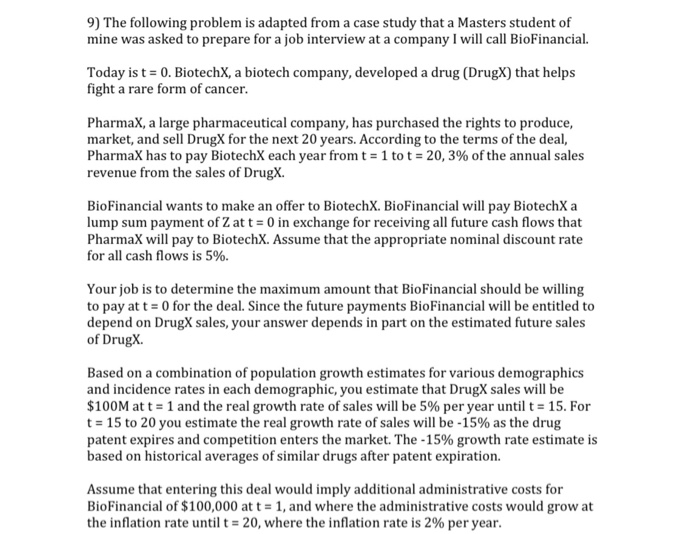

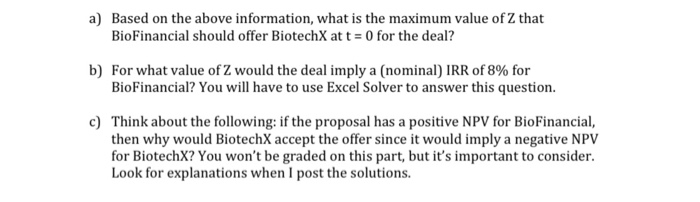

9) The following problem is adapted from a case study that a Masters student of mine was asked to prepare for a job interview at a company I will call BioFinancial Today is t = 0. BiotechX, a biotech company, developed a drug (DrugX) that helps fight a rare form of cancer. Pharmax, a large pharmaceutical company, has purchased the rights to produce, market, and sell DrugX for the next 20 years. According to the terms of the deal, PharmaX has to pay BiotechX each year from t = 1 to t = 20,3% of the annual sales revenue from the sales of DrugX. BioFinancial wants to make an offer to BiotechX. BioFinancial will pay BiotechX a lump sum payment of Z at t = 0 in exchange for receiving all future cash flows that PharmaX will pay to BiotechX. Assume that the appropriate nominal discount rate for all cash flows is 5%. Your job is to determine the maximum amount that BioFinancial should be willing to pay at t = 0 for the deal. Since the future payments BioFinancial will be entitled to depend on DrugX sales, your answer depends in part on the estimated future sales of DrugX. Based on a combination of population growth estimates for various demographics and incidence rates in each demographic, you estimate that DrugX sales will be $100M at t = 1 and the real growth rate of sales will be 5% per year until t = 15. For t = 15 to 20 you estimate the real growth rate of sales will be -15% as the drug patent expires and competition enters the market. The -15% growth rate estimate is based on historical averages of similar drugs after patent expiration. Assume that entering this deal would imply additional administrative costs for BioFinancial of $100,000 at t = 1, and where the administrative costs would grow at the inflation rate until t = 20, where the inflation rate is 2% per year. a) Based on the above information, what is the maximum value of Z that BioFinancial should offer BiotechX at t = 0 for the deal? b) For what value of Z would the deal imply a (nominal) IRR of 8% for BioFinancial? You will have to use Excel Solver to answer this question. c) Think about the following: if the proposal has a positive NPV for BioFinancial, then why would BiotechX accept the offer since it would imply a negative NPV for BiotechX? You won't be graded on this part, but it's important to consider. Look for explanations when I post the solutions