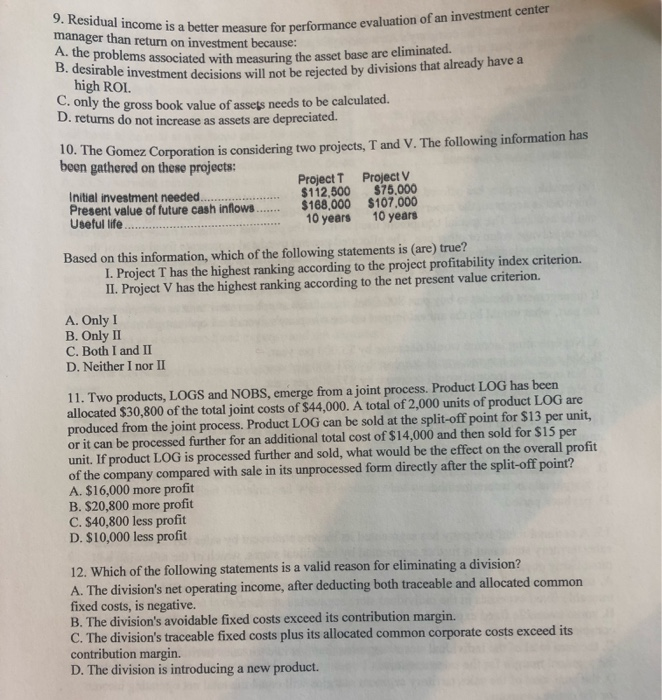

9. Residual income manager than return on investment because: A. the problems associated with measu B. desirable investment decisions is a better measure for performance evaluation of an investment center ems associated with measuring the asset base are eliminated. will not be rejected by divisions that already havea high ROI C. only the gross book value of assets needs to be calculated. D. returns do not increase as assets are depreciated. 10. The Gomez Corporation is considering two projects, T and V. The following information has boon gathered on these projects: Project T $112,500 $75.000 Project V Initial investment needed Present value of future cash inflows........$168,000 $107,000 Useful life 10 years 10 years I. Project T has the highest ranking according to the project profitability index criterion. II. Project V has the highest ranking according to the net present value criterion Based on this information, which of the following statements is (are) true? A. Only I B. Only II C. Both I and II D. Neither I nor II 11. Two products, LOGS and NOBS, emerge from a joint process. Product LOG has been allocated $30,800 of the total joint costs of $44,000. A total of 2,000 units of product LOG are produced from the joint process. Product LOG can be sold at the split-off point for $13 per unit, or it can be processed further for an additional total cost of $14,000 and then sold for $15 per unit. If product LOG is processed further and sold, what would be the effect on the overall profit of the company compared with sale in its unprocessed form directly after the split-off point? A. $16,000 more profit B. $20,800 more profit C. $40,800 less profit D. $10,000 less profit 12. Which of the following statements is a valid reason for eliminating a division? A. The division's net ope fixed costs, is negative. B. The division's avoidable fixed costs exceed its contribution margin. C. The division's traceable fixed costs plus its allocated common corporate costs exceed its contribution margin. D. The division is introducing a new product. rating income, after deducting both traceable and allocated common