Answered step by step

Verified Expert Solution

Question

1 Approved Answer

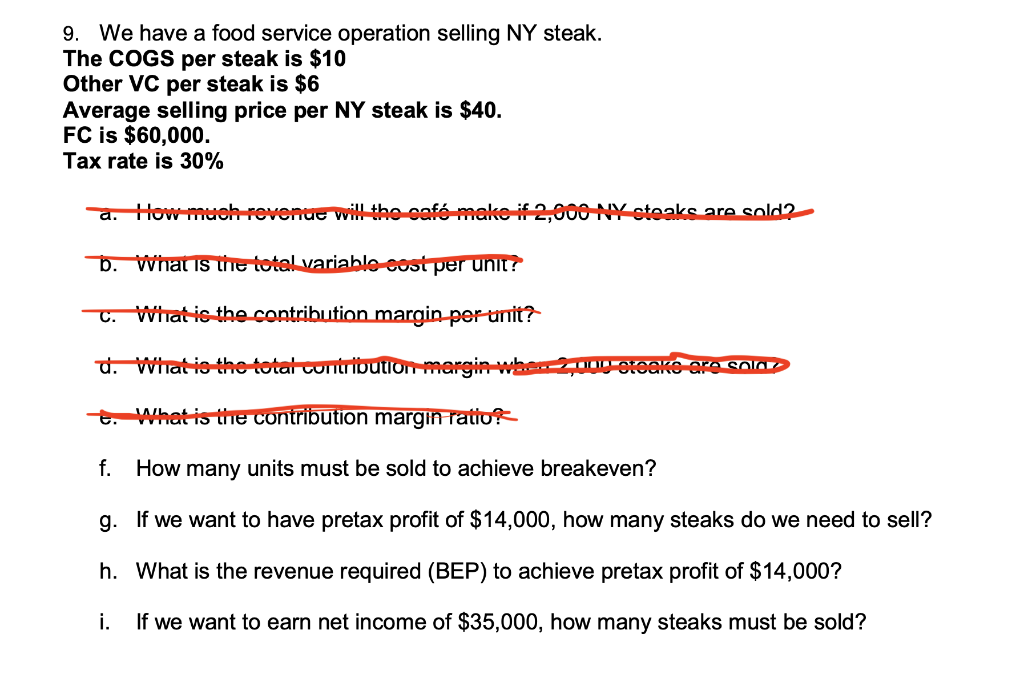

9. We have a food service operation selling NY steak. The COGS per steak is $10 Other VC per steak is $6 Average selling price

9. We have a food service operation selling NY steak. The COGS per steak is $10 Other VC per steak is $6 Average selling price per NY steak is $40. FC is $60,000. Tax rate is 30% a. How much revenue will the caf-mako if 2,000 NY steaks are sold? b. What is the total variable cost per unit? C. What is the contribution margin per unit? d. What is the total contribution margin-when-2000 otoako Oro solo t. What is the contribution margin ratio? f. How many units must be sold to achieve breakeven? g. If we want to have pretax profit of $14,000, how many steaks do we need to sell? h. What is the revenue required (BEP) to achieve pretax profit of $14,000? i. If we want to earn net income of $35,000, how many steaks must be sold

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started