Question

9. Transactions involving purchase orders being received from other companies should be reconciled by comparing the ______________________ with the accounts receivable ledger accounts. 10. In

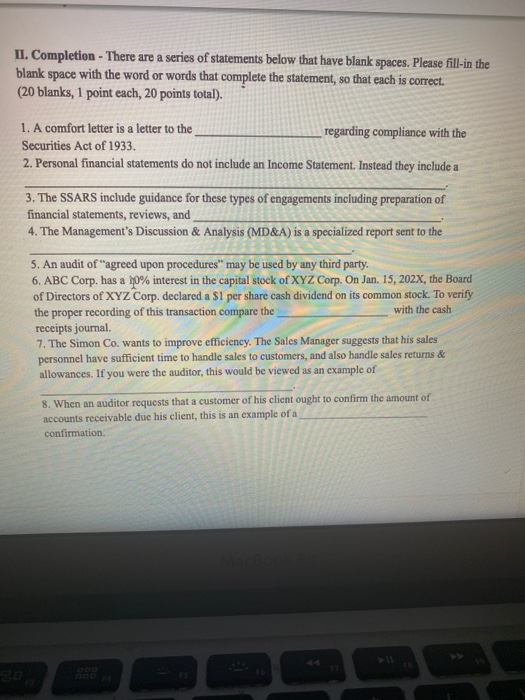

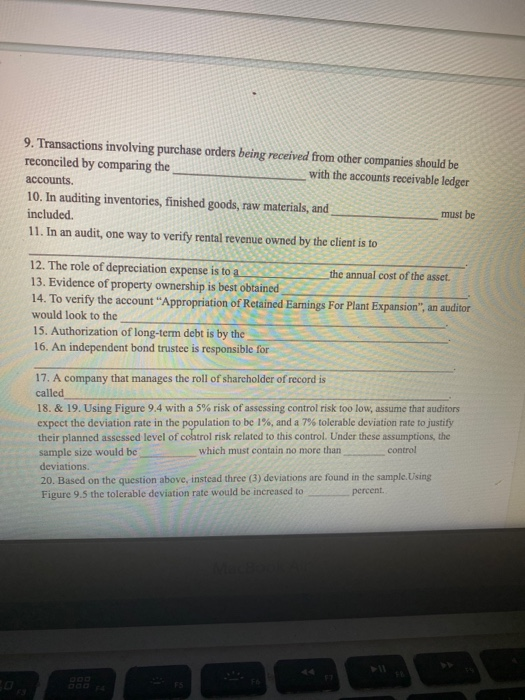

9. Transactions involving purchase orders being received from other companies should be reconciled by comparing the ______________________ with the accounts receivable ledger accounts. 10. In auditing inventories, finished goods, raw materials, and ___________________ must be included. 11. In an audit, one way to verify rental revenue owned by the client is to ___________________________________________________________________________. 12. The role of depreciation expense is to a the annual cost of the asset. 13. Evidence of property ownership is best obtained __________________________________. 14. To verify the account Appropriation of Retained Earnings For Plant Expansion, an auditor would look to the __________________________________________________________. 15. Authorization of long-term debt is by the _____________________________________. 16. An independent bond trustee is responsible for ___________________________________________________________________________. 17. A company that manages the roll of shareholder of record is called______________________________________________________________________. 18. & 19. Using Figure 9.4 with a 5% risk of assessing control risk too low, assume that auditors expect the deviation rate in the population to be 1%, and a 7% tolerable deviation rate to justify their planned assessed level of control risk related to this control. Under these assumptions, the sample size would be __________ which must contain no more than ________ control deviations. 20. Based on the question above, instead three (3) deviations are found in the sample.Using Figure 9.5 the tolerable deviation rate would be increased to ________ percent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started