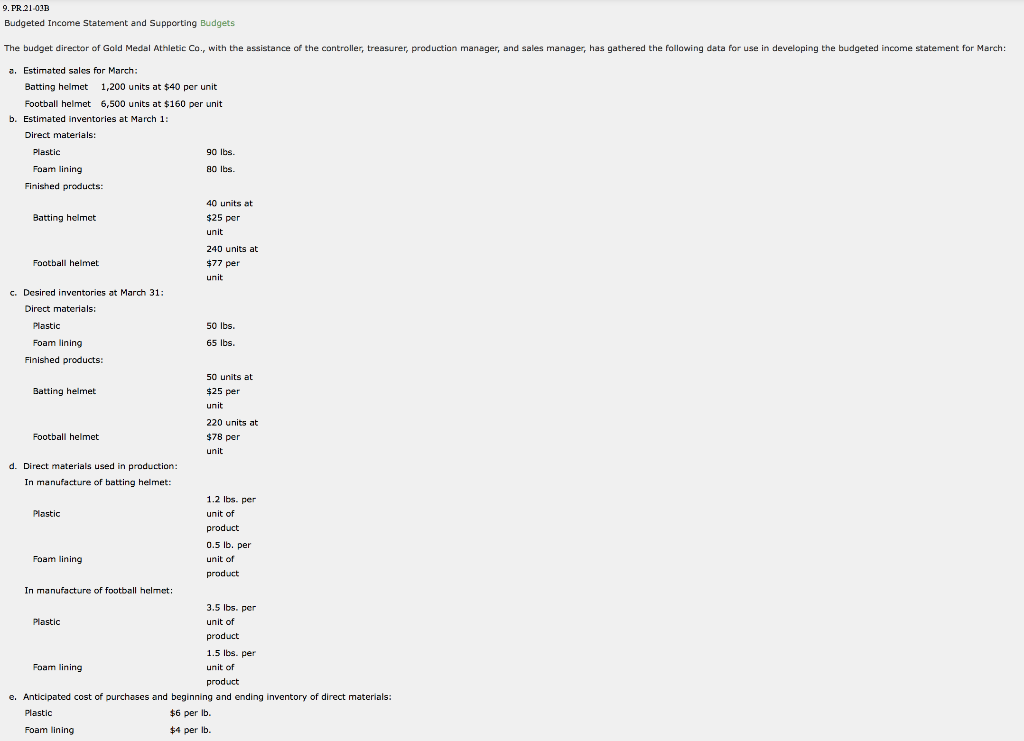

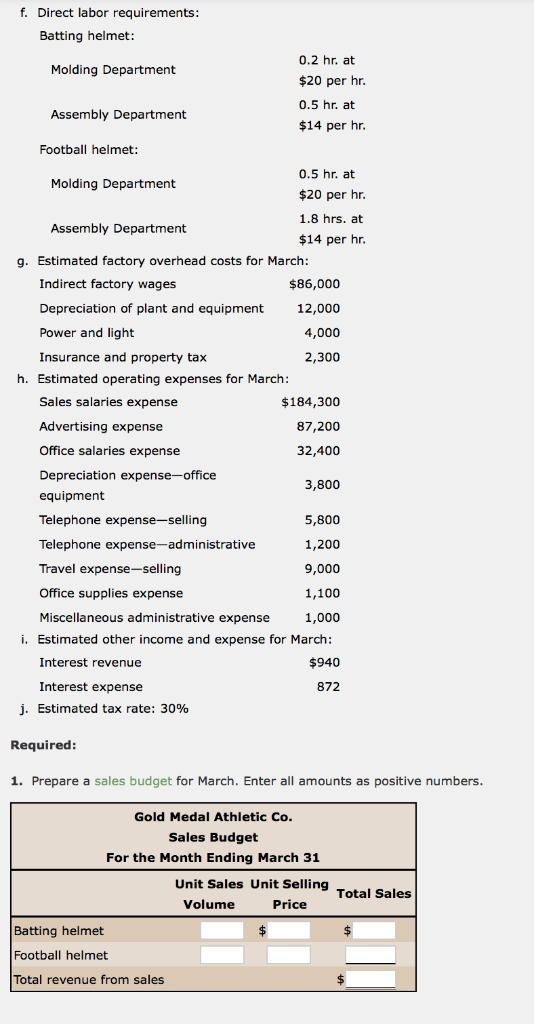

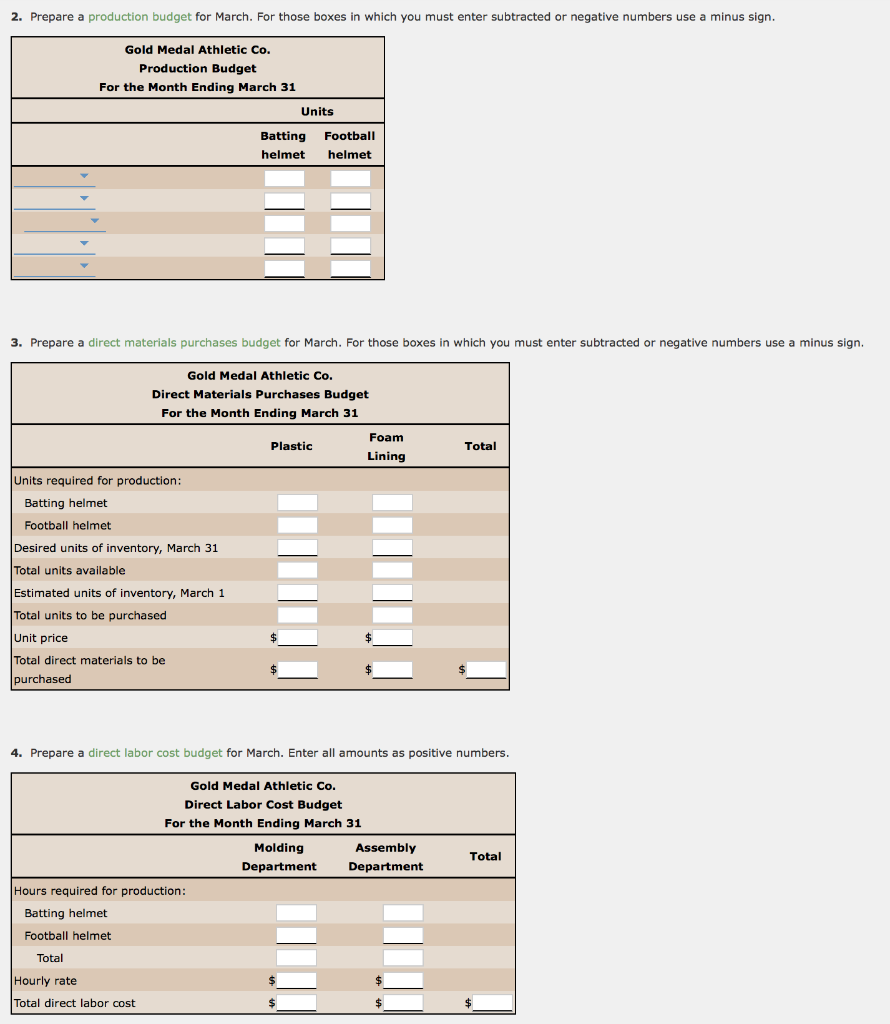

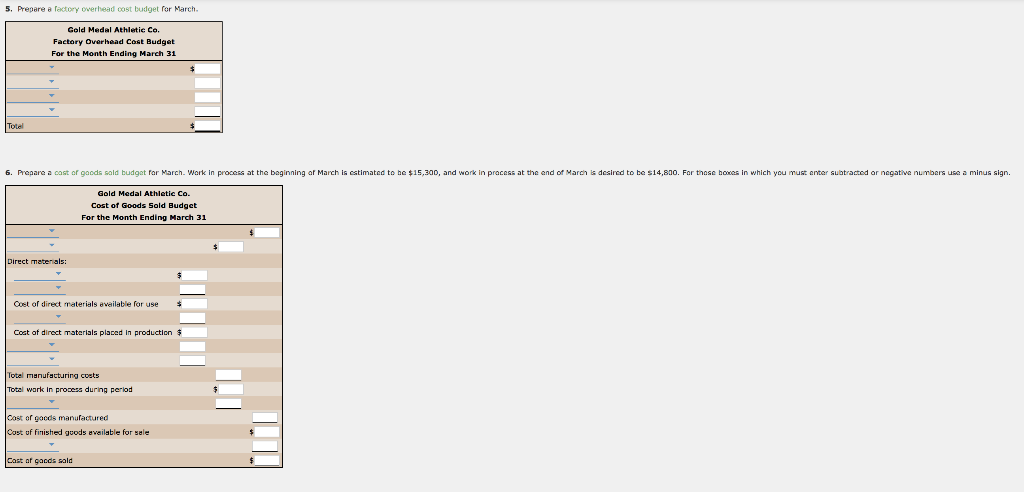

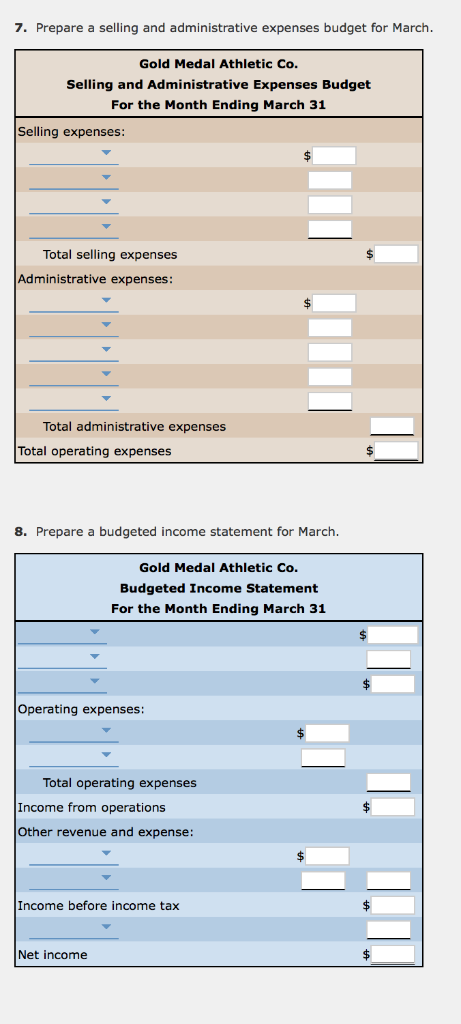

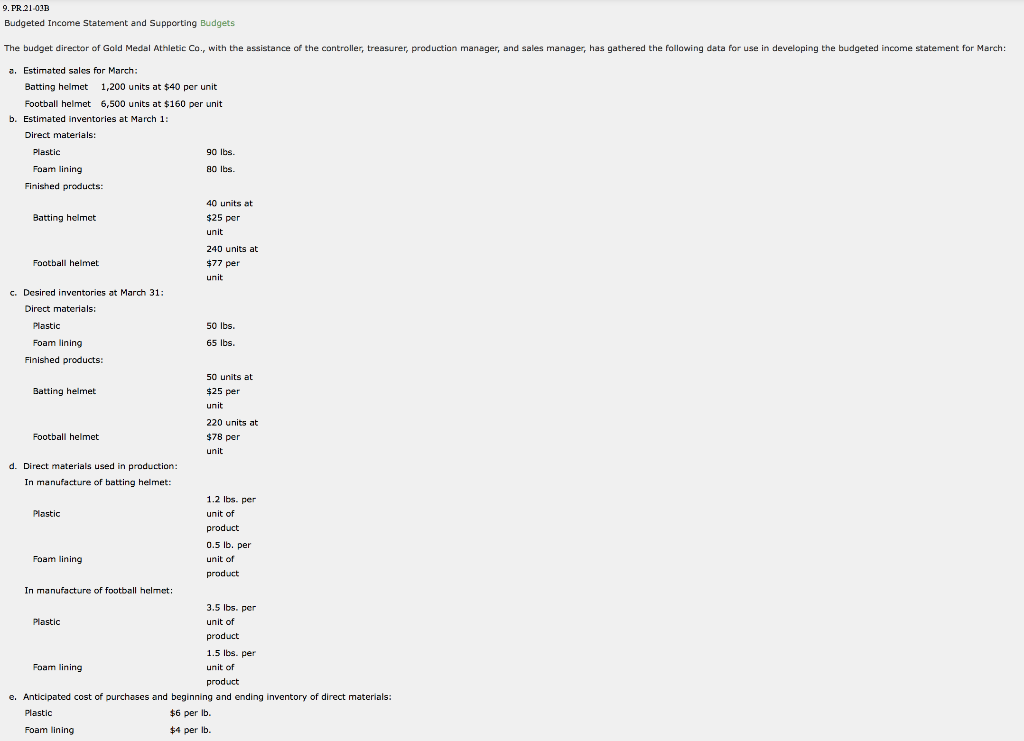

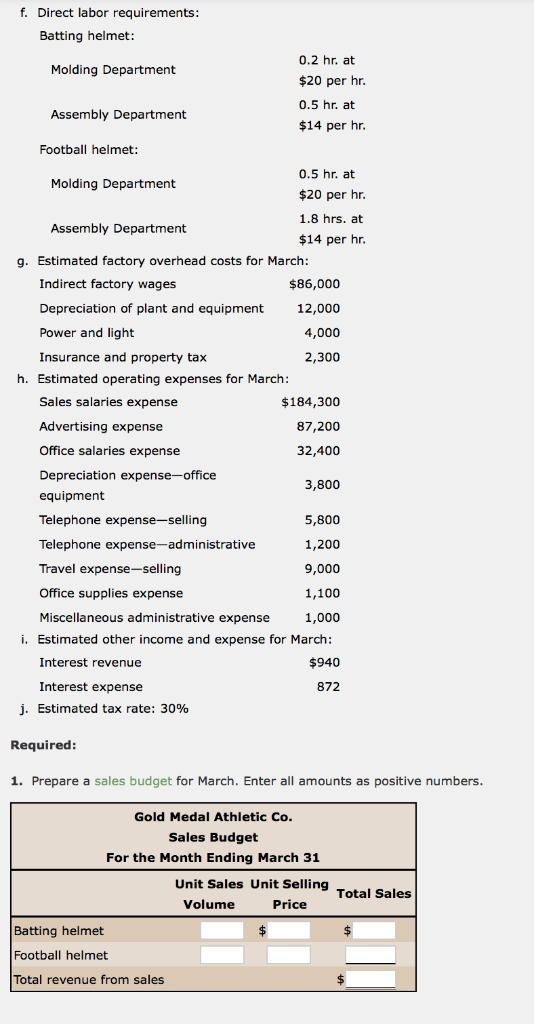

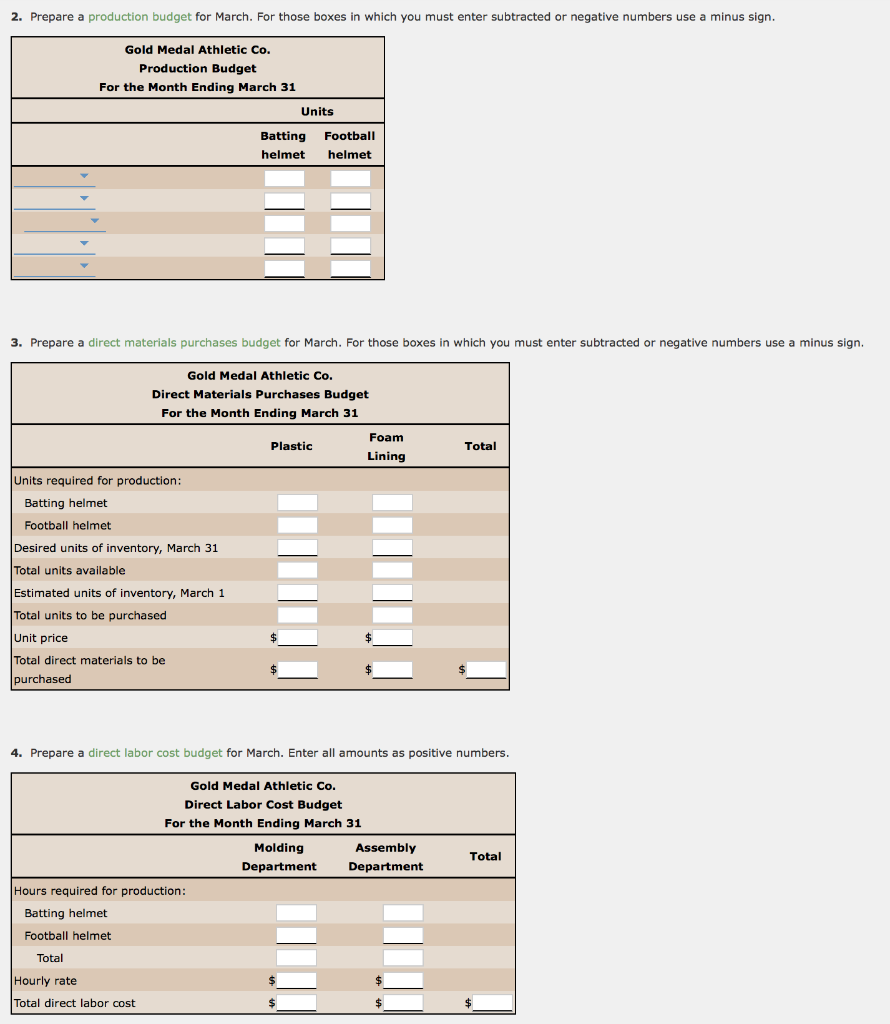

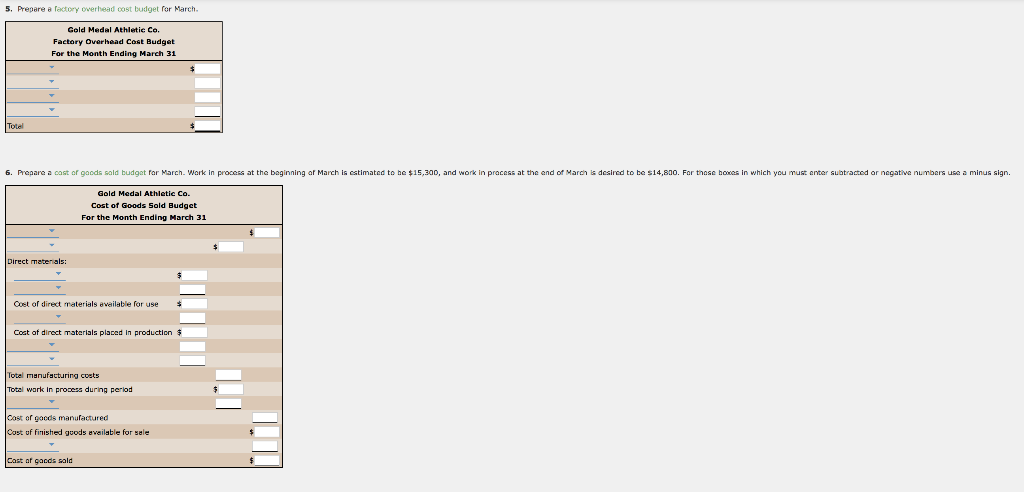

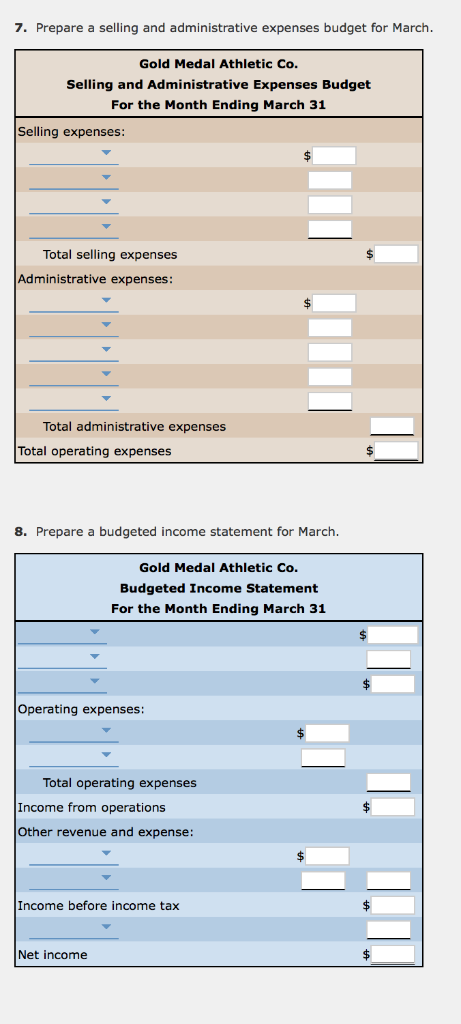

9. PR.21-013 Budgeted Income Statement and Supporting Budgets The budget director of Gold Medal Athletic Co., with the assistance of the controller, treasurer, productian manager, and sales manager, has gathered the fallawing data for use in developing the budgeted income statement for March: Estimated sales for March Batting helmet 1,200 units at $40 per unit Football helmet 6,500 units at $160 per unit