Answered step by step

Verified Expert Solution

Question

1 Approved Answer

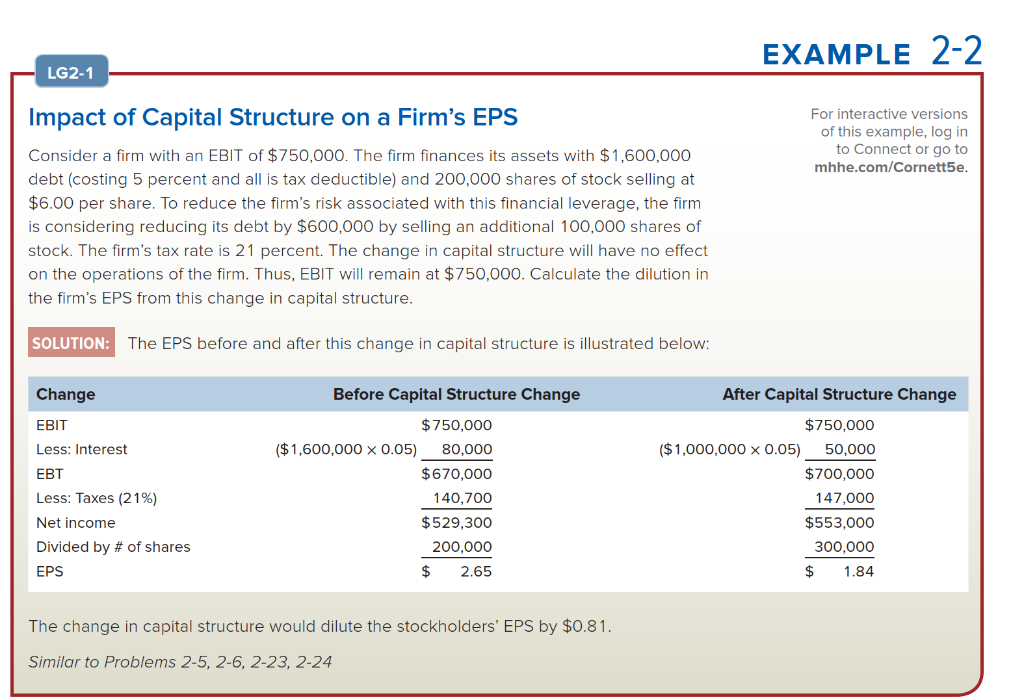

9. Suppose that you are considering a stock investment in one of two firms (AllDebt, Inc., and AllEquity, Inc.), both of which operate in the

| 9. Suppose that you are considering a stock investment in one of two firms (AllDebt, Inc., and AllEquity, Inc.), both of which operate in the same industry and have identical IBITDA of $6.2 million and operating incomes of $5 million. AllDebt, Inc. finances its $12 million in assets with $11 million in debt (on which it pays 10 percent interest, or interest payments of $1.1 million) and $1 million in equity. With $6.2 million of EBITDA AllDebt Inc. may deduct up to $1.86 million ($6.2 x 30 percent) of interest expense for tax purposes. Thus, AllDebt Inc. is allowed to deduct all of its interest expense. AllEquity, Inc. finances its $12 million in assets with no debt and $12 million in equity. Both firms pay 21 percent tax on their taxable income. Calculate the income that each firm has available to pay its debt and stockholders (the firm's asset funders) and the resulting returns to these asset funders for the two firms. Refer to Example 2-5 on page 44. | |||||||||

| AllDebt | AllEquity | ||||||||

| Equity | $1,000,000 | $12,000,000 | |||||||

| Asset-funders' investment (assets) | $12,000,000 | $12,000,000 | |||||||

| Earnings before interest, taxes, depreciation, and amortization (EBITDA) | $6,200,000 | $6,200,000 | |||||||

| Less: Depreciation and amortization | $1,200,000 | $1,200,000 | |||||||

| Operating income (EBIT) | |||||||||

| Less: interest | $1,100,000 | $0 | |||||||

| Taxable income | |||||||||

| Tax rate | 21% | 21% | |||||||

| Less: Taxes | |||||||||

| Net income | |||||||||

| Income available for asset funders (Operating income - Taxes) | |||||||||

| Return on asset-funders' investment (return on assets) | |||||||||

| Return on equity (Net income / Equity) (AOL focus for course.) | |||||||||

| Lesson: Debt has a tax advantage for a profitable company. While the advantage of debt shows up slightly in Return on Assets, it has a dramatic impact on Return on Equity. However, debt can lead to bankruptcy if a company has a few unprofitablel years. | |||||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started