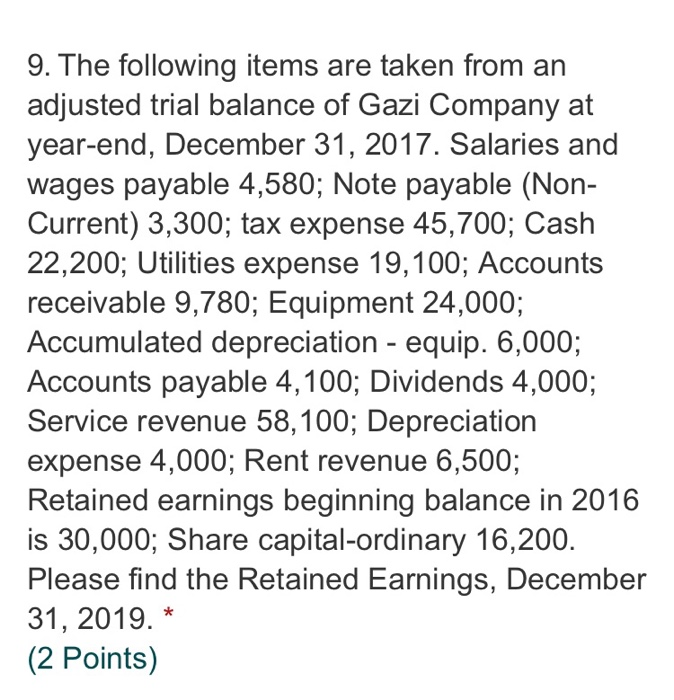

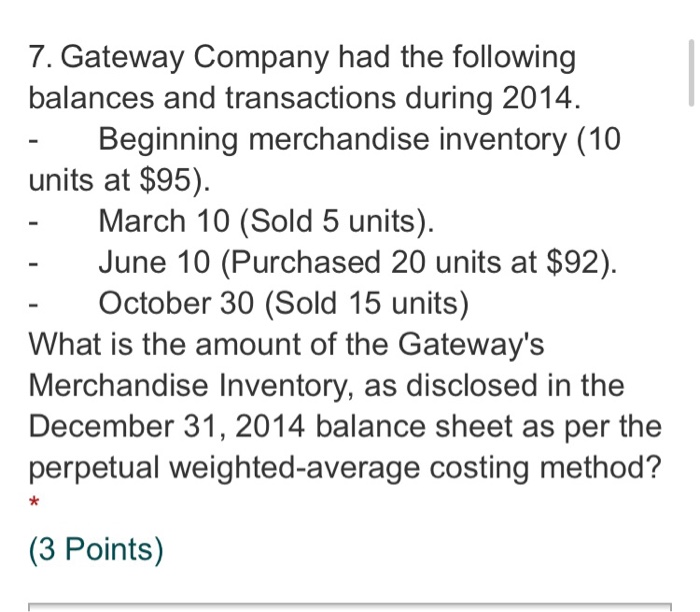

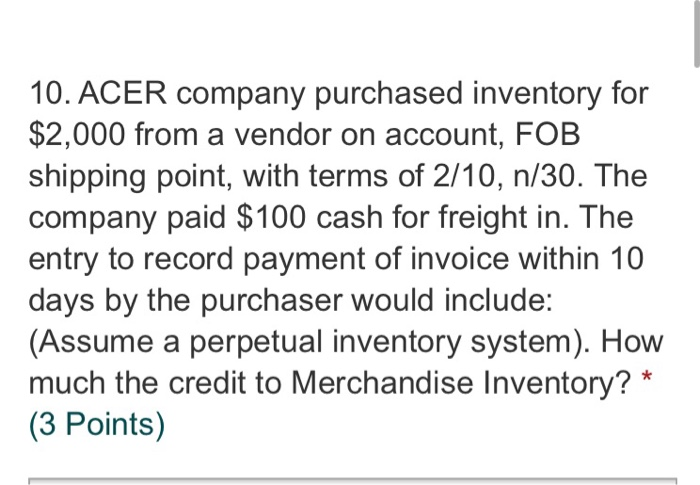

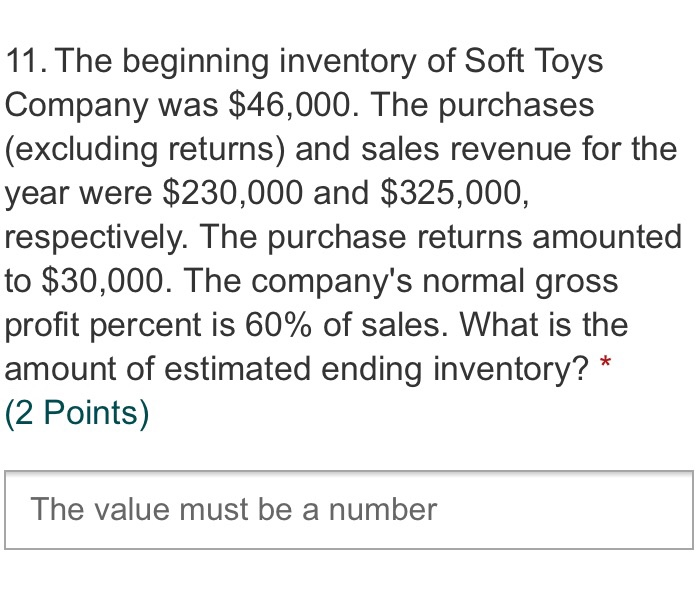

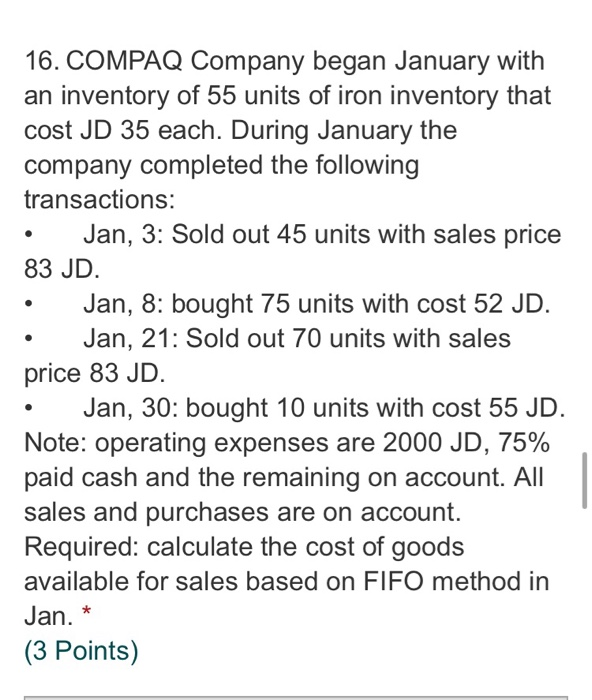

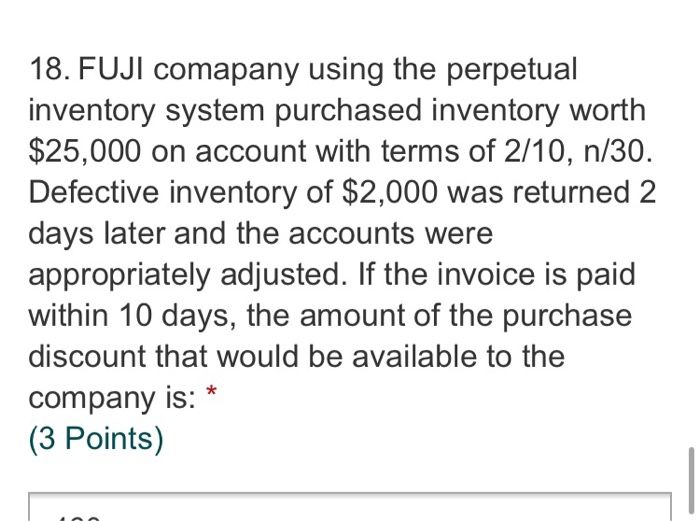

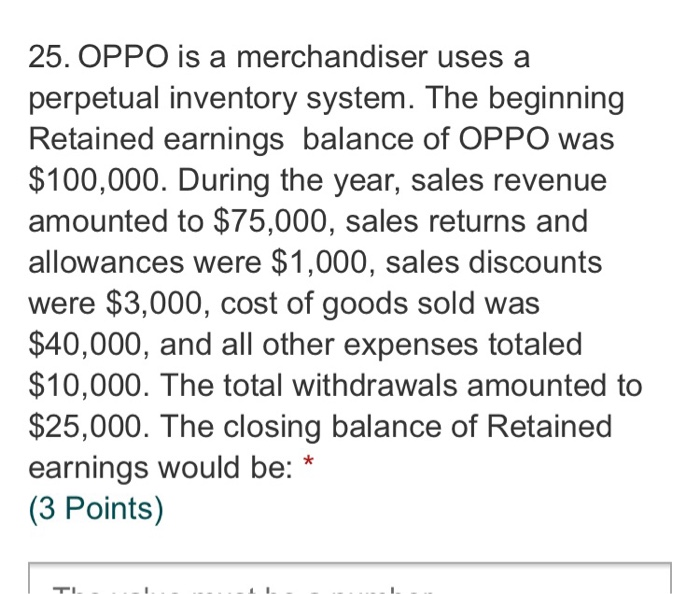

9. The following items are taken from an adjusted trial balance of Gazi Company at year-end, December 31, 2017. Salaries and wages payable 4,580; Note payable (Non- Current) 3,300; tax expense 45,700; Cash 22,200; Utilities expense 19,100; Accounts receivable 9,780; Equipment 24,000; Accumulated depreciation - equip. 6,000; Accounts payable 4,100; Dividends 4,000; Service revenue 58,100; Depreciation expense 4,000; Rent revenue 6,500; Retained earnings beginning balance in 2016 is 30,000; Share capital-ordinary 16,200. Please find the Retained Earnings, December 31, 2019. * (2 Points) 7. Gateway Company had the following balances and transactions during 2014. Beginning merchandise inventory (10 units at $95). March 10 (Sold 5 units). June 10 (Purchased 20 units at $92). October 30 (Sold 15 units) What is the