Answered step by step

Verified Expert Solution

Question

1 Approved Answer

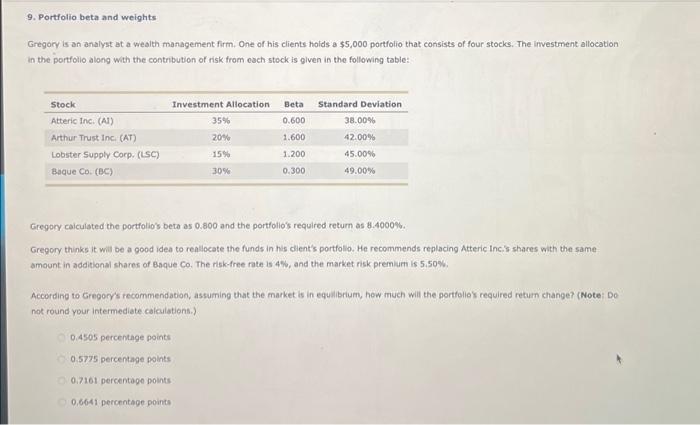

9. Portfolio beta and weights Gregory is an analyst at a wealth management firm. One of his clients holds a $5,000 portfolio that consists of

9. Portfolio beta and weights Gregory is an analyst at a wealth management firm. One of his clients holds a $5,000 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Stock Atteric Inc. (AI) Arthur Trust Inc. (AT) Lobster Supply Corp. (LSC) Baque Co. (BC) 0.4505 percentage points 0.5775 percentage points Investment Allocation 0.7161 percentage points 35% 20% 15% 30% 0.6641 percentage points Beta Gregory calculated the portfolio's beta as 0.800 and the portfolio's required return as 8.4000%. Gregory thinks it will be a good idea to reallocate the funds in his client's portfolio. He recommends replacing Atteric Inc.'s shares with the same amount in additional shares of Baque Co. The risk-free rate is 4%, and the market risk premium is 5.50%. 0.600 1.600 1.200 0.300 According to Gregory's recommendation, assuming that the market is in equilibrium, how much will the portfolio's required return change? (Note: Do not round your intermediate calculations.) Standard Deviation 38.00% 42,00% 45.00% 49.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started