Answered step by step

Verified Expert Solution

Question

1 Approved Answer

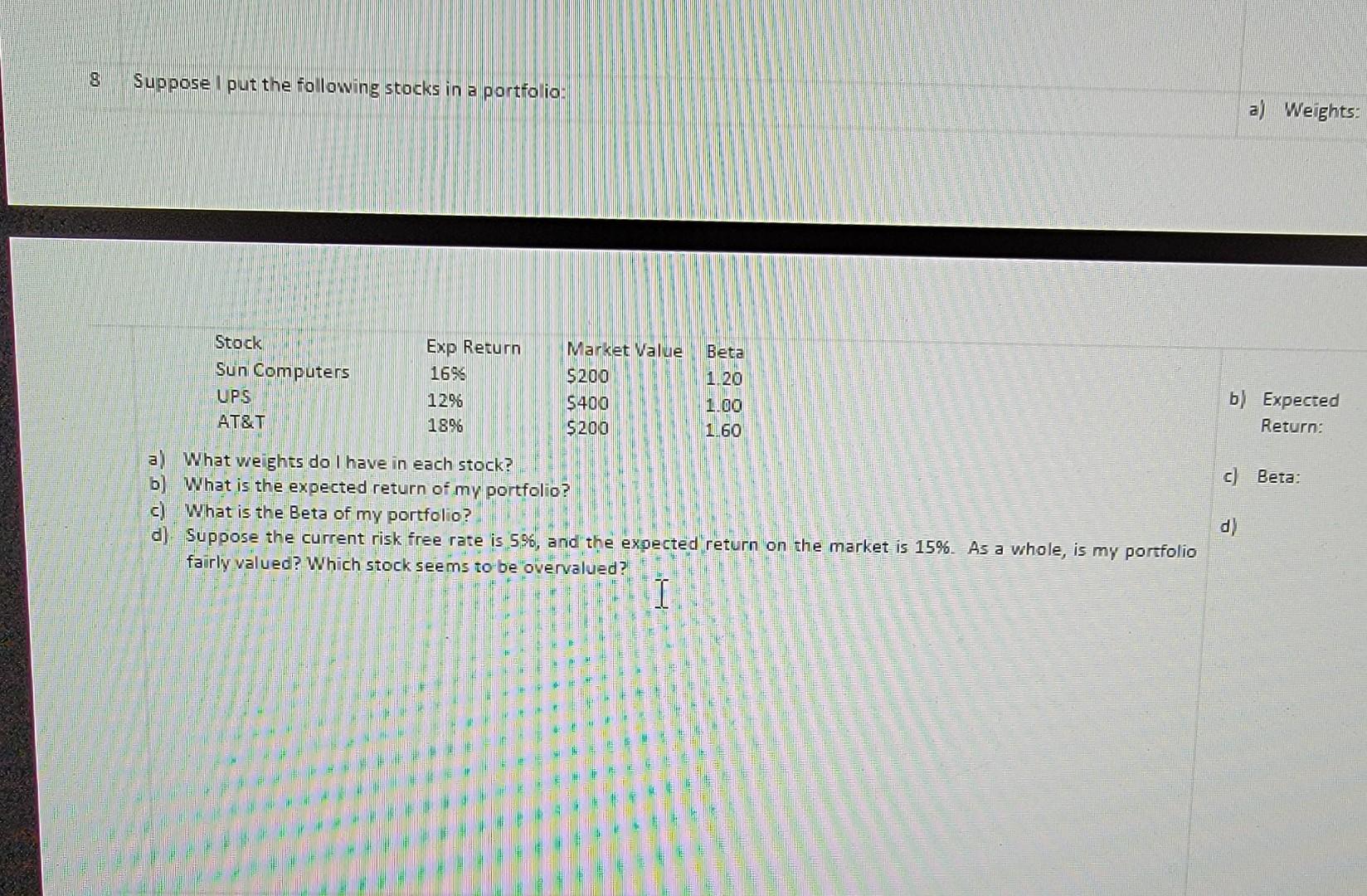

9 Suppose put the following stocks in a portfolio: a) Weights: Stock Sun Computers UPS AT&T Exp Return 1696 12% 1896 Market Value $200 $400

