Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. Webster Company reported sales for 2021 of $800,000. Webster Company listed $50,000 of inventory on its balance sheet. Using a 365-day year, how many

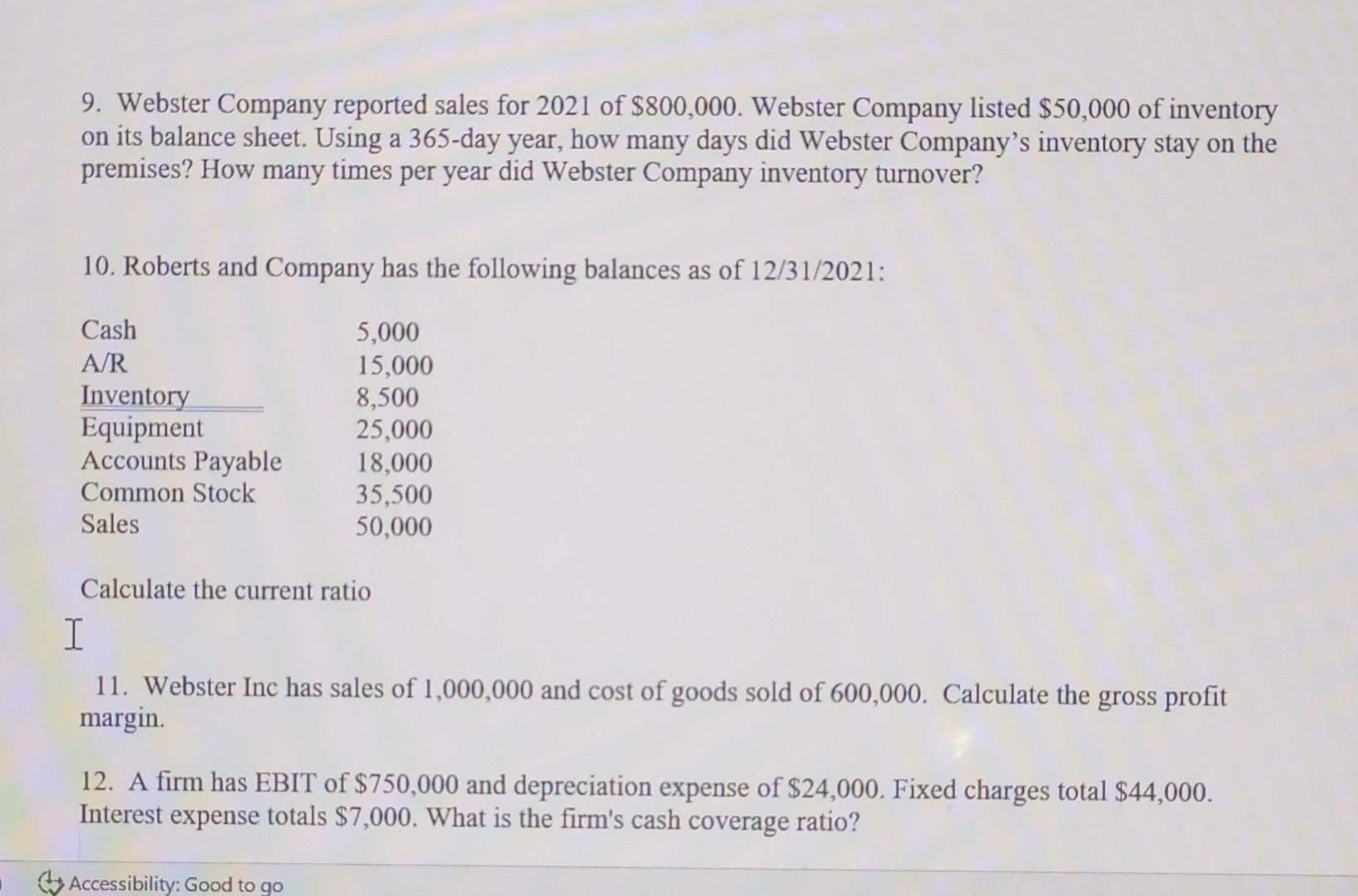

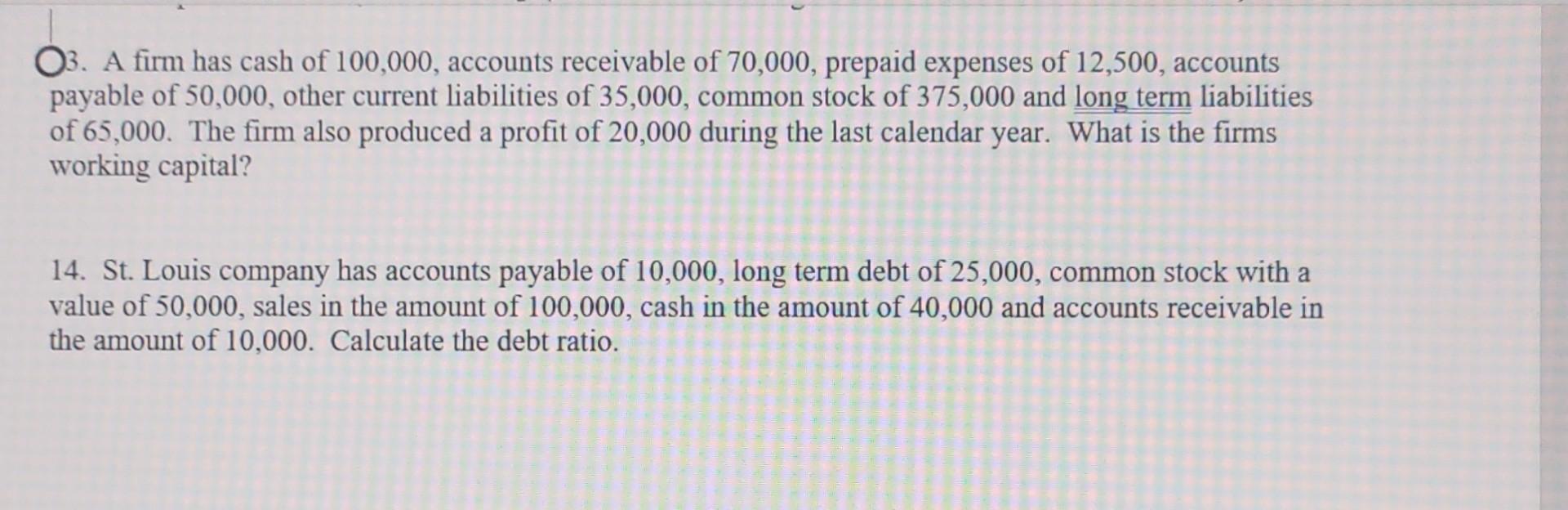

9. Webster Company reported sales for 2021 of $800,000. Webster Company listed $50,000 of inventory on its balance sheet. Using a 365-day year, how many days did Webster Company's inventory stay on the premises? How many times per year did Webster Company inventory turnover? 10. Roberts and Company has the following balances as of 12/31/2021 : Calculate the current ratio 11. Webster Inc has sales of 1,000,000 and cost of goods sold of 600,000 . Calculate the gross profit margin. 12. A firm has EBIT of $750,000 and depreciation expense of $24,000. Fixed charges total $44,000. Interest expense totals $7,000. What is the firm's cash coverage ratio? 3. A firm has cash of 100,000 , accounts receivable of 70,000 , prepaid expenses of 12,500 , accounts payable of 50,000 , other current liabilities of 35,000 , common stock of 375,000 and long term liabilities of 65,000 . The firm also produced a profit of 20,000 during the last calendar year. What is the firms working capital? 14. St. Louis company has accounts payable of 10,000 , long term debt of 25,000 , common stock with a value of 50,000 , sales in the amount of 100,000 , cash in the amount of 40,000 and accounts receivable in the amount of 10,000 . Calculate the debt ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started