Answered step by step

Verified Expert Solution

Question

1 Approved Answer

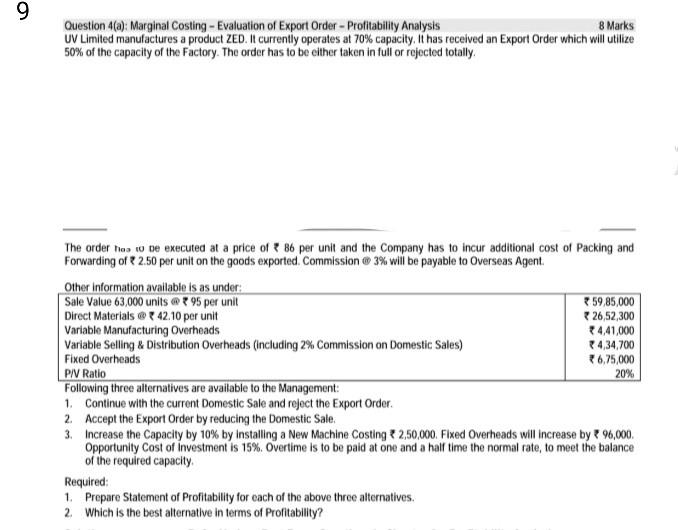

9 Question 4(a): Marginal Costing - Evaluation of Export Order - Profitability Analysis 8 Marks UV Limited manufactures a product ZED. It currently operates at

9 Question 4(a): Marginal Costing - Evaluation of Export Order - Profitability Analysis 8 Marks UV Limited manufactures a product ZED. It currently operates at 70% capacity. It has received an Export Order which will utilize 50% of the capacity of the Factory. The order has to be either taken in full or rejected totally. The order has to be executed at a price of B6 per unit and the Company has to incur additional cost of Packing and Forwarding of 2.50 per unit on the goods exported. Commission 3% will be payable to Overseas Agent Other Information available is as under Sale Value 63,000 units @ ? 95 per unit 59,85,000 Direct Materials @ 42.10 per unit 26,52,300 Variable Manufacturing Overheads 4,41,000 Variable Selling & Distribution Overheads (including 2% Commission on Domestic Sales) 434,700 Fixed Overheads 6,75,000 PN Ratio 20% Following three alternatives are available to the Management: 1. Continue with the current Domestic Sale and reject the Export Order 2. Accept the Export Order by reducing the Domestic Sale 3. Increase the capacity by 10% by Installing a New Machine Costing 2,50,000. Fixed Overheads will increase by 96,000 Opportunity Cost of investment is 15%. Overtime is to be paid at one and a half time the normal rate, to meet the balance of the required capacity Required: 1. Prepare Statement of Profitability for each of the above three alternatives. 2. Which is the best alternative in terms of Profitability

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started