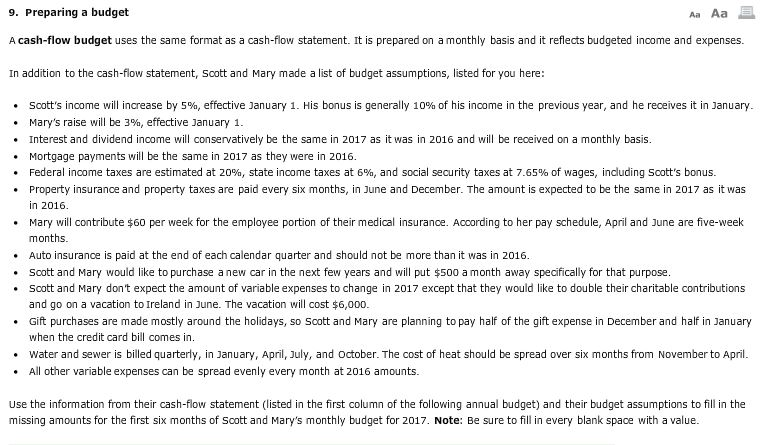

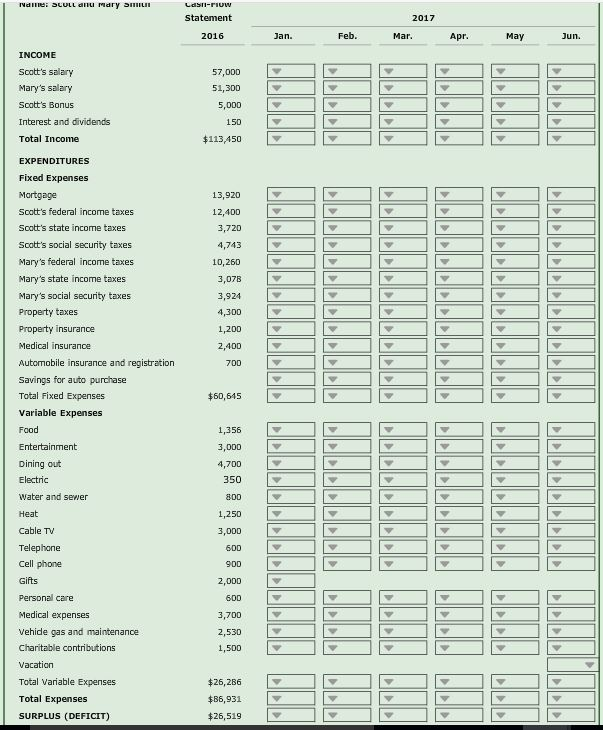

9. Preparing a budget A cash-flow budget uses the same format as a cash-flow statement. It is prepared on a monthly basis and it reflects budgeted income and expenses. In addition to the cash-flow statement, Soott and Mary made a list of budget assumptions, listed for you here: . scott's income will increase by 5%, effective January 1 His bonus is generally 10% of his income in the previous year, and he recerves it in January. Mary's raise will be 3%, effective January 1 Interest and dividend income will conservatively be the same in 2017 as it was in 2016 and will be received on a monthly basis. Mortgage payments will be the same in 2017 as they were in 2016. Federal income taxes are estimated at 20%, state income taxes at 6%, and social security taxes at 7.65% of wages, including Scotts bonus. Property insurance and property taxes are paid every six months, in June and December. The amount is expected to be the same in 2017 as it was in 2016. Mary will contribute $60 per week for the employee portion of their medical insurance. According to her pay schedule, April and June are five-week months. Auto insurance is paid at the end of each calendar quarter and should not be more than it was in 2016. Scott and Mary would like to purchase a new car in the next few years and will put $500 a month away specifically for that purpose. . . Scott and Mary don't expect the amount of variable expenses to change in 2017 except that they would like to double their charitable contributions and go on a vacation to Ireland in June. The vacation will cost $6,000. Gift purchases are made mostly around the holidays, so Scott and Mary are planning to pay half of the gift expense in December and half in January when the credit card bill comes in. Water and sewer is billed quarterly, in January, April, July, and october. The cost of heat should be spread over six months from November to April. All other variable expenses can be spread evenly every month at 2016 amounts. Use the information from their cash-flow statement (listed in the first column of the following annual budget) and their budget assumptions to fill in the missing amounts for the first six months of Scott and Mary's monthly budget for 2017. Note: Be sure to fill in every blank space with a value. Statement 2017 2016 an. Mar Apr May un. $113,450 Soott's federal income taxes Soott's state income taxes Scott's social security taxes Mary's federal income taxes Mary's state income taxes Property insuranoe Automobile insurance and registration Medical expenses Vehide gas and maintenance Charitable contributions Total Variable Expenses SURPLUS (DEFICIT)