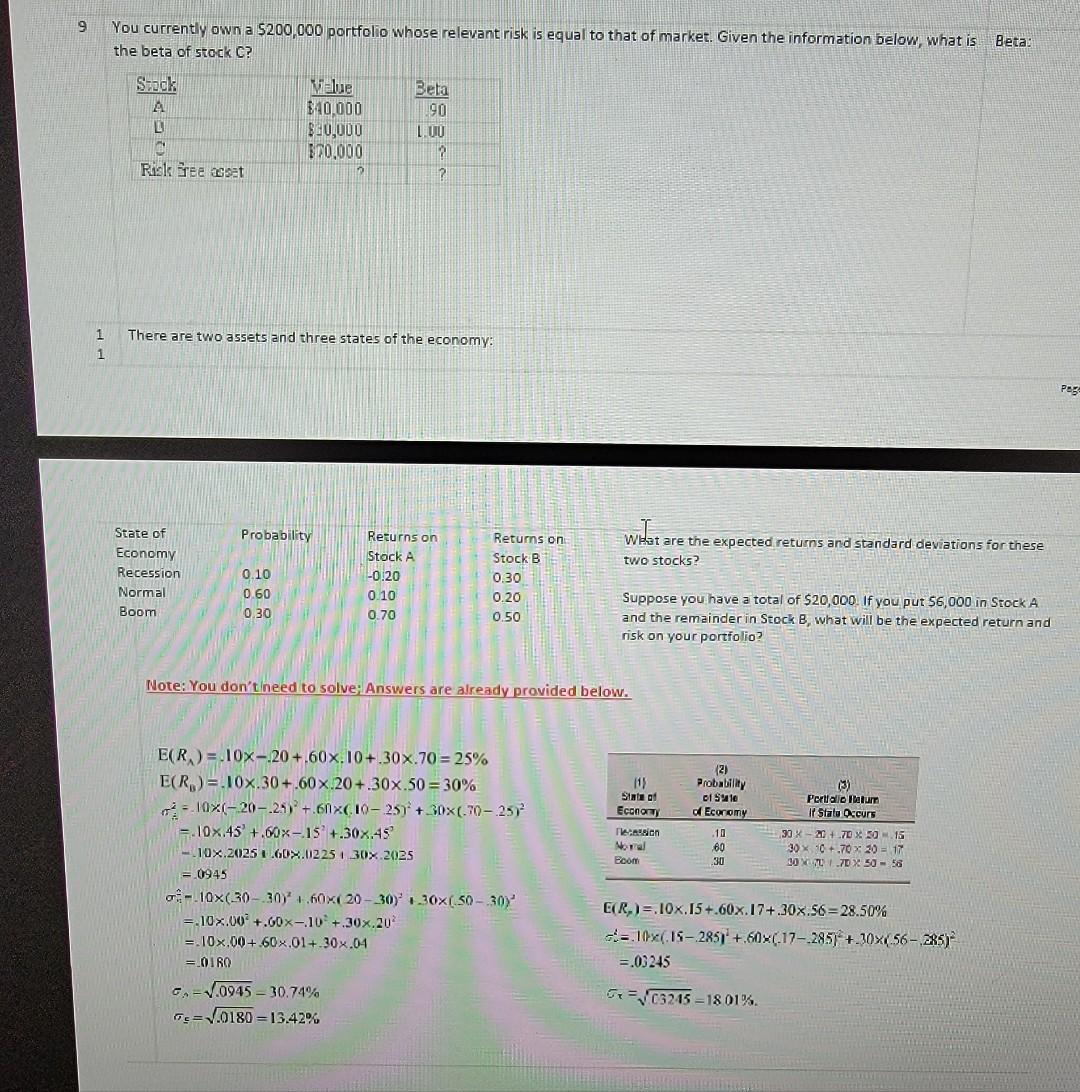

9 Suppose put the following stocks in a portfolio: a) Weights: Stock Sun Computers UPS AT&T Exp Return 1696 12% 1896 Market Value $200 $400 $200 Beta 1.20 1.00 1.60 b) Expected Return: c) Beta: a) What weights do I have in each stock? b) What is the expected return of my portfolio? c) What is the Beta of my portfolio? d) Suppose the current risk free rate is 596, and the expected return on the market is 15%. As a whole, is my portfolio fairly valued? Which stock seems to be overvalued? I d) 9 You currently own a $200,000 portfolio whose relevant risk is equal to that of market. Given the information below, what is Beta: the beta of stock C? Stock A LI Melue $40,000 B20,000 100.000 12 Beta 90 1.00 12 ? Risk See at There are two assets and three states of the economy: 1 1 Pas probabit Probability What are the expected returns and standard deviations for these two stocks? State of Economy Recession Normal Boom 0.10 0.60 0.30 Returns on Stock A (-0.20 0.10 0.70 Returns on Stock B 0.30 0.20 0.50 Suppose you have a total of $20,000. If you put $6,000 in Stock A and the remainder in Stock B, what will be the expected return and risk on your portfolio? Note: You don't need to solve: Answers are already provided below. Siang 2) Probability o Sul of Ecoromy Economy recension Nore! BOOM .10 60 .30 Portfolio Melum I State Occurs 30 X-20 +70 X 30 15 30 % 0 +.70 x 30 = 17 30 X 70 X 50 - 58 E(R) = 10x-.20+.60x. 10+.30.70 = 25% E(R) = 10.30+.60X.20+.30X.50 = 30% 10X(-20-25 +.611XC10-257 + 30X0.70-2572 = 10.45 +.60X-15 +.302.45 -10.2025 L60.02 251 30% 2025 =0945 08-10X(30-307 1.60X20-30) 1.30% 50-30) = 10x.00 +.60x-.10+.30x.20 = 10.00+ 60x.01+.30.04 =OIRO GA=V.0945 - 30.74% = .0180=13.42% E(R)= 10x. 15+.60x. 17+.30x.56=28.50% 10X(IS-2851 +.60X(.17-285) +.30X(.56 - 285) =.03245 GC3245 =1801%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started