Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. Suppose an individual earns income $600 when they are sick, and $1000 when they are healthy. Suppose this individual is sick with probability

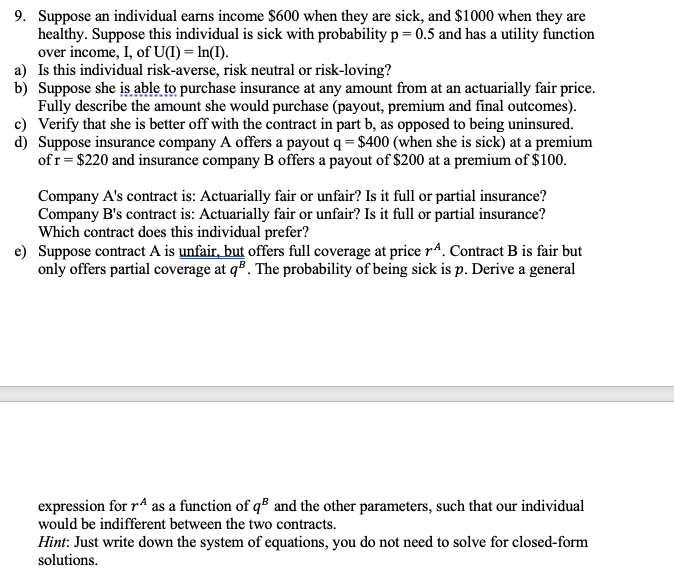

9. Suppose an individual earns income $600 when they are sick, and $1000 when they are healthy. Suppose this individual is sick with probability p = 0.5 and has a utility function over income, I, of U(I) = In(I). a) Is this individual risk-averse, risk neutral or risk-loving? b) Suppose she is able to purchase insurance at any amount from at an actuarially fair price. Fully describe the amount she would purchase (payout, premium and final outcomes). c) Verify that she is better off with the contract in part b, as opposed to being uninsured. d) Suppose insurance company A offers a payout q = $400 (when she is sick) at a premium of r = $220 and insurance company B offers a payout of $200 at a premium of $100. Company A's contract is: Actuarially fair or unfair? Is it full or partial insurance? Company B's contract is: Actuarially fair or unfair? Is it full or partial insurance? Which contract does this individual prefer? e) Suppose contract A is unfair, but offers full coverage at price A. Contract B is fair but only offers partial coverage at q. The probability of being sick is p. Derive a general expression for rA as a function of q and the other parameters, such that our individual would be indifferent between the two contracts. Hint: Just write down the system of equations, you do not need to solve for closed-form solutions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started