amount of the Gateway's Merchandise Inventory, as disclosed in the December 31, 2014 balance sheet as per the perpetual weighted-average costing method? (3 Points) 10. ACER company purchased inventory for $2,000 from a vendor on account, FOB shipping point, with terms of 2/10, n/30. The company paid $100 cash for freight in. The entry to record payment of invoice within 10 days by the purchaser would include: (Assume a perpetual inventory system). How much the credit to Merchandise Inventory? * (3 Points) 11. The beginning inventory of Soft Toys Company was $46,000. The purchases (excluding returns) and sales revenue for the year were $230,000 and $325,000, respectively. The purchase returns amounted to $30,000. The company's normal gross profit percent is 60% of sales. What is the amount of estimated ending inventory? * (2 Points) The value must be a number 16. COMPAQ Company began January with an inventory of 55 units of iron inventory that cost JD 35 each. During January the company completed the following transactions: Jan, 3: Sold out 45 units with sales price 83 JD. Jan, 8: bought 75 units with cost 52 JD. Jan, 21: Sold out 70 units with sales price 83 JD. Jan, 30: bought 10 units with cost 55 JD. Note: operating expenses are 2000 JD, 75% paid cash and the remaining on account. All sales and purchases are on account. Required: calculate the cost of goods available for sales based on FIFO method in Jan. (3 Points) 18. FUJI comapany using the perpetual inventory system purchased inventory worth $25,000 on account with terms of 2/10, n/30. Defective inventory of $2,000 was returned 2 days later and the accounts were appropriately adjusted. If the invoice is paid within 10 days, the amount of the purchase discount that would be available to the company is: (3 Points) 1 25. OPPO is a merchandiser uses a perpetual inventory system. The beginning Retained earnings balance of OPPO was $100,000. During the year, sales revenue amounted to $75,000, sales returns and allowances were $1,000, sales discounts were $3,000, cost of goods sold was $40,000, and all other expenses totaled $10,000. The total withdrawals amounted to $25,000. The closing balance of Retained earnings would be: (3 Points) TI