Answered step by step

Verified Expert Solution

Question

1 Approved Answer

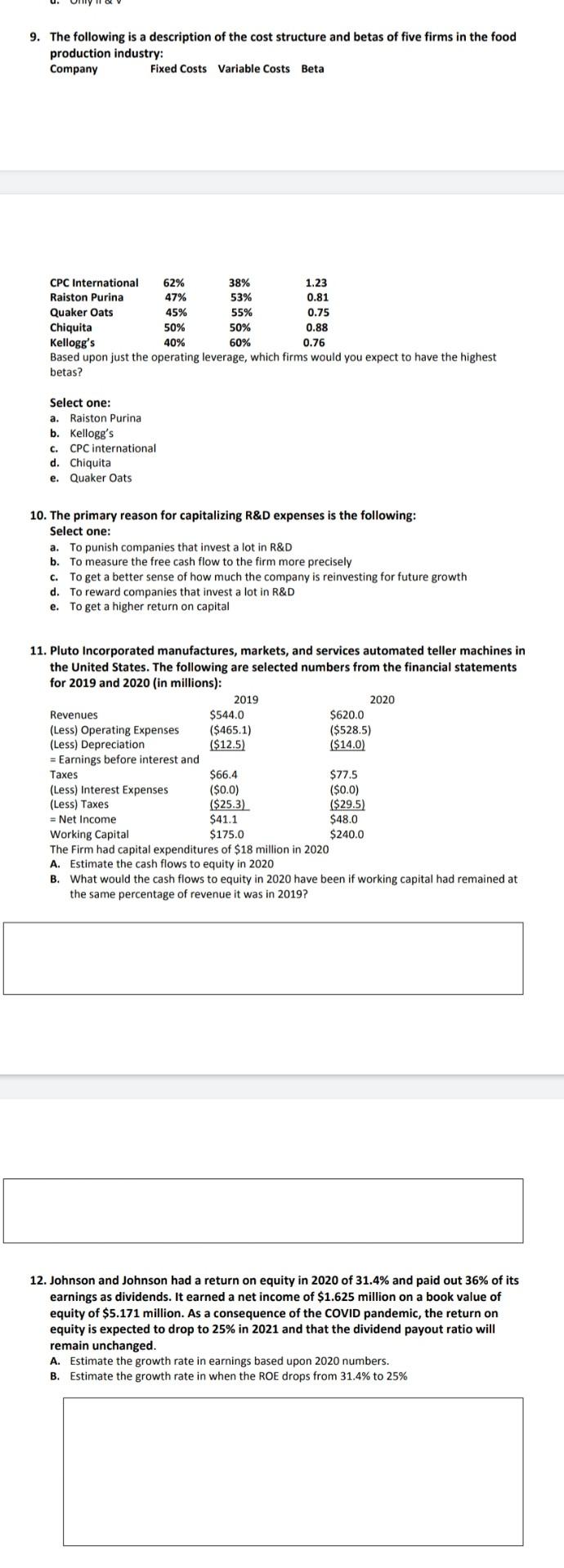

9. The following is a description of the cost structure and betas of five firms in the food production industry: Company Fixed Costs Variable Costs

9. The following is a description of the cost structure and betas of five firms in the food production industry: Company Fixed Costs Variable Costs Beta CPC International 62% 38% 1.23 Raiston Purina 47% 53% 0.81 Quaker Oats 45% 55% 0.75 Chiquita 50% 50% Kellogg's 40% 60% 0.76 Based upon just the operating leverage, which firms would you expect to have the highest betas? 0.88 a. Select one: Raiston Purina b. Kellogg's C. CPC international d. Chiquita e. Quaker Oats 10. The primary reason for capitalizing R&D expenses is the following: Select one: a. To punish companies that invest a lot in R&D b. To measure the free cash flow to the firm more precisely c. To get a better sense of how much the company is reinvesting for future growth d. To reward companies that invest a lot in R&D To get a higher return on capital e. 11. Pluto Incorporated manufactures, markets, and services automated teller machines in the United States. The following are selected numbers from the financial statements for 2019 and 2020 (in millions): 2019 2020 Revenues $544.0 $620.0 (Less) Operating Expenses ($465.1) ($528.5) (Less) Depreciation ($12.5) ($14.0) = Earnings before interest and Taxes $66.4 $77.5 (Less) Interest Expenses ($0.0) ($0.0) (Less) Taxes ($25.3) ($29.5) = Net Income $41.1 $48.0 Working Capital $175.0 $240.0 The Firm had capital expenditures of $18 million in 2020 A. Estimate the cash flows to equity in 2020 B. What would the cash flows to equity in 2020 have been if working capital had remained at the same percentage of revenue it was in 2019? 12. Johnson and Johnson had a return on equity in 2020 of 31.4% and paid out 36% of its earnings as dividends. It earned a net income of $1.625 million on a book value of equity of $5.171 million. As a consequence of the COVID pandemic, the return on equity is expected to drop to 25% in 2021 and that the dividend payout ratio will remain unchanged. A. Estimate the growth rate in earnings based upon 2020 numbers. B. Estimate the growth rate in when the ROE drops from 31.4% to 25%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started