Answered step by step

Verified Expert Solution

Question

1 Approved Answer

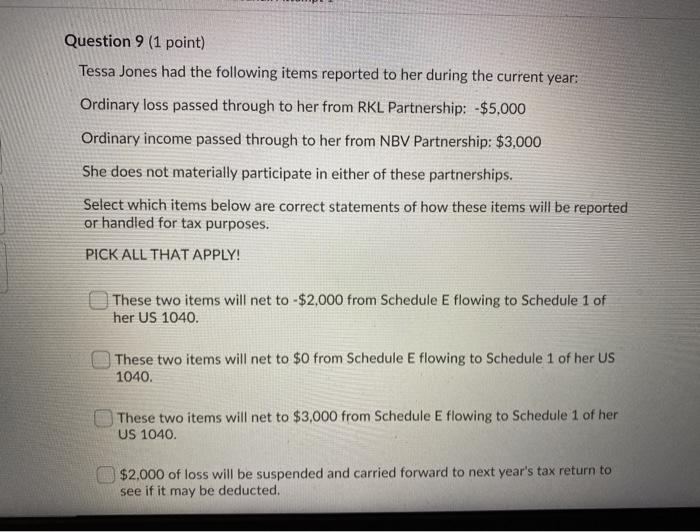

9 select all apply not only one answer. thank you Question 9 (1 point) Tessa Jones had the following items reported to her during the

9

Question 9 (1 point) Tessa Jones had the following items reported to her during the current year: Ordinary loss passed through to her from RKL Partnership: $5,000 Ordinary income passed through to her from NBV Partnership: $3,000 She does not materially participate in either of these partnerships. Select which items below are correct statements of how these items will be reported or handled for tax purposes. PICK ALL THAT APPLY! These two items will net to-$2,000 from Schedule E flowing to Schedule 1 of her US 1040. These two items will net to $0 from Schedule E flowing to Schedule 1 of her US 1040. These two items will net to $3,000 from Schedule E flowing to Schedule 1 of her US 1040 $2,000 of loss will be suspended and carried forward to next year's tax return to see if it may be deducted select all apply not only one answer. thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started