b. Estimated inventories at March 1: Direct materials: Plastic 90 lbs Foam lining 80 lbs Finished products: 40 units at $25 per unit 240 units at $77 per unit Batting helmet Football helmet c. Desired inventorics at March 31 Direct materials 50 lbs. Plastic Foam lining 65 lbs. Finished products: 50 units at $25 per unit 220 units at $78 per unit Batting helmet Footbal helmet d. Direct materials used in production In manufacture of batting helmet: 1.2 lbs. per unit of product 0.5 lb. per unit of Plastic Foam lining In manufacture of football helmet: 3.5 lbs. per Plastic unit of 1.5 lbs. per unit of Foarn lining e. Anticipated cost of purchases and beginning and ending inventory of direct materials Plastic $6 per lb. Foam lining $4 per lb. f. Direct labor requirements Batting helmet 0.2 hr. at $20 per hr 0.5 hr. at $14 per hr Molding Department Assembly Department Football helmet: 0.5 hr. at $20 per hr 1.8 hrs. at $14 per hr Molding Department Assembly Department g. Estimated factory overhead costs for March $86,000 12,000 4,000 2,300 Indirect factory wages Depreciation of plant and equipment Power and light Insurance and property tax h. Estimated operating expenses for March Sales salaries expense Advertising expense Office salaries expense Depreciation expense-office equipment Telephone expense-selling Telephone expense-administrative Travel expense-selling Office supplies expense Miscellaneous administrative expense $184,300 87,200 32,400 3,800 5,800 1,200 9,000 1,100 1,000 i. Estimated other income and expense for March: Interest revenue $940 872 Interest expense j, Estimated tax rate: 30% Required: 1. Prepare a sales budget for