value of the completed work is 275,000 USD. However, as per the schedule you should have earned 325,000 USD to date. Calculate the Estimate at Completion (EAC). Solution: Given in the question: Budget at Completion (BAC)= 600,000 USD Actual Cost (AC)= 300,000 USD Earned Value ( EV )= 275,000 USD Planned Value (PV)=325,000 USD To calculate the EAC, first you have to calculate the CPI and SPI. SPI =EV/PV =275,000/325,000 =0.85 CPI=EV/AC =275,000/300,000 =0.92 Now, you can use the formula EAC=AC+(BACEV)((CPISPI) =300,000+(600,000275,000)/(0.850.92) pleasw give me right answer write on paper with clear handwritting

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started