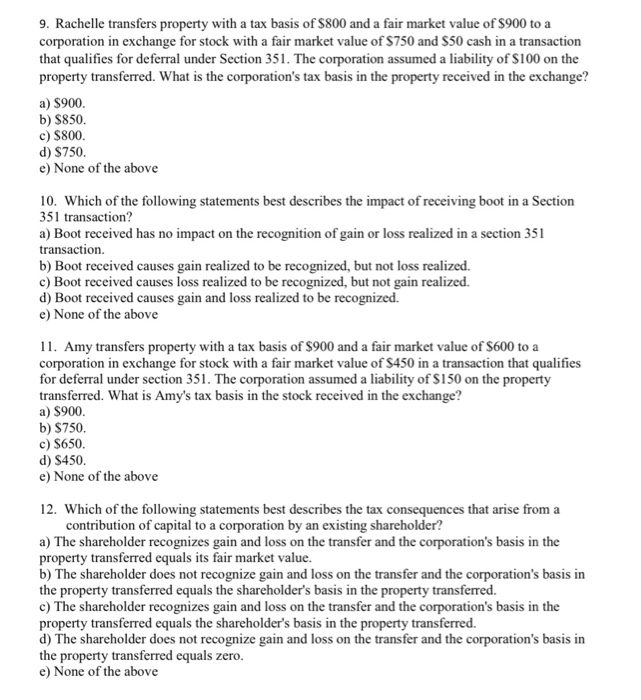

9. Rachelle transfers property with a tax basis of $800 and a fair market value of $900 to a corporation in exchange for stock with a fair market value of $750 and $50 cash in a transaction that qualifies for deferral under Section 351. The corporation assumed a liability of $100 on the property transferred. What is the corporation's tax basis in the property received in the exchange? a) $900. b) $850. c) $800. d) $750. e) None of the above 10. Which of the following statements best describes the impact of receiving boot in a Section 351 transaction? a) Boot received has no impact on the recognition of gain or loss realized in a section 351 transaction. b) Boot received causes gain realized to be recognized, but not loss realized. c) Boot received causes loss realized to be recognized, but not gain realized. d) Boot received causes gain and loss realized to be recognized. e) None of the above 11. Amy transfers property with a tax basis of $900 and a fair market value of $600 to a corporation in exchange for stock with a fair market value of $450 in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $150 on the property transferred. What is Amy's tax basis in the stock received in the exchange? a) $900. b) $750. c) $650. d) $450. e) None of the above 12. Which of the following statements best describes the tax consequences that arise from a contribution of capital to a corporation by an existing shareholder? a) The shareholder recognizes gain and loss on the transfer and the corporation's basis in the property transferred equals its fair market value. b) The shareholder does not recognize gain and loss on the transfer and the corporation's basis in the property transferred equals the shareholder's basis in the property transferred. c) The shareholder recognizes gain and loss on the transfer and the corporation's basis in the property transferred equals the shareholder's basis in the property transferred. d) The shareholder does not recognize gain and loss on the transfer and the corporation's basis in the property transferred equals zero. e) None of the above