March. Enter all amounts as positive numbers Gold Medal Athletic Co Sales Budget For the Month Ending March 31 Unit Sales Unit Selling Total Sales Volume Price Batting helmet Football helmet Total revenue from sales 2. Prepare a production budget for March. For those boxes in which you must enter subtracted or negative numbers use a minus sign Gold Medal Athletic Co. Production Budget For the Month Ending March 31 Units Batting Football helmet helmet 3. Prepare a direct materials purchases budget for March. For those boxes in which you must enter subtracted or negative numbers use a minus sign Gold Medal Athletic Co. Direct Materials Purchases Budget For the Month Ending March 31 Foam Plastic Total Lining Units required for production Batting helmet Football helmet Desired units of inventory, March 31 Total units available Estimated units of inventory, March 1 Total units to be purchased Unit price Total direct materials to be purchased 4. Prepare a direct labor cost budget for March. Enter all amounts as positive numbers Gold Medal Athletic Co. Direct Labor Cost Budget For the Month Ending March 31 Molding Assembly Department Total Department Hours required for production Batting helmet Football helmet Total Hourly rate Total direct labor cost 5, Prepare rectory overhead oost budget ror March. Gold Medal Athletic Co. Factory Overhead Cost Budgat For the Month Ending March 31 6. Prepare oast or adds sald b d at ar March work in process at the beginning af March is estimated to be $15,300 and work in Pracess at the end of March desired to be s14 sao. Far nose bo es in which you must ente subtracted or ne ative numbers use minus si Medal Athletic Co. Cost of Goods Sold Budget For the Month Ending March 31 Cost of direct materials evailable for use cost of direct materials placed in production otel manufacturing cvets wark in process during perlod of gocds manufactured uf finished goods available for sale af gacds sald 7. Prepare a selling and administrative expenses budget for March Gold Medal Athletic Co. Selling and Administrative Expenses Budget For the Month Ending March 31 Selling expenses Total selling expenses Administrative expenses Total administrative expenses Total operating expenses 8. Prepare a budgeted income statement for March Gold Medal Athletic Co. Budgeted Income Statement For the Month Ending March 31 Operating expenses Total operating expenses Income from operations Other revenue and expense: Income before income tax Net income