Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. Traditional IRA Distributions. (Obj. 2) Over the years, Jen made nondeductible contributions to her traditional IRA. At the beginning of the year, she had

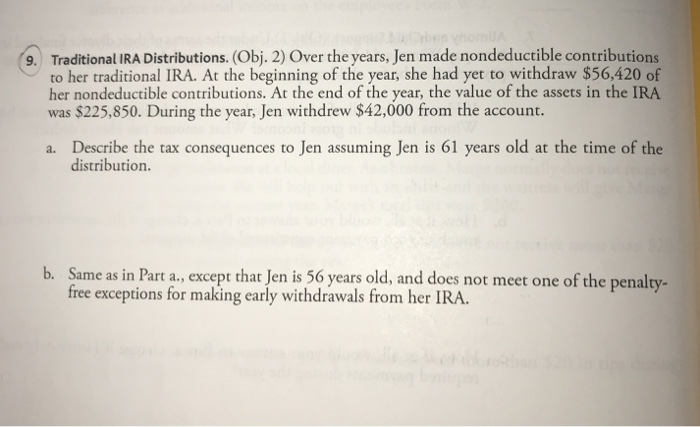

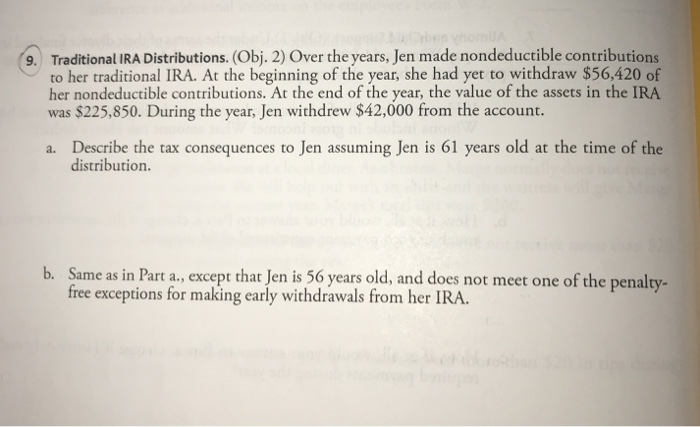

9. Traditional IRA Distributions. (Obj. 2) Over the years, Jen made nondeductible contributions to her traditional IRA. At the beginning of the year, she had yet to withdraw $56,420 of her nondeductible contributions. At the end of the year, the value of the assets in the IRA was $225,850. During the year, Jen withdrew $42,000 from the account. a. Describe the tax consequences to Jen assuming Jen is 61 years old at the time of the distribution. b. Same as in Part a., except that Jen is 56 years old, and does not meet one of the penalty- free exceptions for making early withdrawals from her IRA

9. Traditional IRA Distributions. (Obj. 2) Over the years, Jen made nondeductible contributions to her traditional IRA. At the beginning of the year, she had yet to withdraw $56,420 of her nondeductible contributions. At the end of the year, the value of the assets in the IRA was $225,850. During the year, Jen withdrew $42,000 from the account. a. Describe the tax consequences to Jen assuming Jen is 61 years old at the time of the distribution. b. Same as in Part a., except that Jen is 56 years old, and does not meet one of the penalty- free exceptions for making early withdrawals from her IRA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started