Answered step by step

Verified Expert Solution

Question

1 Approved Answer

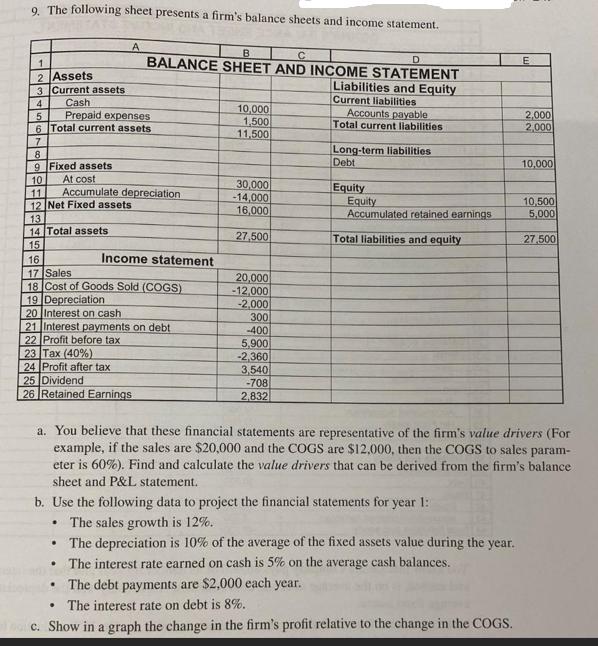

9. The following sheet presents a firm's balance sheets and income statement. 1 2 Assets A 3 Current assets Cash Prepaid expenses B D

9. The following sheet presents a firm's balance sheets and income statement. 1 2 Assets A 3 Current assets Cash Prepaid expenses B D BALANCE SHEET AND INCOME STATEMENT Liabilities and Equity Current liabilities E 4 5 10,000 1,500 Accounts payable 6 Total current assets Total current liabilities 2,000 2,000 11,500 7 Long-term liabilities 8 9 Fixed assets Debt 10,000 10 At cost 30,000 11 Accumulate depreciation Equity -14,000 12 Net Fixed assets Equity 10,500 16,000 Accumulated retained earnings 5,000 13 14 Total assets 27,500 Total liabilities and equity 27.500 15 16 Income statement 17 Sales 20,000 18 Cost of Goods Sold (COGS) -12,000 19 Depreciation -2,000 20 Interest on cash 300 21 Interest payments on debt -400 22 Profit before tax 5,900 23 Tax (40%) -2,360 24 Profit after tax 3,540 25 Dividend 26 Retained Earnings -708 2,832 a. You believe that these financial statements are representative of the firm's value drivers (For example, if the sales are $20,000 and the COGS are $12,000, then the COGS to sales param- eter is 60%). Find and calculate the value drivers that can be derived from the firm's balance sheet and P&L statement. b. Use the following data to project the financial statements for year 1: The sales growth is 12%. The depreciation is 10% of the average of the fixed assets value during the . The interest rate earned on cash is 5% on the average cash balances. The debt payments are $2,000 each year. . The interest rate on debt is 8%. year. loc. Show in a graph the change in the firm's profit relative to the change in the COGS.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started